- We expect the Fed to maintain its monetary policy unchanged in March, in line with wide consensus and market pricing.

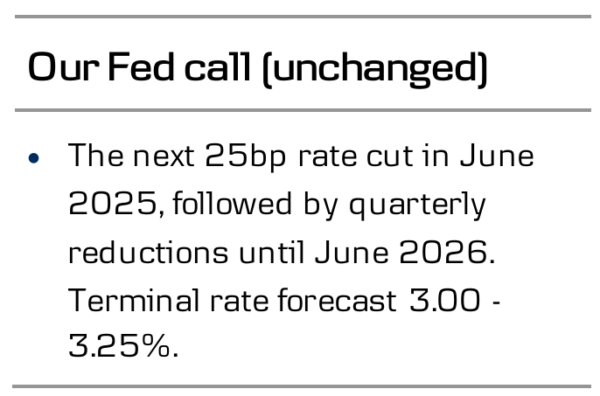

- We do not expect Powell to guide explicitly towards a cut in May, but we do still anticipate three 25bp reductions later in the year starting from June.

- The Fed could signal either tapering or completely ending QT in the coming meetings. We do not anticipate strong immediate market reactions.

The Fed is inarguably navigating uncertain waters, but with hard data signalling little reason for concern, we doubt Powell will sound the alarm next week. While anything other than an unchanged rate decision would be a major surprise, markets are pricing in 35-40% probability of the Fed restarting cuts already in May.

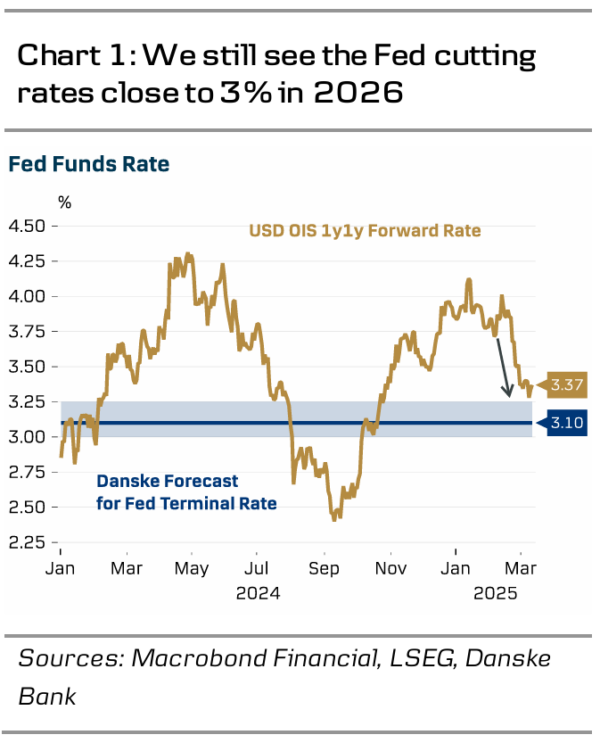

And while Powell has no incentive to close any doors, we do not expect explicit guidance towards a cut in May. We continue to forecast three rate cuts for 2025 followed by two more in 2026, which would take the terminal rate down to 3.00-3.25% – a level below current market pricing. But with employment growth remaining solid and the number of layoffs still low, we think the Fed has room to opt for a more gradual approach.

The updated rate projections could be revised slightly lower to indicate a faster return to neutral (currently only by 2027). The GDP forecast could also be revised slightly lower, while inflation forecasts will likely see only marginal changes. Forecast for unemployment rate could be revised lower as slower immigration tightens labour supply growth.

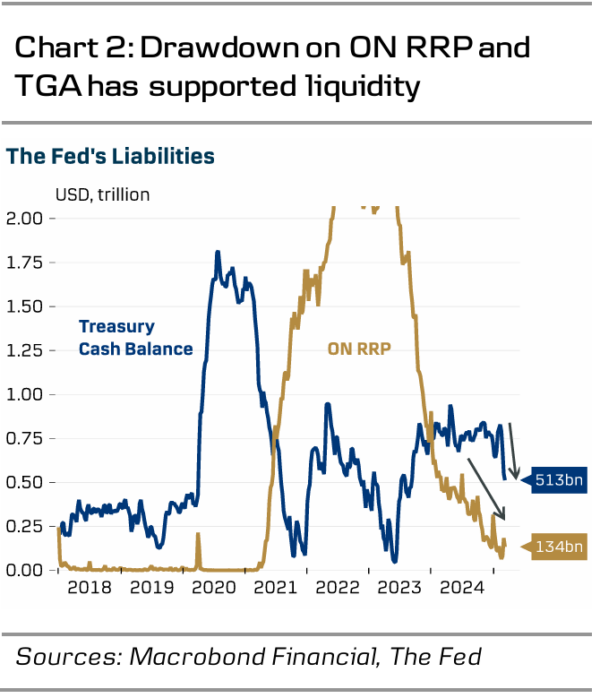

The latest minutes revealed that the policymakers had discussed the endgame for QT in detail already in January, and while we expect no changes next week, the decision to taper or even completely end the balance sheet run-off could be announced already now. While we think that the current level of bank reserves is still generally ample, the policymakers have previously communicated a preference for a cautious approach. The spread between SOFR and Fed Funds Rate has seen occasional upticks especially around month-ends and the liquidity buffer from the ON RRP facility is now mostly depleted. The April tax date and the ongoing process for lifting the debt ceiling create further near-term uncertainty around the liquidity outlook. While passing the debt ceiling raise as part of the Republicans’ budget reconciliation package could still be weeks or even months away, it could theoretically be approved already in April or May. Together with larger-than-usual tax payments, rebuilding the Treasury cash balance could lead to an unexpected tightening of liquidity before the June meeting, which could justify ending the runoff already in May.

With 70bp worth of cuts priced in total for 2025 and 10y UST yield not far from our 12M target (4.20%), we do not anticipate strong market reactions to Wednesday’s announcements. Even if the Fed likely does not see May as the base scenario for restarting the cutting cycle, Powell will have to choose his words cautiously, as sounding too hawkish might drive unwanted tightening of financial conditions. At times of extraordinary uncertainty, a ‘boring’ reaction in the markets is likely high up on Powell’s wish list.