- We expect the Bank of Japan to maintain its ‘QQE with yield curve control’ policy unchanged at this week’s monetary policy meeting and we will be listening closely whether Kuroda will elaborate on recent comments.

- We see USD/JPY trading mostly sideways within the 111.65-114.50 range near term, targeting 113 in 1-3M.

BoJ unchanged – focus on tightening talks and BoJ leadership

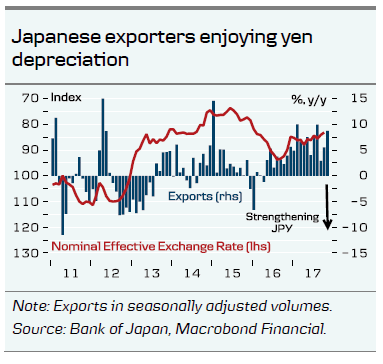

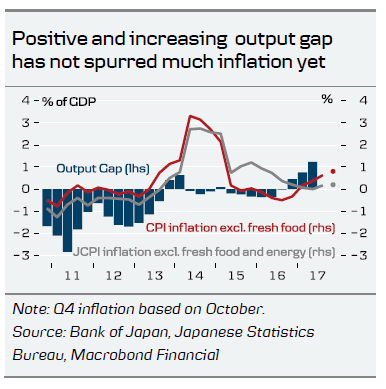

Speculation about policy tightening from the Bank of Japan (BoJ) has gained momentum since governor Kuroda gave a speech at the University of Zurich, where he mentioned the “reversal rate”. Since then, Kuroda has backtracked somewhat on the Zurich remarks, saying that the yield curve control is designed to be highly sustainable. The economic upturn in Japan is still mainly driven by foreign demand as Japanese exporters enjoy tailwind from the relatively weak Yen. See Big Picture (4 December) for details. In our view, a policy tightening would strengthen the yen and potentially derail the economic upturn, and as long as we are not seeing any pickup in core inflation and long global yields remain low, we believe any tightening will be too soon. Hence, we do not expect the BoJ to be close to tightening yet. But we will be listening closely as to whether Kuroda will elaborate on recent comments. In our main scenario, we still expect Koruda to be reappointed and expect the BoJ to keep its current ‘QQE with yield curve control’ policy unchanged in 2018. We believe the BoJ would like to allow for higher longer-term rates in order to give banks some breathing space, but in the current environment with a flat global yield curve, we simply do not think there is room for this.

Record spending and wage growth incentives to support growth

Japan’s ruling bloc has approved a plan to cut the corporate tax rate to around 20% from 30%. The plan, which would be effective for three years from fiscal 2018, needs parliamentary approval to be enacted. If endorsed it would be a helping hand for the BoJ, as the proposed tax cut would apply only for companies that raise wages aggressively and boost domestic capital spending. Along with what looks to be another record public budget for fiscal 2018, this is set to push the economic upswing even further next year. However, tax breaks are in place for only three years and the question is whether companies will be reluctant to increase permanent fixed costs (wages) on the back of this.

USD/JPY to remain range-bound near term

We expect US tax reform and USD liquidity to remain USD/JPY supportive in the short term but we still see USD/JPY trading mostly sideways within the 111.65-114.50 range near term, targeting 113 in 1-3M. While we still expect Fed-BoJ divergence, solid global growth and higher global yields (eventually) to support the cross, we see little potential for a substantial move higher over the medium term. We target 114 in 6-12M, with risks increasingly skewed to the downside amid stretched short JPY positioning, further flattening pressure of the US yield curve and a weaker growth outlook in China