- The Fed maintained its policy rates unchanged in the March meeting as expected.

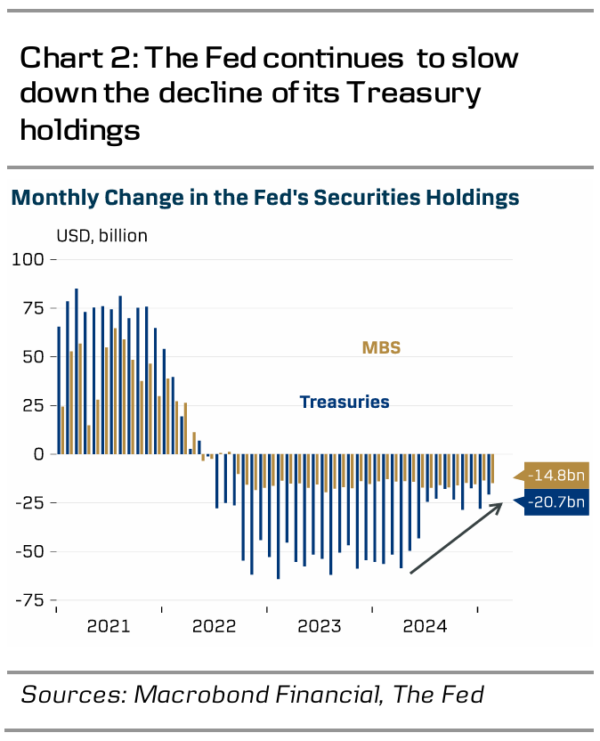

- The Fed’s balance sheet run-off (QT) will be tapered to USD5bn per month for Treasuries (prev. redemption cap USD25bn per month) starting from April, also in line with our expectations. MBS redemptions remain unchanged.

- Overall financial conditions eased modestly with UST yields declining across the curve, EUR/USD ticking higher and equities rising. We make no changes to our Fed call and still look for a total of three cuts in 2025 with the next one in June. Markets price 5bp for May, cumulative 20bp by June and 65bp by December.

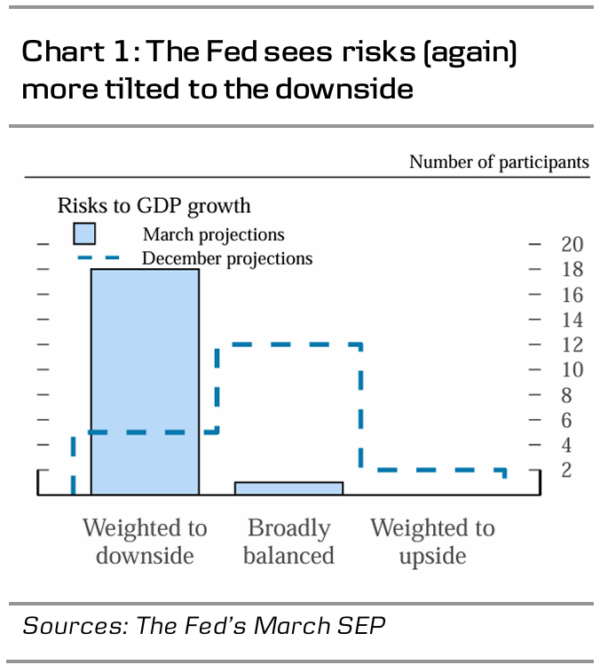

The Fed’s updated economic projections sparked an initial dovish reaction in the markets, as 2025 GDP forecast was taken down to 1.7% (from 2.1%). Inflation forecasts were revised up for both headline (2.7%, from 2.5%) and core (2.8%, from 2.5%). The widely followed median rate projection remained completely steady through 2025 -2027 and also the distribution of individual forecasts was little changed.

The relatively larger change was seen in the perceived balance of risks. Back in December, the risks around the GDP outlook were seen mostly as balanced, but now 18 out of 19 FOMC participants saw them as weighed to the downside. This was reflected in Powell’s remarks as well, as he emphasized that the real economy remained solid both in terms of labour markets and consumer spending, but that the Fed remains mindful of the more cautious signals seen in soft sentiment indicators.

While Powell refrained from specifying how much the expectation of tariffs had influenced the inflation forecasts, he flagged that the ‘base case’ is still for tariffs to cause no persistent inflation. The Fed pays close attention to inflation expectations, but ‘most’ longer-term measures remain anchored near the target (with the Michigan survey as a notable ‘outlier’).

When asked about the possibility of a rate cut in May, Powell did not close the door, but mentioned several times that the Fed is not in a hurry to move. We still look for the next cut in June, followed by quarterly 25bp reductions until the terminal rate of 3.00-3.25% is reached in June of 2026. Our profile is close to market pricing for 2025, but our terminal rate assumption remains below market’s expectations.

The Fed also announced tapering of the balance sheet run-off (QT) as we wrote in our Fed preview, 14 March, and RtM USD – Time to taper, 18 March. The redemption cap for Treasury holdings will be lowered to USD5bn per month from April (from USD25bn), while the redemption cap for MBS will be maintained unchanged at USD35bn. The cap on MBS has not been binding (redemptions have averaged USD15-20bn per month) and Powell signalled that the Fed has ‘strong desire [for] MBS to roll off the balance sheet’. He flagged that the upcoming potential liquidity tightening due to the raise in debt ceiling and rebuild of Treasury cash balance sparked the debate for tapering QT, but also that the move fits well with the general idea of allowing the run-off to progress slower but longer. Reserves remain ample for now (and we agree) but the Fed sends a clear signal for the market not to worry about potential abrupt tightening of liquidity also going forward.