The street continues to be short and caught in gold as 2018 gets underway.

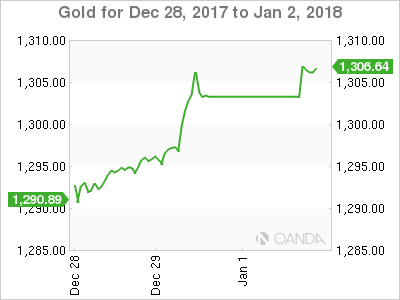

Gold continues to make more comebacks then Mohammed Ali, confounding critics (myself included) and soaring 11 dollars on Friday to recapture the 1300.00 level and close at its highs near 1305.00. The new three-month high represents a near 70 dollar rally from its mid-December lows near 1135.00.

Two cautionary points must be made though. Well over half of the rally was made in the last week over the holiday period on much lower than normal average daily volumes. Secondly, the Relative Strength Index (RSI) is now at very overbought levels. The RSI has been an excellent indicator of short-term price corrections in 2017.

That said, gold has clearly benefited from lower U.S. yields and a much weaker U.S. dollar into the year-end, and one also suspects, quite a bit of urgent short covering in a thin market. The old adage that the market can stay irrational longer then you can stay solvent appears to be alive and well in the gold market at the moment.

As global complacency over the trajectory of U.S. rates continues to be astoundingly low, precious metals, in general, should continue to benefit. Anti-pollution measures in China squeezing the prices of industrial metals heavily will also continue to provide an indirect boost.

Gold has opened positively in Asia, touching 1308.00 initially before correcting to a still respectable 1306.35. Gold has now traced out at double top at 1308.00, and this should be reasonably strong resistance intra-day. A break will open the road to the mid-September highs of 1314.50. Support is at 1302.00 and 1300.00 followed by 1294.00, Friday’s low.