Key Highlights

Crude oil price struggled to move above the $58.00-59.00 levels and moved down against the US dollar.

There was a break below a major bullish trend line with support at $57.40 on the 4-hours chart of XTI/USD.

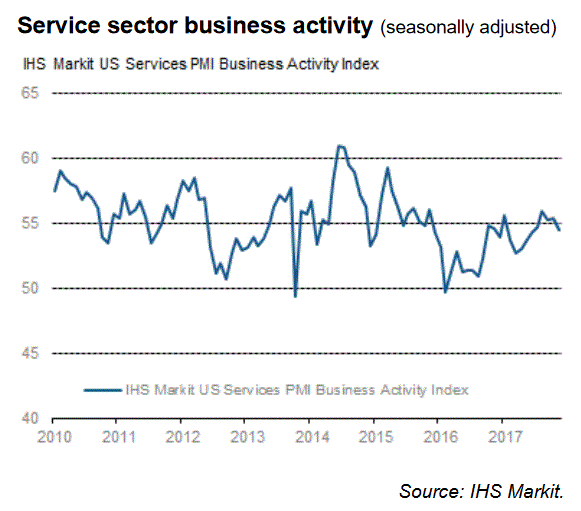

The US Services PMI in Nov 2017 decreased from the preliminary reading of 54.7 to 54.5.

Today, the US ADP Employment Change will be released for Nov 2017, which is forecasted to post a change of 185K, less than the last 235K.

Crude Oil Price Technical Analysis

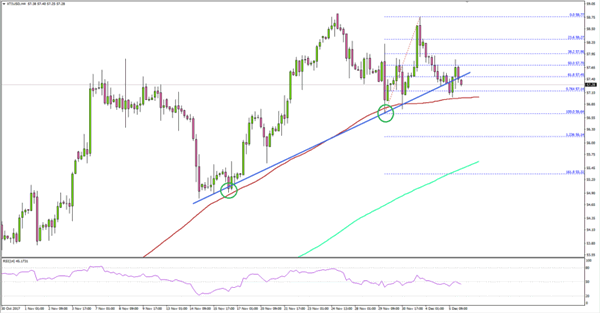

Crude oil price gained heavily in November 2017 and moved above $58.00 against the US dollar. However, the price struggled during the start of December 2017 and is currently under bearish pressure.

Crude oil price struggled to move above the $58.00-59.00 levels and moved down against the US dollar.

There was a break below a major bullish trend line with support at $57.40 on the 4-hours chart of XTI/USD.

The US Services PMI in Nov 2017 decreased from the preliminary reading of 54.7 to 54.5.

Today, the US ADP Employment Change will be released for Nov 2017, which is forecasted to post a change of 185K, less than the last 235K.

Crude Oil Price Technical Analysis

Crude oil price gained heavily in November 2017 and moved above $58.00 against the US dollar. However, the price struggled during the start of December 2017 and is currently under bearish pressure.

Commenting on the report, the Chief Business Economist at IHS Markit, Chris Williamson, stated:

The slowest growth of services sector business activity since June, alongside a slight dip in the pace of manufacturing expansion, means the November PMI surveys registered a modest cooling in the overall rate of business growth. Mid-way through the fourth quarter, the surveys are still pointing to a reasonable GDP growth rate of approximately 2.5%.

Overall, the result was a bit less than the market forecast, which helped Crude oil price is staying above $57.00.

Economic Releases to Watch Today

US ADP Employment Change Nov 2017 – Forecast 185K, versus 235K previous.

BoC Interest Rate Decision – Forecast 1.00%, versus 1.00% previous.