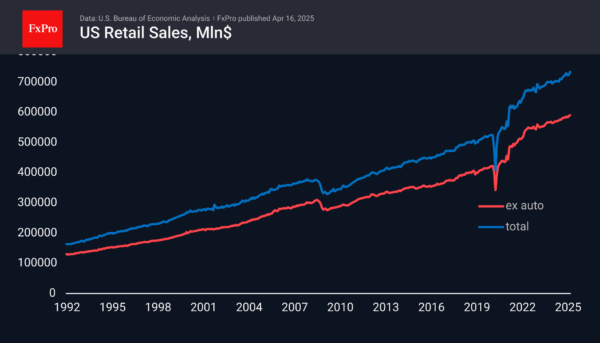

US total retail sales rose 1.4% in March, beating the expected 1.3% after rising 0.2% a month earlier. On an annualised basis, sales rose 4.4%, the fastest pace since December 2023, which contrasted with the slowdown in inflation to 2.4% y/y.

The acceleration in American spending can be attributed to a desire to stock up on goods ahead of a possible price hike triggered by the tariffs announced by Trump last month.

Fears of tariffs have fuelled inflation expectations and a frenzy of demand that could turn into a subsequent slump. The contribution of the automotive sector is particularly notable, where sales growth remains more modest at 0.5% and 0.7% in the previous two months.

While this news is unlikely to cause dramatic changes in markets and policy, it strengthens the position of the hawks at the Fed, who prefer to focus on inflation risks rather than threats to economic growth in the moment. This situation favours the dollar, which buyers could support as it slumps towards the lows of the past three years, giving it a respite after a 9% decline over the past nine weeks. However, the prospect of tighter monetary policy will be a negative factor for the stock market.