Here are the latest developments in global markets:

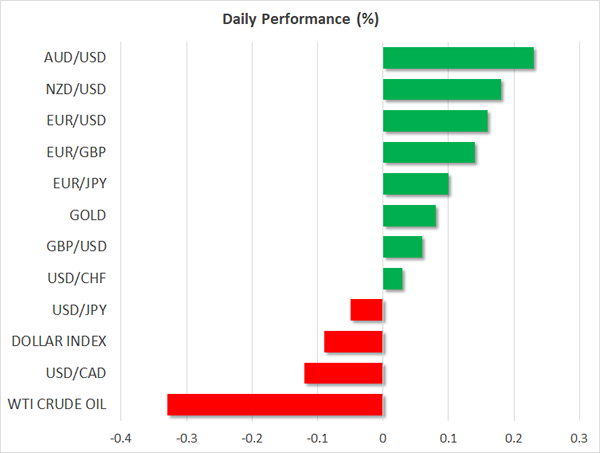

FOREX: The dollar index continued retreating, recording a three-week low. Meanwhile, commodity currencies, including the loonie, aussie and the kiwi, were posting multi-week highs versus the greenback.

STOCKS: The Nikkei 225 closed 0.1% higher. The Hang Seng was down by 0.1%, while the Shanghai Composite lost 0.9%. Euro Stoxx 50 futures traded higher by 0.1% at 0728 GMT, with Dow, S&P 500 and Nasdaq 100 contracts all being roughly flat.

COMMODITIES: WTI and Brent crude lost some ground, though they were still trading not far below the 2-½-year high levels reached yesterday. Tuesday’s rise in oil prices came on the back of news of an explosion in a Libyan crude pipeline, with ongoing OPEC/non-OPEC supply cuts also being supportive of higher prices. WTI was at $59.75 a barrel and Brent at $66.74. Gold traded 0.1% up at $1,284.70 per ounce, this being a four-week high. The precious metal was finding some support from a weakening dollar.

Major movers: Dollar retreats in thin trading ahead of New Year; commodity-currencies at multi-week highs

The dollar index, which gauges the US currency’s strength versus the currencies of six major US trading partners, was 0.1% down at 93.18. Earlier in the day it fell to a three-week low of 93.15. The greenback was losing ground versus most other major rivals, though its losses were limited.

Despite the release of some data out of the US later on, it is expected that it will be a mostly quiet day following the Christmas holidays and ahead of celebrations for the New Year.

Dollar/yen was not much changed at 113.15. Euro/dollar was up by a bit less than 0.2% at 1.1875, with pound/dollar trading slightly higher at 1.3382.

The oil-linked Canadian dollar was on its sixth straight day of advancing versus the greenback, with dollar/loonie trading 0.1% lower at 1.2672, not far above a three-week low recorded earlier in the day.

The also commodity-linked antipodeans posted gains versus the greenback as well. Aussie/dollar was 0.2% higher at 0.7748, trading at two-month high levels. Kiwi/dollar also traded higher by 0.2%, at 0.7052. At one point it touched 0.7055, its highest since October 19.

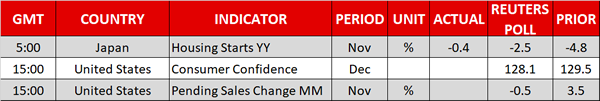

Day ahead: US reports on consumer confidence and releases housing data

Trading volumes are anticipated to be thin on Wednesday in a holiday-shortened week. The economic calendar during today’s European session will be light, with US releases being the only focus in terms of data.

At 1500 GMT the Conference Board will deliver readings on US consumer confidence. In November, the relevant index hit a 17-year high of 129.5 but now analysts expect the measure to drop back to 128.1 in December.

Meanwhile, pending home sales in the US are said to decline by 0.5% m/m in November after surging by 3.5% in the previous month. Worse-than-expected figures could drive the dollar lower versus its peers before the end of the European session.

Despite the US tax overhaul story being more or less a done deal, investors will be looking forward to the US President Donald Trump signing the relevant bill probably in early January after Congress approved the plan in the previous week.

In the Eurozone and in the absence of data, some attention will be in Catalonia where political uncertainty increased after separatist parties won parliamentary majority in the latest regional elections, bringing new headaches to the Spanish government which was the one to call the elections.

In oil markets, the API report on US crude stockpiles is due at 2135 GMT.

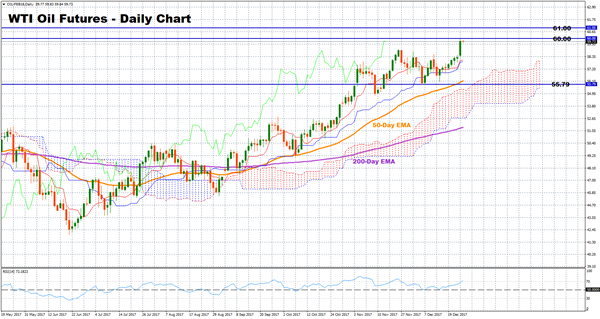

Technical Analysis: WTI oil futures peak at 2-½-year high; risk tilted to downside

WTI crude oil futures for February delivery exited a neutral phase on Tuesday, painting a bullish picture after the market peaked at more than two-year high levels. However, downside movements in the short-term are not ruled out as the futures are currently overbought, suggested by the RSI rising above 70.

In case of a decline, support could be found around the 58-59 area which acted as resistance during the past four weeks. Further decreases from here could also target a recently recorded bottom of 55.79.

On the upside, immediate resistance might occur at the 60 key-level before the 61 and 62 levels come into view.