Key Points:

- Forbes’s article claims New Zealand Facing a Recession in the coming year.

- Labour Government pitched as the prime driver of a recessionary cycle.

- Reality suggests it will take a global shock, not political policy, to induce a recession.

The past few days have seen a range of media outlets repeating claims from Forbes opinion piece that suggested that New Zealand could be facing a recession under Jacinda Ardern’s Labour Party. Now as easy as it is to point the finger of discontent at the new incumbents the truth, as always, lays somewhere in between.

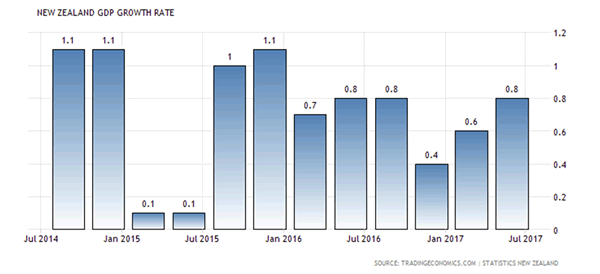

The thing is that most economists have been wondering when the next global down turn will appear for the past few years. The lack of inflation, along with any recessionary pressures, has been the subject of plenty of navel gazing from those of us within the profession. So given that economies typically run on cycles it isn’t out of the question that we could see a recession in New Zealand over the next few years.

In fact, the chances of rising global risks and additional economic headwinds is actually quite likely over the next few years but to suggest that a recession on the way is pure speculation and not based on any current modelling, at least that I’ve seen. Sure, we are likely to shave some GDP growth in the coming years given the anti-immigration, anti-foreign property mantra from Labour. However, this could be largely balanced out by increased government spending in a variety of social areas. Subsequently, it would be a brave person that would predict a recession totally based on the prospects of a social/left wing dominated government.

In reality, New Zealand’s next recession is likely to come from abroad and represent a significant global shock. Will it be the collapse of the debt fuelled, credit driven Chinese economy? Will the bubble pop around the dearth of mounting bad debts in the U.S. student loan market? Or potentially it could be a collapsing global car industry which has also been fuelled by easy credit terms.

The thing is economists are often the worst people in the world at predicting recessions given the role that human behaviour and expectations play in their formation. In fact, central bank’s typically raise rates into recessionary cycles given that their data is typically backward looking. So use some caution when reading claims that the Labour Government will pitch us into a recession especially when even the experts are unsure of when and where the next one will come from