The final consumer price index report for 2024 on Tuesday will be closely watched for further signs of easing in underlying price pressures in Canada, but we expect the data will be distorted by the GST holiday that began on Dec. 14. It applied to a subset of consumer purchases including some groceries, toys, and restaurant meals.

We expect headline inflation to edge down in December to 1.5% from 1.9% year-over-year. This slowdown was largely driven by slower food price growth, which offsets an increase in energy inflation. Excluding those two volatile components, we look for core inflation to remain steady at 1.9%.

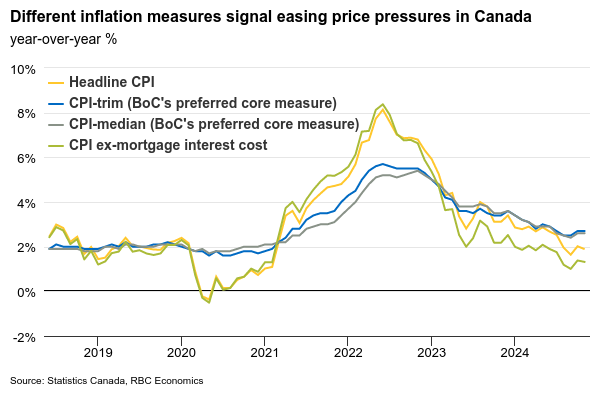

The Bank of Canada’s preferred “core” measures are calculated from price data that is adjusted to exclude the impact of indirect taxes, which means they should be cleaner reads. We expect the trim and median measures to hover around 2 ½ %, consistent with a softening economy that continues to weigh on domestic price pressures.

Mortgage interest costs continue to disproportionately impact total CPI growth, and also have an impact on the core measures, but are expected to continue to slow with a lag from the BoC interest rate cuts last year. By our count, year-over-year growth in median and trim measures would have been 0.5% lower on averrage in November (2.2% and 2.1%, respectively) if mortgage interest costs weren’t included in the calculation.

The release of the BoC’s Business Outlook Survey for Q4 is also out on Monday. We think inflation expectations likely continued to moderate, given readings have stayed near the central bank’s 2% target for four consecutive months. With job openings declining—a sign of weakening hiring demand—expected wage growth should slow further. The BoC will be paying close attention to any further deterioration in key capacity pressures such as labour shortages and supply chain disruptions. Those could signal a deeper economic slowdown, a wider economy output gap, and disinflationary risks going forward.

Week ahead data watch

On Thursday, we expect Canadian retail sales to hold steady in November in line with Statistics Canada’s advance estimate. Seasonally adjusted auto sales jumped 8%, while sales at gas stations likely bounced back in November due to higher prices. But weak core sales are expected to offset the growth.