- We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 4.50% on Thursday 20 March in line with consensus and market pricing.

- Data has been mixed and amid elevated uncertainty, this warrants a continued signalling of only a gradual approach to monetary policy easing.

- We expect the reaction in EUR/GBP to be rather muted with risks tilted to the topside.

We expect the Bank of England to keep the Bank Rate unchanged at 4.50% on Thursday 20 March in line with consensus and market pricing. We expect the vote split to be 6-3 with the majority voting for an unchanged decision and Dhingra, Taylor and Mann voting for a cut. Note, this meeting will not include updated projections nor a press conference following the release of the statement.

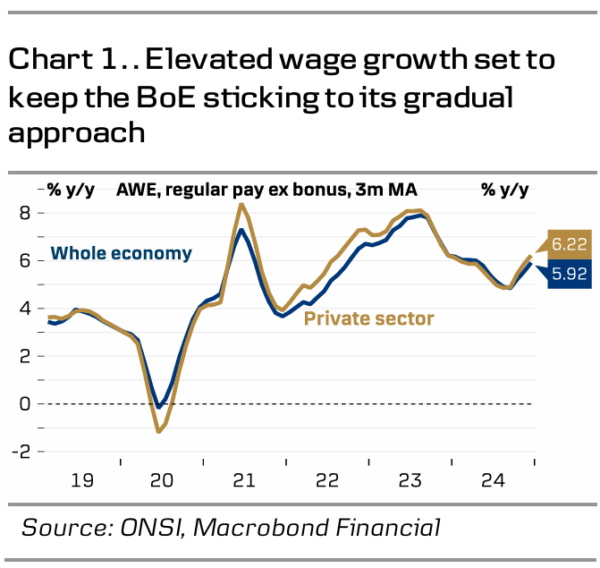

Overall, we expect the BoE to stick to its previous guidance noting that “a gradual and careful approach to removing monetary policy restraint remains appropriate“. We expect the MPC to highlight heightened uncertainty due to domestic fiscal policy initiatives and trade policy tensions. By extension, we expect them to be in no rush to alter the current guidance. Since the last monetary policy decision in February, data has been mixed. The economy continues to stagnate, the labour market is gradually loosening while price pressures continue to be elevated. The economy ended 2024 on a slightly stronger note than in the MPC’s projection, growing 0.1% q/q in Q4 2024. However, PMI data and monthly GDP estimate for January signals that growth remains muted, increasing the downside risks to the growth outlook. While private sector wage growth was slightly lower than expected at 6.2% in the three months to September (vs BoE forecast of 6.3%) it remains significantly elevated. On the inflation front, inflation was slightly higher than expected in headline terms but still showed broad based easing when looking at the service sector. The reaction to the impending increase in employers’ national insurance contribution from April remains a risk for the labour market.

BoE call. We expect the BoE to stick to quarterly cuts, leaving the Bank Rate at 3.75% by YE 2025, which is lower than markets are expecting. Markets are pricing around 55bp for the remainder of the year. However, we highlight that the risk is skewed towards a swifter cutting cycle in 2025, given the dovish bias within the MPC.

Market reaction. We expect the market reaction to be rather muted upon announcement with an unchanged decision fully expected by markets and the BoE aiming to keep its options fully open. More broadly, we expect EUR/GBP to move lower in the coming quarters driven by a relatively hawkish BoE, and a growth pickup in the UK relative to the euro area in 2025. The key risks are continued elevated uncertainty, more euro optimism and a more forceful policy easing stance from the BoE.