The healthy combination of rising corporate profits, strong global growth and cautious optimism over U.S. corporate tax cuts, simply reinvigorated global equity bulls on Tuesday – boosting stocks across the globe.

Asian shares headed for a record close during early trading on Wednesday, following Wall Street’s robust gains overnight. European markets concluded mostly higher on Tuesday and may open on a positive note today as market players continue to shrug off the political uncertainty in Europe. With U.S. stock indexes marching to record highs yesterday as technology and health stocks rallied, it will be interesting to see if the upside momentum is maintained this afternoon.

Chancellor Philp Hammond in the spotlight

Chancellor Philip Hammond will be in the limelight today as he presents the U.K. budget statement to the House of Commons. While Hammond’s speech may revolve around managing the housing crisis, investors will be paying attention to the Office for Budget Responsibility (OBR) which is expected to trim Britain’s GDP growth forecasts. If the overall tone of the budget statement is gloomy and Brexit concerns making an appearance, Sterling is likely to find itself under renewed selling pressure.

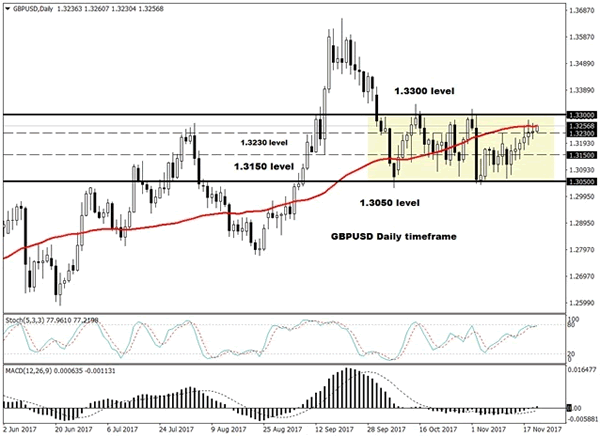

Taking a look at the technical outlook, the GBPUSD has found light support at 1.3230. An intraday breakout above 1.3250 could encourage a further incline towards 1.3300. Alternatively, a failure for prices to keep above 1.3230 may encourage a decline to 1.3150.

Dollar lower ahead of FOMC minutes

The Greenback weakened against a basket of currencies on Tuesday, after Yellen’s cautious remarks reinforced market expectations of the Federal Reserve raising interest rates at a gradual pace.

Yellen cautioned that raising interest rates too quickly could obstruct the Feds efforts to reach the golden 2% target and reiterated the fact that this year’s low U.S. inflation remained a mystery. With the outgoing Fed chair uncertain over the stubbornly low inflation being transitory, investors were left pondering over how this could influencethe central bank’s monetary policy strategy in 2018.

Much attention will be directed towards the minutes from the latest FOMC meeting this evening which should offer further clues on the central bank’s outlook future interest rate increases. With markets widely expecting U.S. interest rates to be increased in December, investors are likely to closely scrutinize the minutes for fresh insight into monetary policy beyond 2017.

The Dollar could receive a boost if the minutes are presented with a hawkish touch, alternatively, if the minutes express concerns over low inflation and fail to bring anything new to the table, sellers may make a move. From a technical standpoint, the Dollar Index is coming under pressure on the daily charts with resistance found at 94.00. Sustained weakness below this level may encourage a further decline towards 93.50. Alternatively, a breach back above 94.15 puts this current bearish setup at risk, with the next level of interest at 94.50.