Here are the latest developments in global markets:

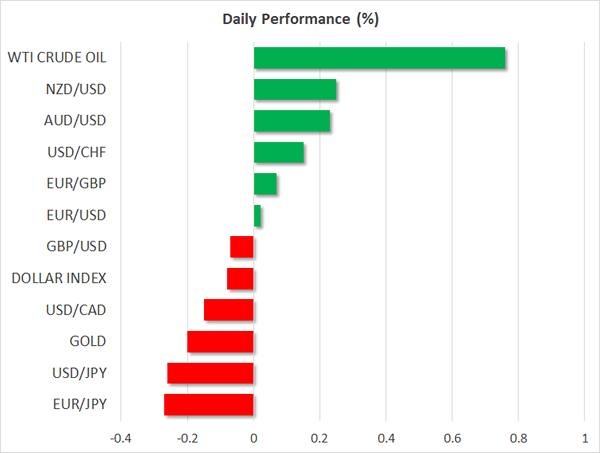

FOREX: The US dollar index – which tracks the greenback’s performance against a basket of six major currencies – traded slightly lower on Tuesday, after posting some gains on Monday.

STOCKS: Asian markets extended their recent winning streak, with Japan’s Nikkei 225 and Topix indices trading higher by 0.6% and 0.5% respectively as the nation returned from a holiday; both indices hovered near multi-decade highs. In Hong Kong, the Hang Seng climbed 0.3%, while in Europe, futures tracking the Euro Stoxx 50 suggest the index may open slightly lower. Over in the US, the S&P 500 and the Nasdaq Composite closed at yet another record high. Meanwhile, although the Dow Jones broke an all-time high as well, it did not manage to sustain its gains, closing at 25,283 after touching the 25,308 mark earlier. Futures tracking the Dow, S&P, and Nasdaq 100 are all currently in the green, albeit marginally.

COMMODITIES: In energy markets, WTI and Brent crude oil were up 0.8% and 0.5% respectively as traders remained bullish on the precious liquid. Data released on Fridayshowed a decline in the number of active US oil rigs, easing concerns that US supply may rise due to the recent increase in prices. Gold was trading down by 0.2%. Given the continued gains in equity markets and the broader risk-on environment, the yellow metal will likely struggle to advance from current levels, at least in the absence of some risk-off event.

Major movers: Yen spikes higher on BoJ operations, but is this a signal or noise?

The Japanese yen jumped overnight, after the Bank of Japan (BoJ) bought fewer longer-dated Japanese government bonds (JGBs) under its regular operations, generating speculation that the days of ultra-easy monetary policy may be approaching their end. Dollar/yen fell by more than 0.2%, last trading near 112.70 after having touched 112.49 earlier.

The key question here is whether this was a signal of what is to come from the BoJ, or whether it is merely noise in the bigger picture. On balance, this appears more like noise. Under its current QQE with yield-curve control framework, the BoJ has committed to buying enough bonds so as to keep the yields on longer-dated JGBs anchored near 0%. The fact that the BoJ bought fewer bonds today while yields remained near 0% simply shows that the Bank needed to intervene less in the market in order to achieve its goal, which can hardly be read as a policy signal. Indeed, it would be quite strange for the BoJ to begin taking its foot off the stimulus-gas with inflation still so far away from its target. Still, the yen’s jumpy reactions to any hawkish BoJ headlines signify that when the Bank does finally signal a policy change, the currency is likely to experience substantial movements.

Elsewhere, the commodity-linked currencies traded higher against their US counterpart. Dollar/loonie was down almost 0.2%, as the gains in oil prices and expectations for a rate hike by the Bank of Canada (BoC) next week kept the Canadian currency under demand. According to Canada’s overnight index swaps, a rate increase by the BoC on January 17 is now almost fully priced in, with the implied probability for such an action currently resting at 86%. Aussie/dollar and kiwi/dollar were both up by a little more than 0.2%.

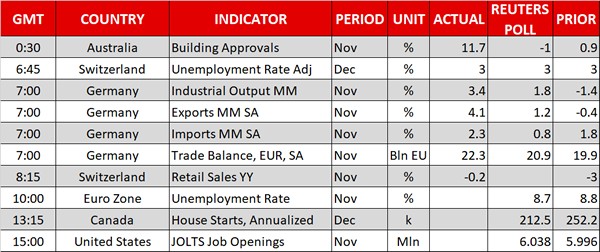

Day ahead: Eurozone unemployment, Canadian housing starts and JOLTS job opening out of the US on today’s agenda

The eurozone’s unemployment rate for the month of November will be released at 1000 GMT. It is forecast to fall by 0.1% relative to October, matching its lowest since January 2009 of 8.7% and pointing to a labor market that continues to improve. A positive surprise could instill further confidence in the eurozone growth story, leading to long euro positions. Forex markets are expected to react accordingly to a negative surprise as well.

Canadian housing starts for December are due at 1315 GMT, with loonie traders keeping an eye on the release.

The most important reading out of the US will pertain to the JOLTS job openings report, scheduled for release at 1500 GMT. The number of openings is expected to stand at around 6 million. Deviations from analysts’ projections have in the past led to positioning on the dollar.

Minneapolis Fed President Neel Kashari, who voted against all three 25 bps rate hikes delivered last year, is scheduled to participate in a Q&A session at 1500 GMT. It is of note that he will not be holding voting rights in the FOMC during 2018.

In oil markets, the API weekly report including information on US crude oil stocks is due at 2130 GMT.

In politics, the talks between North Korea and South Korea – the first such talks in more than two years – could continue further ahead. The 2018 Winter Olympic Games and North Korea’s potential participation fueled the talks, but nevertheless they’re seen as a positive step for a more peaceful coexistence between the two countries.

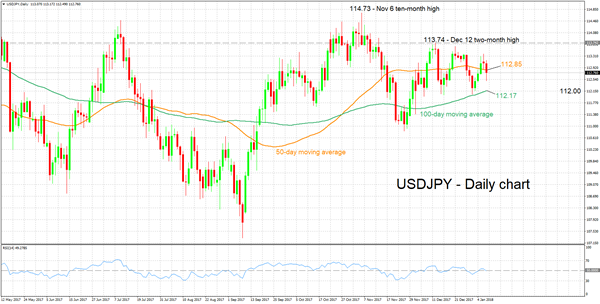

Technical Analysis: USDJPY looking neutral in short-term

USDJPY has been moving sideways over the last five weeks between roughly 112.00 and 113.74. The RSI is projecting a neutral picture for the pair in the short-term: the indicator has been moving sideways in recent weeks and in proximity to the 50 neutral-perceived level.

A stronger-than-expected JOLTS report out of the US could push the pair higher. The current level of the 50-day moving average at 112.85 might act as resistance to upside movements in price – note that this level failed to provide support as the pair headed lower earlier in the day. Further above, the focus would shift to December 12’s two-month high of 113.74 for additional resistance.

Weaker US data would turn the attention to the area around the current level of the 100-day MA at 112.17 as potential support. The range around this mark was congested in the past and encapsulates the 112.00 handle as well, this being a potential psychological level.