On Wednesday, as expected, the Fed raised the interest rates by a quarter of a percentage point and forecasted three more hikes in the coming year. As expected, Minneapolis Fed President, Neel Kashkari and Chicago Fed’s Charles Evans dissented, preferring to leave the rates unchanged.

At the same time, we heard Yellen’s final statement as the Fed chair where she reflected on her tenure and her successes in containing inflation and lowering the unemployment rate.

The focus now shifts to today’s statements from the SNB, ECB, and BoE.

The SNB will announce its base interest rate decision at 8:30 am (GMT). Traders expect the committee to leave rates unchanged at -0.75%. They also expect the SNB to provide the inflation expectations for the coming year.

At noon, the BoE is expected to leave interest rates unchanged at 0.5%. Remember, in the October meeting, the BoE raised the rates for the first time in 10 years. While traders will watch the interest rate decision closely, they will pay a closer attention to Carney’s statement. This is because yesterday, it was announced that inflation soared to 3.1% led by air fares and computer games. As a rule, Carney will have to write a letter to Phillip Hammond explaining the sudden rise in consumer prices.

At 12:45 PM, the ECB will release its interest rate decision with analysts expecting the committee to leave rates unchanged. They also expect the bank’s deposit facility rate to remain at -0.4%.

Traders will pay close attention to the ECB statement and inflation guidance for 2018 and 2019. In the October meeting, the ECB decided to continue with the quantitative easing program until September 2018, leaving room for an extension. From January through to September, the monthly purchases will be reduced into £30 billion.

Furthermore, traders will listen to Draghi’s comments on the deposit facility which has become a thorny issue in some countries like Germany. A negative deposit facility means that instead of the ECB paying banks an interest in deposits, the banks pay a fee. This has raised concerns about the bank’s profitability though Draghi played down the fears during a speech at the Peterson Institute.

Traders will also watch out for Canada’s Central Bank Governor speech at 5:35 PM.

While eyes remain on the three central banks, traders will also watch out for Australia’s employment change data that comes out at 12:30 AM. Traders expect the Australian economy to add 19K jobs in November. They will also watch out for industrial production data from China which will be released at 2 AM. They expect the YoY manufacturing to grow by 6.2%.

At 8:30 AM, the German manufacturing and services PMI will be released with traders expecting a reading of 62.2 and 54.7 respectively.

At 9:00 AM, the EAI will release its monthly report which will show the demand and supply situation particularly in crude oil. This will come less than a month after OPEC and Russia committed to production cuts.

Other relevant data expected today are the retail sales in the U.K and Japan’s manufacturing and non-manufacturing index.

EUR/GBP

Today’s data releases and the expected statements from the ECB and BoE will be at play for this pair. Yesterday, the pair rose, fell, and then fell again after disappointing employment and inflation data. The only silver lining for the cable was the wages that showed some improvement.

The main points to watch today will be: 0.8819 to the upside and 0.8774 to the downside as shown below.

CAD/CHF

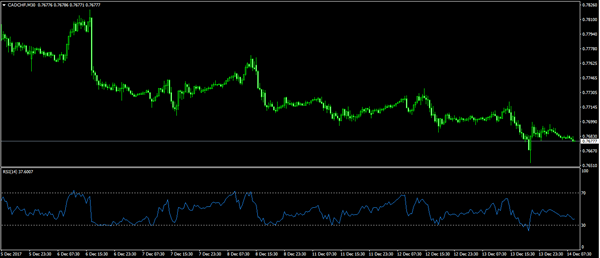

The short-term downside movement that started on Wednesday last week continued yesterday with the pair falling to a week’s low of 0.7654. Today’s statement by Canadian Central Bank governor and the expected SNB statement could help bring some more activities on this pair.

With the RSI of 38 headed south, there could be some more downward movements on the pair. As shown below, the RSI has been quite accurate in predicting the pair’s short-term movements.

EUR/USD

The dollar eased yesterday after the decision by the Fed which was already priced-in. Yellen’s statement did not help either. Today’s major factor will be Draghi’s statement that comes at 1:30 PM.

The main points to watch out for are 1.17169 to the downside. On the upside, the chart could reach 1.1792 or even 1.1811.