Sunrise Market Commentary

- Rates: Trading expected to shift in lower gear

Today’s eco calendar is thin with only US empire manufacturing and industrial production. We don’t expect them to influence trading. With the final key events of the year behind us, volumes will probably slow to a trickle. That could cause some erratic moves in coming days. - Currencies: USD trading to shift into year-end modus

Strong EMU/US eco data and a mixed ECB message failed to give clear guidance for EUR/USD trading yesterday. In the end, the topside in EUR/USD still looks rather well protected given divergent guidance from the ECB and the Fed. The fate of the US tax bill remains a wildcard for USD trading going into the end of the year.

The Sunrise Headlines

- US stock markets corrected up to 0.4% lower yesterday. Most Asian indices record losses as well this morning with China underperforming (-1%).

- President Trump’s drive to win passage of a sweeping Republican tax bill in the US Congress hit potential obstacles as two more Republican senators insisted on changes, joining a list of lawmakers whose support is uncertain.

- EU leaders applauded British PM May for her work so far on Brexit, assuring her at a summit in Brussels that sufficient progress has been made to allow Britain to move on to the next stage of leaving the union.

- The Canadian dollar recovered its vim on Thursday after Bank of Canada governor Poloz said the central bank is growing ‘increasingly confident’ that the economy will need less stimulus over time.

- Business conditions in Japan improved still further in the fourth quarter as the Bank of Japan’s Tankan index registered the best quarter for the country’s big manufacturers in eleven years.

- A new dissenter on the Bank of Japan board calling for more stimulus has prompted the BOJ to adjust its communications to flag risks of additional easing, according to people familiar with the central bank’s discussions.

- Today’s eco calendar contains US industrial production data and empire manufacturing. ECB Nowotny and Rimsevics are scheduled to speak.

Currencies: USD Trading To Shift Into Year-End Modus

USD/JPY and EUR/USD show mixed picture

There was plenty of eco and central bank news yesterday. Initially, no theme was able to give USD trading a clear direction. Eco data were strong both in the US and in EMU. The ECB brought a mixed signal with a sharp upward revision for its growth forecast but with inflation still expected to rise only very gradually. Finally EUR/USD drifted back south below the 1.18 barrier as EMU yields declined more than US ones. The pair closed the session at 1.1778, reversing part of the post-Fed rise. At the same time, USD/JPY traded with a negative bias (cautious risk-off, lower core yields). The pair finished at 112.39.

Major Asian equities indices mostly trade in negative territory showing losses between 0.5% and 1.0%. The closely watched large manufacturing index in the Q3 Japan Tankan report rose from 22 to 25, the highest level in 11 years. Other sub-indices also suggest an improvement in the broader economic performance including a tightening labour market and tentative signs of price rises. For now this is not enough for markets to expect that the BOJ will change its ultra-easy monetary policy in the foreseeable future. USD/JPY trades in the 112.15 area, near the post-Fed low. Uncertainty on the fate of the US tax bill might play a role. EUR/USD trades sideways in the 1.1785 area.

There are no important data Europe today. The US Empire manufacturing survey and November production data will be published. NY manufacturing confidence is expected to ease slightly further off very high levels reached over the previous months. US production growth is expected to ease to 0.3% after strong October data. These data are usually only of intraday significance for trading.

With most key eco data and key central bank meetings out of the way, FX markets will gradually shift to year-end modus. Declining market liquidity will result in more erratic trading. Markets will keep a close eye on the final outcome of the US tax debate. An agreement, even if ‘imperfect’, might still be slightly positive for the dollar. The combined position of the Fed (ongoing policy normalisation) and the ECB (ongoing soft inflation assessment) in theory should cap any sustained EUR/USD gains for now. We maintain the working hypothesis that a break beyond the 1.1961 resistance will be difficult except in case of negative (political) news from the US.

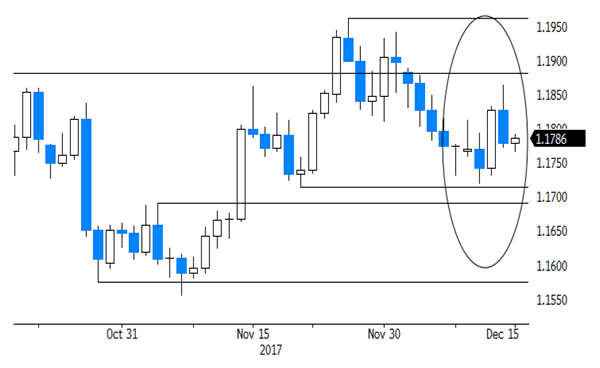

Technical picture. EUR/USD set a post-ECB low mid-November, but the USD’s momentum wasn’t strong enough. EUR/USD settled in a directionless consolidation pattern in the 1.17/19 area.

The outcome of the ECB and Fed meetings were not able to push EUR/USD out of the recent tight consolidation pattern. A return below 1.1713 would signal an improvement in the ST USD momentum. Next support comes in at 1.1554 (November low). USD/JPY’s momentum deteriorated early November, dropping below the 111.65 neckline. No aggressive follow-through selling occurred though. Over the previous two weeks, the pair rebounded, calling off the downside alert and returning to the 110.84/114.73 range. We amended our ST bias from negative to neutral. We maintain the view that a sustained break north of 115 will remain difficult.

EUR/USD: Fed nor ECB were able to unlock recent stalemate

EUR/GBP

Sterling gains, but within established ranges

Yesterday, UK November retail sales beat the consensus by a wide margin, but had only a temporary positive impact on sterling. The BoE as expected left is policy unchanged. The Bank saw last week’s Brexit deal as reducing the chances of disorderly UK departure. However, the BoE also saw tentative signs that the economy might be slowing into the yearend. There were no specific indications that the BoE considers a next rate hike in the near/foreseeable future. Sterling developed a directionless trading pattern for most of the day. Sterling finally captured a better bid later in the session. The EU supporting PM May’s efforts to make progress on Brexit might have been an sterling positive. A cautious EUR/USD decline also weighed on EUR/GBP¨. EUR/GBP finished the day at 0.8770. Cable closed at 1.3431.

Today, there are no important eco data in the UK. The EU will formally approve that the second phase of the Brexit negotiations can start as enough progress has been made in the separation topics. The approval might support a temporary positive sterling momentum, but we don’t expect any sterling rebound to go far. The next phase of the Brexit negotiations will remain very tough, UK PM May faces political hurdles at home and there is no indication that the BoE will take additional action anytime soon. In this context we see little room for a protracted sterling rebound.

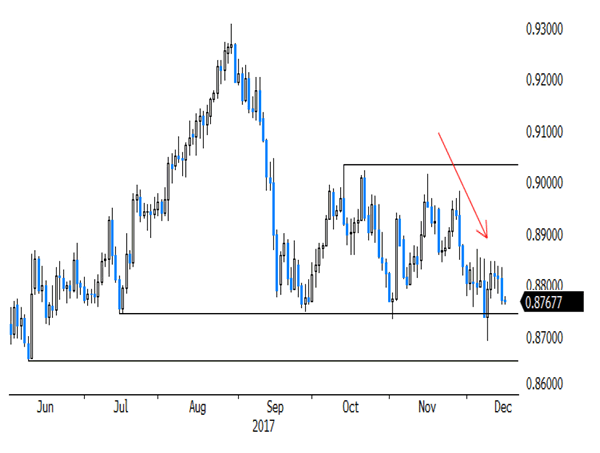

Recent developments pushed EUR/GBP lower in the 0.8690/0.9033 consolidation pattern. EUR/GBP tested 0.8693 support (62% retracement), but the test was rejected. Next support comes in at 0.8653. We assume that the 0.8653/90 area won’t be easy to break short-term. We hold a neutral bias on EUR/GBP short-term. We consider a return to the bottom of this range as an opportunity to reduce sterling long exposure against the euro.

EUR/GBP: sterling momentum improves slightly, but within established range