- As expected, the BoE today kept the Bank Rate unchanged at 4.50%.

- The vote split was slightly to the hawkish side but we do not see this as a broad shift in sentiment within the MPC.

- Overall, the statement revealed that BoE still favours a “gradual” and “careful” approach to easing monetary policy whilst highlighting heightened uncertainty.

- The market reaction was modest with Gilt yields tracking slightly higher and EUR/GBP moving lower on the hawkish vote split.

As expected, the Bank of England (BoE) decided to keep the Bank Rate unchanged at 4.50% today. The vote split had a hawkish twist to it with 8 members voting for an unchanged decision and Dhingra voting for a 25bp cut.

The BoE retained its previous guidance noting that “a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate“. As expected, the BoE highlighted the elevated uncertainty noting that “economic uncertainties, both globally and domestically, had risen recently“. The BoE likewise kept the wording that “monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further“. On the inflation front, the MPC flagged an increased focus on the pass through from wage growth to non-energy core goods, where focus has previously been centred around primarily service inflation.

Overall, we think the communication today supports our call of a continuous gradual approach to the cutting cycle. We expect the next 25bp cut in May with the Bank Rate ending the year at 3.75%. While we have previously highlighted that we saw the risks skewed towards a swifter cutting cycle in 2025, we now see the risk picture as more balanced.

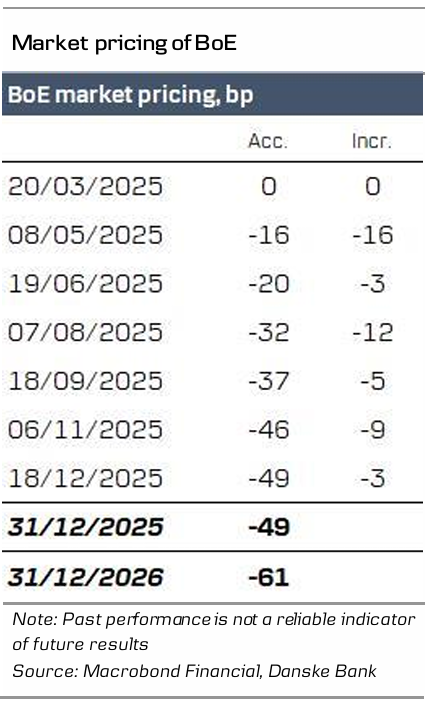

Rates. Gilt yields moved higher across the board on the hawkish vote split. Markets price 16p worth of cuts for May and around 50bp by YE 2025, cf. the margin table. We highlight the potential for BoE to deliver more easing in 2025 than currently priced, expecting three additional cuts this year with the next cut in May.

FX. EUR/GBP moved lower on the announcement with the hawkish vote split taking centre stage. The still cautious guidance delivered today highlights the more gradual approach of the BoE. More broadly, we expect EUR/GBP to move lower in the coming quarters driven by a relatively hawkish BoE compared to G10 peers, an investment environment characterised by continued tight credit spreads and a positive correlation for GBP to a USD positive investment environment (which we expect will return). While we continue to expect a growth pickup in the UK delivered from a fiscal boost, the shift in fiscal stance in Germany leaves the impact from the relative growth outlook more muted for the cross. The key risks are reignited debt concerns and a more forceful policy easing stance from the BoE.