Sunrise Market Commentary

- Rates: Trading expected to slow down ahead of US Thanksgiving & Black Friday

Today’s eco calendar turns more interesting, but it’s uncertain whether US claims, durable goods, FOMC Minutes and EMU consumer confidence can break the calm on core bond markets ahead of EMU PMI’s and US Thanksgiving (tomorrow). - Currencies: US curve flattening caps USD rebound

Yesterday, the dollar traded mixed to slightly lower. Ongoing low LT US interest rates prevent a protracted USD rebound. Today, the US eco news flow (data , Fed minutes) might be supportive for the dollar. However, liquidity might become thin ahead of Thanksgiving

The Sunrise Headlines

- US stock markets (+0.65% to +1%) closed at fresh record highs, driven by a rally in the tech and the healthcare sector. Asian stock markets gain around 0.4% overnight with China outperforming.

- Britain and the EU are targeting a Brexit divorce deal within three weeks, with negotiators drawing up a political road map that seeks to overcome the toughest unresolved issues on a financial settlement and Northern Ireland.

- ECB Coeuré said he expects policy makers to change their guidance on monetary policy next year, focusing on interest rates more than bond purchases as officials become more optimistic that inflation is back on track.

- Hungary’s central bank said it will start buying mortgage bonds in order to push yields lower on long dated government bonds and to encourage borrowers to choose fixed-rate housing loans. It will also launch a new unconditional 5-yr and 10-yr interest rate swap, at up to HUF300 bn in Q1 2018.

- The US, Mexico and Canada failed to resolve any major differences in a fifth round of talks to rework the NAFTA trade deal, drawing a swift complaint from the Trump administration that the lack of progress could doom the process.

- Fed Chair Yellen stuck by her prediction that US inflation will soon rebound but offered an unusually strong caveat: she is "very uncertain" about this and is open to the possibility that prices could remain low for years to come.

- Today’s eco calendar contains EMU consumer confidence, US weekly jobless claims, durable goods orders and FOMC Minutes. The UK Chancellor presents budget to Parliament and Germany holds a 30-yr Bund auction

Currencies: US Curve Flattening Caps USD Rebound

USD struggles as long term US yields stay low

The dollar traded mixed yesterday. It held a cautious positive bias against the euro during the European session supported by a high/slightly rising interest rate differential, but EUR/USD reversed the early losses later on to finish the session little changed at 1.1738. The yen remained strong despite the outright risk-on sentiment. Ongoing low (LT) core yields keep the yen relatively attractive. USD/JPY dropped temporary to the 112.20 area, but finished the session at 112.45 (from 112.62).

The WS equity-rally continues in Asia overnight, with several regional indices reaching a cycle top. Even so, the USD dollar remains in the defensive. Ongoing low LT US yields (and a flatting yield curve) are weighting on the dollar. Cautious comments from Fed’s Yellen also don’t help, even as the direct impact is limited. The won touched the highest level against the USD since the spring of 2015. USD/JPY (112.10) is again drifting south despite good gains of Japanese equities. EUR/USD trades little changed from yesterday’s close (1.1750 area).

Today, EMU consumer confidence is expected to reach the highest level since early 2001. In the US, initial claims (240K from 249K), Michigan consumer confidence (up to 98 from 97.8) and the durable orders will be published. Orders are expected to grow at a sold pace and that should would also be visible to in the capital goods orders and shipments. The Minutes of the November 1 FOMC meeting will be scrutinized for clues about December rate hike. The November statement was relative hawkish as it qualified growth as ‘solid’. Solid growth often points to a Fed in tightening mode. We suspect that the minutes won’t question the likelihood of a December rate hike.

The eco news flow (data and Fed minutes) might be slightly supportive for the dollar. However, (FX) markets currently also keep a close eye at the long end of the US yield curve. Usually, a rise in short-term yields/interest rate differentials is considered supportive for the currency (in casu the dollar). However, FX markets are clearly puzzled by ongoing low LT yields and a flatting yields curve. We have a cautiously negative bias on EUR/USD and assum that the 1.1861/80 area will be difficult to break. The dollar profited only modestly from the rising interest rate differential of late. At the same time, the high yield spread should at least make investors cautious to be USD short, giving the USD currency downside protection. For now, we don’t change tactics. That said, trading might become more erratic as market liquidity dries up going into the Thanksgiving weekend.

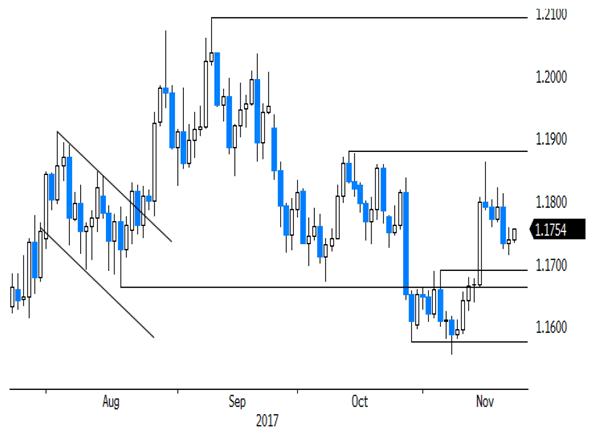

From a technical point of view, EUR/USD set a post-ECB low two weeks ago and regained since intermediate resistance at 1.1690/1.1837. The 1.1880 MT correction top was left intact. A break above the latter would suggest a full retracement to the 1.2092 correction top. We don’t preposition for such a scenario unless real negative news from the US pops up. On the downside, the 1.1554 reaction low remains the first important reference, but it is still far away. A downside correction within the 1.1554/1.1880 range is favoured. The USD/JPY momentum was positive in October, but deteriorated this month. The pair tested the 114.49 MT range top, but the attempt failed. Recent price action was unconvincing despite solid US interest rate support. Last week’s drop below the 112.96 support reinforces the downside pressure. 111.65 is the next key support. A break would turn the picture outright USD negative.

EUR/USD declines very gradually in the 1.1880/1.1554 trading rang

EUR/GBP

Sterling rebound to slow

Yesterday, Sterling trading entered calmer waters and moved mostly sideways yesterday. The UK eco data were mixed. Several BoE members testifying before a parliamentary Committee maintained a balanced approach and indicated that gradual policy tightening was likely needed to control inflation during the policy horizon. EUR/GBP basically held a sideways range in the mid 0.88 area. The pair closed the session at 0.8863. Cable shows no clear trend and finished the day at 1.3239.

There are no UK eco data today. The focus for trading will be on the UK budget and the Brexit process. Slowing growth gives UK Finance Minister little room to support the UK economy as the Brexit process continues. So, there will probably only selective measures to support parts of the economy. This probably won’t change to framework for BoE policy further down the road. There are again press headlines this morning that the EU and the UK are stepping up efforts the bring a positive message to the 14/15 EU summit, but plenty issues still have to be solved. Over the previous days, sterling profited slightly from more constructive headlines on Brexit. For now, we have to impression that this repositioning has run its course unless there is more concrete news. So, some further consolidation in EUR/GBP around current levels might be on the cards

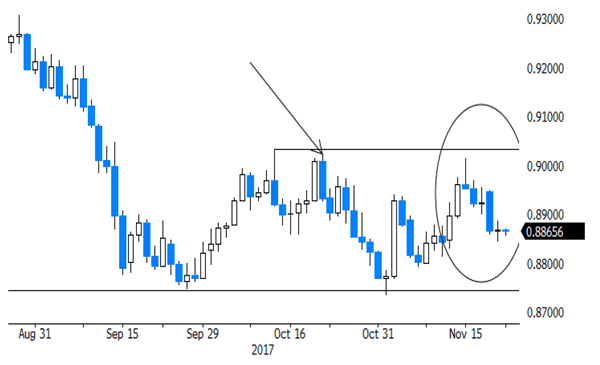

MT technical: Recently, the BoE driven sterling rebound ran into resistance and sterling declined again as markets anticipated that any rate cycle would be very gradual and limited. EUR/GBP trades in a 0.8733/0.9033 consolidation range. Last week, the EUR/GBP rebound ran into resistance just ahead of the 0.9033 range top. We changed our ST bias on EUR/GBP from positive to neutral last week. The 0.9015/33 area might be tough to break short-term.

EUR/GBP: topside test rejected, but momentum of sterling rebound slows