- Fed decides on policy amid recession fears.

- Yen traders lock gaze on BoJ for hike signals.

- SNB seen cutting interest rates by another 25bps.

- BoE to stand pat after February’s dovish cut.

Tariffs remain at the top of investors’ agenda

The US dollar exhibited a mixed performance this week against its major counterparts as US President Donald Trump’s erratic tariff strategy left investors in a state of uncertainty. On Tuesday, Trump announced a 50% tariff on steel and aluminum imported into the US from Canada, only to backtrack after the Canadian province of Ontario suspended its 25% surcharges on electricity that it sends to some northern states in the US.

Nonetheless, the 25% tariffs on steel and aluminum went into effect on Wednesday, with both Canada and the EU retaliating on Thursday. Further escalation remains a possibility, as the introduction of reciprocal tariffs and a potential increase of the steel and aluminum duty to 50% loom on the horizon, with April 2 being the critical date for imposition.

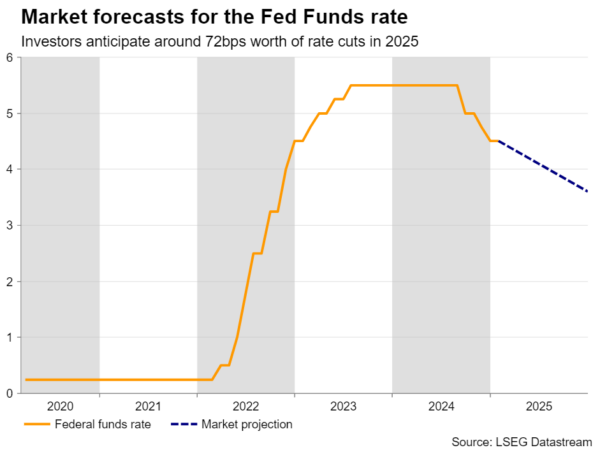

All this uncertainty has led to a marked deterioration in risk appetite, with Wall Street indices tumbling. The US dollar, too, has been caught in the crossfire of Trump’s tariff threats and attacks, as investors shifted their focus from inflation concerns to the broader implication on economic growth. They are currently penciling in around 72bps worth of rate cuts by the Fed this year, which is nearly one additional quarter-point rate cut compared to the 50bps indicated in the December dot plot.

Fed decision: Mind the dots

With all that in mind, next week’s FOMC decision, scheduled for Wednesday, may attract amplified attention. This will be one of the bigger meetings where, besides the decision, the statement and the press conference, the Committee will release updated economic projections, including a new “dot plot”; and with no action expected until June, the spotlight is likely to be firmly on the dots.

If Powell and Co. appear genuinely concerned about the impact of tariffs on the US economy and the dots are revised lower to point to more basis points worth of rate reductions this year, the US dollar is likely to extend its slide. Equities, which in the recent past were celebrating the prospect of lower borrowing costs, are more likely to continue their downturn as expectations grow that the US economy may tip into recession.

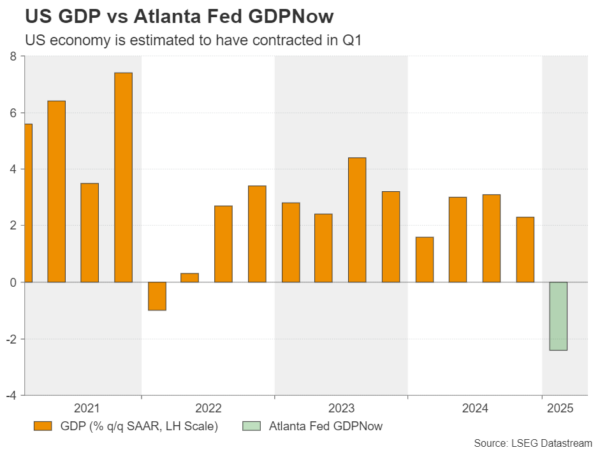

Speaking of recession, the day before the decision, the Atlanta Fed will release its updated estimate of GDP for Q1. The GDPNow model is already projecting a 2.4% qoq SAAR contraction, and a worse print may intensify speculation about the need for further rate cuts. Weaker-than-expected retail sales on Monday could indeed trigger such a downside revision.

Yen bulls await BoJ hike signals

The Fed is not the only central bank to decide on interest rates next week. During Wednesday’s Asian session, the Bank of Japan (BoJ) will announce its own decision. At its first gathering of 2025, this Bank raised its key interest rate by 25bps to 0.5%, with Governor Ueda reaffirming his stance that additional hikes will probably be needed if economic conditions unfold as anticipated.

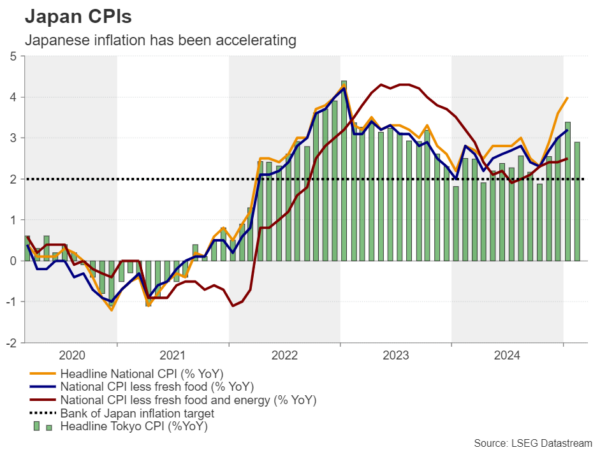

Since then, data has continued to suggest that underlying trends of wage growth remain solid, with consumer prices accelerating to 4.0% y/y from 3.6% in December and the BoJ’s own core CPI metric rising to 2.2% y/y from 1.9%. Although the Tokyo prints for February pointed to a mild slowdown, they were far from indicating that price pressures are well anchored around the Bank’s 2% objective. The Nationwide prints for February will be released during Friday’s Asian session, after the rate decision.

Taking all of this into account, along with the recent hawkish remarks by BoJ policymakers and the acceleration in economic activity during the last quarter of 2024, investors are fully pricing in the next 25bps rate increase to be delivered in September, assigning a strong 80% probability for it to occur in July. What further bolsters investors’ expectations is the fact that many of Japan’s biggest companies have met union demands for substantial wage hikes for a third straight year, helping employees cope with rising cost of living.

Thus, although the Bank is not expected to alter its monetary policy decision at this gathering, any hawkish commentary may allow the yen, which has been the top-performing currency this year, to extend its prevailing uptrend.

Will the SNB press the cut button again?

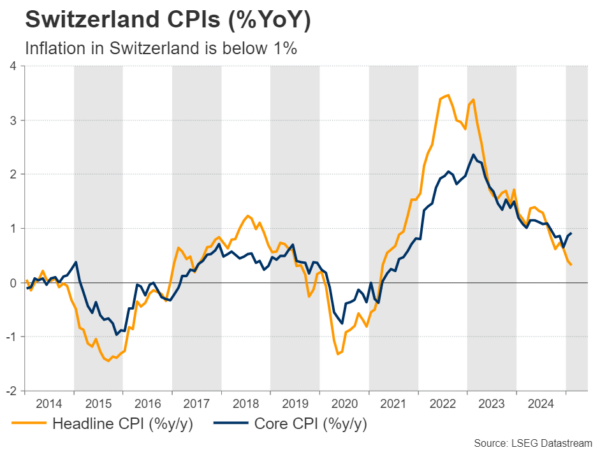

On Thursday, the central bank torch will be passed to the SNB and the BoE. Getting the ball rolling with the SNB, this will be the Bank’s first policy meeting since the turn of the year. Back in December, policymakers delivered a bigger-than-expected 50bps rate cut in an effort to curb gains in the Swiss franc.

However, the uncertainty surrounding Trump’s tariff policies has further fuelled the currency, while Swiss inflation fell to its lowest level in nearly four years in February, increasing the likelihood for another rate cut this year. The probability for another 25bps reduction next week rests at 75%, with the remaining 25% pointing to no action.

Thus, the rate cut alone is unlikely to spark significant volatility in the Swiss franc. For the currency to surrender a notable portion of its recent gains, the Bank may appear willing to proceed with more reductions if necessary.

Will the BoE sound hawkish or dovish?

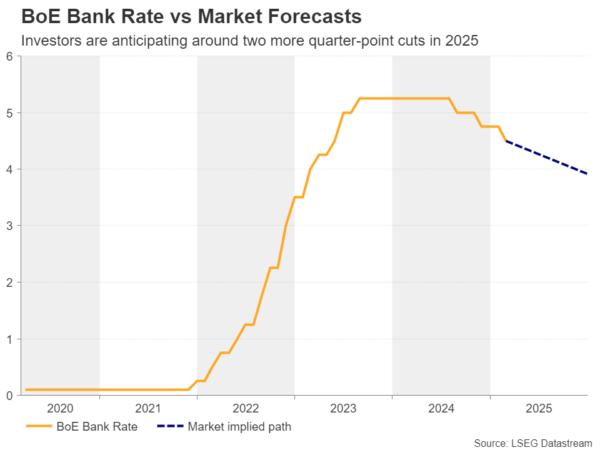

Passing the ball to the BoE, UK policymakers are widely anticipated to remain on hold after cutting interest rates by 25bps in February. At that meeting, the Bank downgraded its growth projections and raised its inflation forecasts. That said, the direction of the revisions was largely anticipated. What caught markets off guard was the fact that two members voted for a 50bps cut, with notorious hawk Catherine Mann – who was the sole advocate for keeping rates steady in November – this time voting for a double reduction.

Since then, economic data has mostly surprised to the upside, leading market participants to price in only two additional quarter-point reductions for this year, with the next one expected in June. However, a week ago, Catherine Mann said that Trump’s tariffs and volatility in financial markets mean policymakers need to act more decisively.

Thus, although no action is expected next week, a dovish stance, suggesting that more policymakers are holding the same view, could hurt the pound as investors may revive bets on deeper rate cuts. For the pound to extend its gains, the Committee may need to sound more concerned about inflation spiralling out of control.

Canada’s CPI, NZ GDP and AU jobs report also on tap

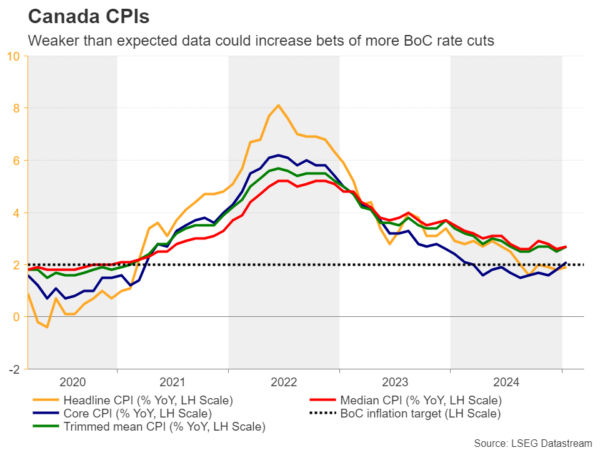

Elsewhere, Canada’s CPI numbers for February and the nation’s retail sales for January are set for release on Tuesday and Friday, respectively. This week, the BoC cut rates by another 25bps, warning that the nation is now facing a “new crisis” due to Trump’s tariffs. Market participants swiftly pencilled in another reduction for the April decision and weaker-than-expected data could further solidify that view.

New Zealand’s Q4 GDP report and Australia’s February employment data are also on the radar, which are both set to be released during Thursday’s Asian session.