Here are the latest developments in global markets:

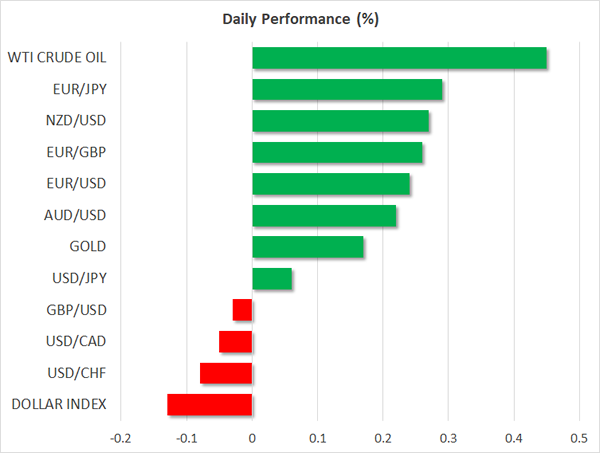

FOREX: The dollar was steady versus the yen at 112.62 as investors were waiting for the final tax vote to begin today, while trading was in general thin ahead of the holiday season. The euro, on the other hand, posted moderate gains versus the greenback, edging up to an intra-day high of 1.1817(+0.23%) and remained flat against the pound at 0.8832 as the German Ifo business climate index inched below expectations but remained at record high levels in December. The pound fell back to yesterday’s lows, trading at $1.3370, while the aussie and the kiwi consolidated around today’s highs.

STOCKS: The pan-European STOXX 600 rose to a fresh six-week high (+0.17%) as financials and consumer cyclicals continued to support the index. The blue-chip Euro STOXX 50 was flat at 1000 GMT with losses in utilities offsetting gains in telecommunications. The Spanish IBEX 35 and the British FTSE 100 jumped by 0.24%.

COMMODITIES: The shutdown of the British Forties pipeline in the North Sea continued to underpin Brent, sending it 0.35% higher to $63.63 per barrel. WTI crude also held onto gains, climbing by 0.45% to $57.42 as OPEC-led supply cuts supported the market despite concerns over a rising US oil production. Gold was last seen at $1,263.00 per ounce (+0.14%).

Day ahead: US Congress to make final decision on tax legislation

The long-awaited US tax vote will take place today around 1830 GMT at the House of Representatives before Senators also likely voting in favor of the final bill probably later today or on Wednesday. Projections are for the tax cuts to turn into law despite doubts over the post-growth effect remaining in the background. Positive sentiment on the tax code strengthened on Monday after two Senate Republicans agreed to back the legislation.

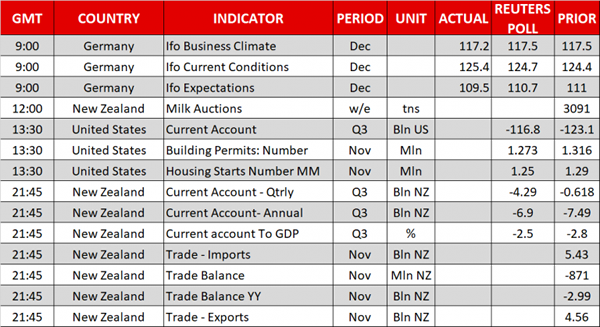

Meanwhile, the US Department of Commerce and the Bureau of Economic Analysis are scheduled to publish housing data and readings on the current account at 1330 GMT. Analysts expect the current account to improve from -$123.1 billion to -$116.8 billion in the third quarter, while they also forecast a slowdown in November’s building permits and housing starts. The number of building permits and new constructions are said to decline by 0.04 million to 1.27 million (-3.1% m/m) and by 1.25 million respectively (-3.2% m/m).

At 2145 GMT, New Zealand will release figures on the current account as well as trade. Year-on-year, the current account is forecasted to rise by NZ$0.59 billion to -NZ$6.90 billion in the third quarter, whereas on a quarterly basis the deficit is anticipated to widen to -NZ$4.290 billion (six times larger than in the previous quarter).

Moreover, global dairy auction data are due today (the release, however, is tentative without a specific time of release), bringing some volatility to the kiwi.

In energy markets, investors will be waiting for the API weekly report at 2145 GMT to indicate the change in US crude oil stocks for the week ending December 15.