Market picture

Crypto market capitalization rose another 3.4% in 24 hours to $3.5 trillion, recovering to levels seen before the January 7 sell-off. Both the decline at the beginning of the month and the latest recovery are due to U.S. economic data, which temporarily has an unusually strong impact on cryptocurrencies. Recently, crypto lacks its own drivers, other than Ripple’s case against the SEC and its impact on XRP.

Bitcoin briefly climbed above $100K on Wednesday evening and Thursday morning, stabilizing near $99,600 by the start of active trading in Europe. The price closed Wednesday above the 50-day moving average (bullish signal), but this may just be another test of a meaningful round level. The selling activation after surpassing $100K is still clearly visible.

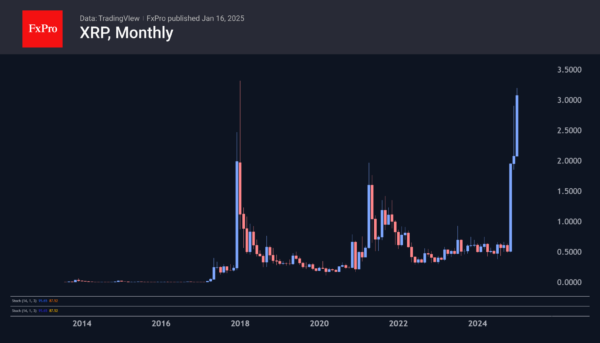

The XRP price soared to $3.20, pulling back later to $3.0. The coin was only above this mark for minutes in January 2018. This is an area of historical highs where you should prepare for increased volatility. Bulls are intrigued by the potential for a Fibonacci extension pattern with a potential target of $4.40. On the other hand, many long-term holders will probably want to get rid of this coin after years of losses, and some will want to lock in profits after a 10-fold increase in two years.

News background

The average purchase price through the Bitcoin ETF is $94K, and falling below that level can cause sell-offs in the BTC ETF.

Thanks to developments in blockchain infrastructure and clarifying legislation, 2024 was a positive year for USDC, Circle’s annual report notes. Compared to 2023, the asset’s turnover increased by 78%.

The U.S. SEC has extended by 45 days the deadline for a decision on an application to convert an index fund from Bitwise into an ETF. The Bitwise 10 Crypto Index Fund (BITW) product tracks the 10 “most valuable proven cryptocurrencies” weighted by market capitalization.

According to Bloomberg, the CFTC may open an investigation against Crypto.com. The commission questioned the legality of the exchange’s futures contracts, which allow users to bet on sporting events.