The long-awaited U.S. reciprocal tariffs announced have been large and broad-based, but critically exempt Canada and Mexico (at least for now) through CUSMA/USMCA compliant trade.

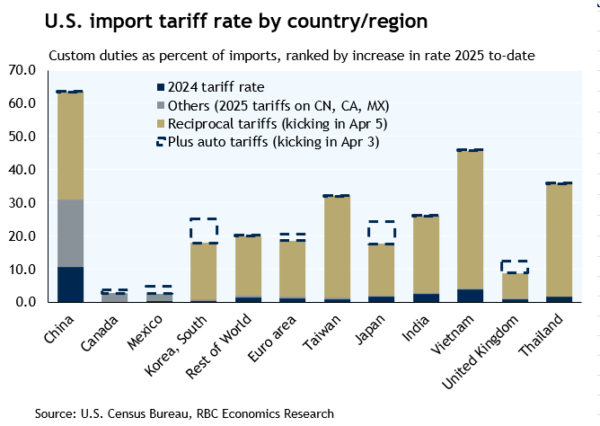

The announcement includes a baseline 10% minimum tariff rate for all countries as of April 5th, but with substantially higher tariff rates imposed on specific countries to follow on April 9th —particularly those that make up the bulk of the U.S. trade deficit. That includes a 34% increase on import tariffs from China, 26% on India, a whopping 46% on imports from Vietnam, and 20% on imports from the European Union.

Tariffs on imports from Canada are still set to rise on Thursday. Auto tariffs announced last week will still push the average U.S. tariff rate on imports from Canada to about 3.5% from 2.5% by our count. That increase will still matter, but looks small now compared to dramatically higher tariffs set to be imposed on other countries.

A lower tariff rate increase is positive for Canada on a relative basis, and it eliminates what had been a growing incentive for U.S. importers to purchase goods from other regions. But, that will be little consolation if overall tariffs are large enough to shrink U.S. demand and the total U.S. import market overall.

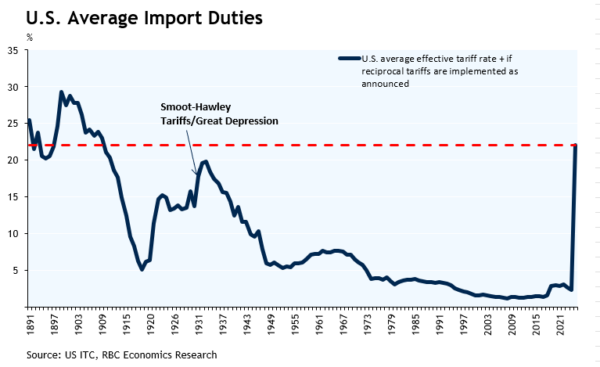

Prior tariff announcements have been significantly altered or rolled back days (or even hours) after, and there is a big possibility that tariffs announced today will look different a week from now. But, if the measures today are implemented, it would push the average U.S. import tariff rate to over 20%— according to our estimates—the highest rate in more than a century.

Today’s announcement will not be the last on trade from the U.S. administration and we will continue to rely on our tariff playbook to assess about how these announcements will impact the Canadian economy.

Magnitude of tariff hikes add downside risks to U.S. growth and supply chains.

Broadly speaking, we have argued before that U.S. buyers will have difficulty finding domestically produced alternatives to imports. A wave of retirements and immigration cutbacks limit the amount that American production can increase in the near-term, and capital investments to “reshore” manufacturing production will take years and billions.

Given those constraints in the near-term to U.S. domestic production capacity, the impact of tariffs depends largely on whether alternative, cheaper import markets are available. Canada’s position compared to other countries on import tariffs looks substantially better today than it did yesterday. But, there’s also the looming threat of whether the total tariffs imposed are large enough to significantly weaken U.S. economic growth and shrink the size of the total import pie.

Furthermore, even though, most of Canada’s trade is directly with the U.S., supply chain disruptions after pandemic lockdowns eased is a reminder of how disruptions globally can spill over to Canadian production and price growth.

The U.S. economy is much less trade sensitive than many of its trading partners (including Canada)—and we do not have a recession as a base case expectation for the U.S. economy. But, tariff hikes, headwinds from government spending cuts, and reduced immigration are adding to yellow flags in the U.S. economic outlook.

Trade uncertainty is here to stay

With or without additional tariff measures, trade uncertainty is threatening to slow consumer and business spending.

Our tracking of Canadian consumer spending is holding up significantly better than consumer confidence so far. And, motor vehicle sales spiked higher in both Canada and the U.S., likely in part as consumers rushed to get ahead of possible auto tariff hikes. But, we expect business investment will remain weak regardless of additional tariff measures.