- Most economists think the US expansion is going to continue in coming years with growth above potential and see few risks near term.

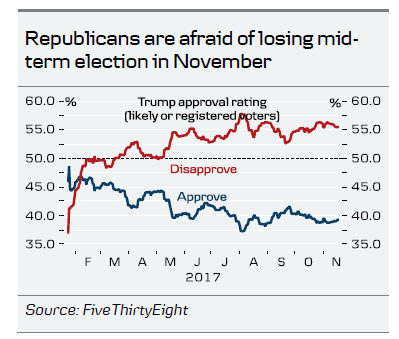

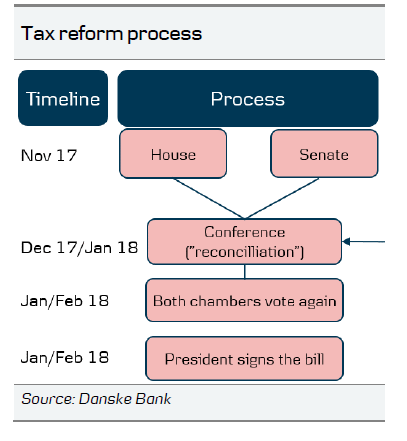

- Most expect the Republicans to deliver a deficit-financed tax cut (most realistically in Q1 18), as they are afraid of the mid-term election in November next year. However, the final version is likely to be watered down (in terms of how big cuts they can make), as there is opposition to the tax revenue raises (like removing tax deductions). Growth impact is expected to be small both in the short and long run so it should not mean a lot in terms of Fed policy. This also limits how much it should push up US yields.

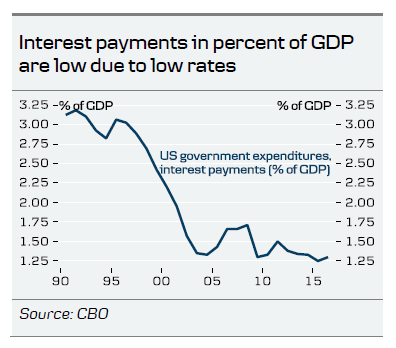

- Economists – including at the rating agencies – do not seem to be concerned about increasing public debt despite US public finances being unsustainable to begin with already under current law. One reason is that interest payments in percent of GDP are low due to low rates.

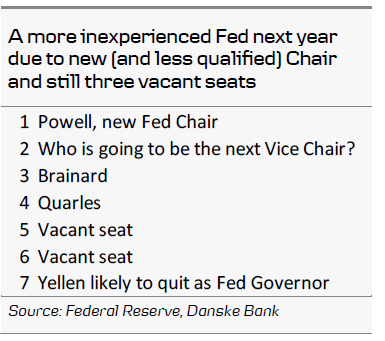

- Jerome Powell was the safe choice for the next Fed Chair and will continue the current monetary policy strategy but will rely more heavily on staff compared to Yellen or Bernanke. Do not expect any controversial nominations for the vacant Fed seats.

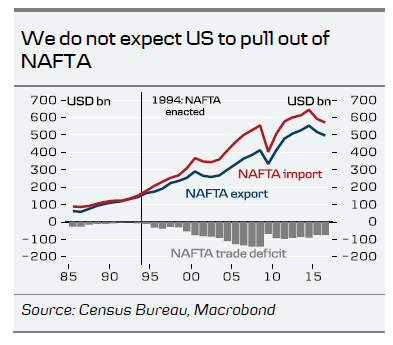

- Low probability of a trade war with China. NAFTA is a ‘joker’ (not least with elections in Mexico next year), which may disrupt US supply chains but analysts expect the US to remain in NAFTA.

Expansion set to continue in coming years

The consensus view is that the US expansion is set to continue in coming years with growth above 2% (potential growth is 1.75-2.00%, according to consensus). Confidence is high among consumers and businesses, suggesting growth will be driven more balanced between private consumption and business investment, as the oil sector has rebounded after the downturn due to sharp oil price drop. The oil sector has become more important for the rest of the economy, as shale oil production requires more input from the rest of the industrial sector than traditional oil production. Economists in general do not think there are many risk factors out there at the moment but mentioned the Chinese debt situation, increasing US rates and NAFTA (North American Free Trade Agreement) as three potential risks. US economists are also still worried about the political situation in Europe, with both the Catalonian crisis and Italy mentioned.

In terms of the Fed, most expect two to three hikes next year (in line with our view), as inflation rebounds and Powell is not expected to change the current monetary policy strategy. That said, we met a few suggesting the Fed could hike four to five times, as they expect higher-than-consensus wage growth and inflation. Others were sceptical to this view, as they think markets are not prepared for so many hikes and it could lead to a stronger USD, which would slow growth and inflation.

Tax cuts are on their way

Most people we spoke with expect the Republicans to deliver tax cuts. The main reason is that the Republicans are afraid of the mid-term election in November next year. The Republican hypothesis is that they will lose badly if they are unable to deliver at least one major legislative result. This has only become more important for the Republicans after they suffered big losses in the recent elections in New Jersey and Virginia. This also helps to explain why Republican fiscal hawks have accepted a budget resolution making room for deficit-financed tax cuts of USD1,500bn over 10 years (equivalent to 0.9% of nominal GDP per year). That said, it is not a given that tax cuts will actually increase support for the Republicans, as corporate tax cuts are not especially popular among the Americans.

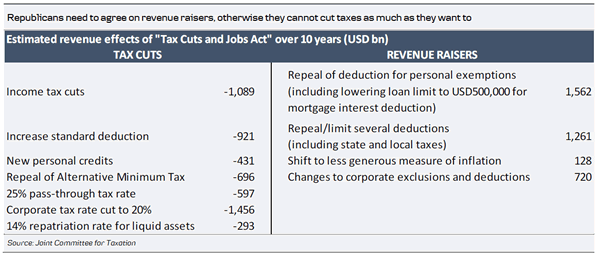

Tax reform has become more likely but is definitely not certain and there is still a risk that the whole thing could backfire, as was the case with Obamacare. I think this is also the reason why analysts have different views on where we might end up. The consensus view is that it will be a watered down version of what is currently on the table, not least given that there is some heavy lobbying against some of the revenue raisers such as a deduction for state and local taxes, a deduction for property taxes and so on. Without tax revenue raisers, Republicans cannot make big corporate tax cuts as they are very expensive (by itself a corporate tax rate cut to 20% costs USD1,500bn over ten years). Remember that the Republican can only afford to lose two votes in the Senate and 22 in the House. Given that the rules to avoid filibusters in the Senate are stricter than in the House and given that the Republicans can only afford to lose two votes in the Senate, the final deal likely looks to be more like the Senate tax bill than the House tax bill (remember, the House also had to give in on the budget). The most important people to follow in the Senate are McCain, Flake, Corker and Collins (Trump has had conflicts with most of them).

Based on our discussions with political analysts, we expect the Republicans to deliver tax cuts in the beginning of next year, as we believe the negotiations between the House and the Senate are going to be very complicated. We expect the final version to be a watered down versions, as they cannot agree on financing all the elements they want to include (but still using the whole USD1,500bn tax cut window). Comparing the House and Senate tax bills, it seems like the Republicans are prioritising corporate tax cuts over income tax cuts.

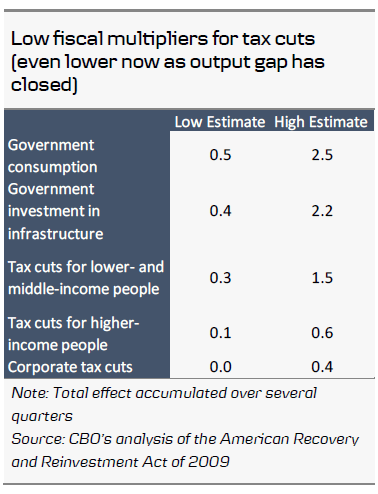

Do not expect a big boost to growth from tax reforms

Most economists do not expect a big economic boost from tax reform although it is slightly positive. The reason is two-fold: (1) income tax cuts target mainly high income earners (also as low income earners already pay little or no tax), who generally have a low, marginal propensity to consume and (2) investments may not increase significantly despite the possibility of deducting investment costs, as credit has been cheap in recent years. Overall, tax reform is more likely to boost investment than consumption. This also means that the Fed is unlikely to hike much faster next year on the back of this. The Republicans’ hope that tax reform will increase potential growth from 2% to 3% was described as ‘fantasy’. We agree that it would not have a big impact on potential growth (which is pulled down by demographics and low productivity growth) and hence it should not increase the natural rate of interest significantly, thus limiting the impact of tax reform in the longer end of the US yield curve.

Besides corporate tax cuts, tax reform will most likely include a one-off tax rate for companies bring money held offshore back to the US, i.e. another round of ‘Homeland Investment Act’. In the House plan, the tax rate is 14%, so higher than promised earlier. Most economists do not expect it to have a significant growth impact, in line with what research proved to be the case last time. The money will more likely be spent on share buybacks and dividends. In addition, the companies may pay down their debt.

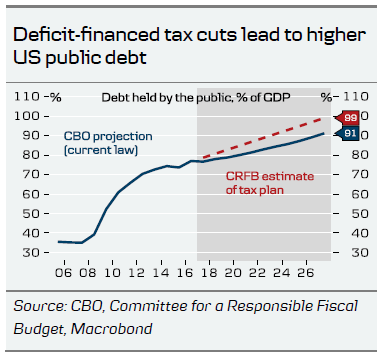

Increasing public debt but downgrade unlikely at the moment

Economists agree that it is not the right time to spend more money, as we are already close to full employment and fiscal policy works with a lag on the real economy. Also, it means there is less ammunition to boost growth through fiscal policy when the next crisis hits. According to estimations made by Committee for a Responsible Fiscal Budget (CRFB), US public debt will increase from around 77% currently to 99% (versus 91% under currently law) based on the House tax bill. Here, it is important to remember that the Republicans have included some ‘gimmicks’ in the proposal to make it look cheaper than it actually is. For instance, new policy appears to be temporary in the bills but in reality it is going to be extended (politicians have talked openly about this). Also note that most models show that the dynamic effect on government deficit is limited, see CFRB: Dynamic Scoring Confirms: House or Senate Tax Bills Would Still Add to Debt, 16 November. Despite higher public debt (remember that public debt is already unsustainable in the long run under current law), economists do not seem worried about a potential downgrade. Interest payments in percent of GDP have declined due to lower rates and the US economy is in good shape. There does not seem to be a clear tipping point but history shows that politicians do not usually act until a problem becomes urgent, which could be when the US falls into recession next time and public finances deteriorate. One economist made the point that Japan did not lose its triple ‘AAA’ rating before debt reached 120% of GDP. Others argued that it may not be a major event if the US credit rating is lowered.

Powell was the safe choice as next Fed Chair

As President Trump was unlikely all along to reappoint Janet Yellen as Fed Chair, Powell was the safe choice, as he is likely to pursue the current monetary policy strategy with gradual hikes and a continuation of ‘quantitative tightening’ (shrinking the balance sheet) but is likely to be a bit easier on regulation. Also, his nomination means that the Fed’s independence is not under pressure (at least for now), as some have feared that people like Kevin Warsh or Gary Cohn, who might have been under Trump’s control, could take over.

That said, Powell’s record and background is definitely not as strong as Janet Yellen’s or Ben Bernanke’s and he is going to rely more on Fed staff than previous Fed Chairs. A more inexperienced Fed may be problematic when the next crisis hits or when the Fed is going to decide the future monetary policy framework.

No-one expects any trouble when the Senate is set to approve Powell, most likely before New Year (but perhaps not until after the December Fed meeting). Economists do not expect further nominations for the vacant seats before Powell is approved. There is not much speculation about who could be nominated for the seats but names like Marvin Goodfriend, Kristin Forbes and Jeremy Stein were mentioned. Analysts do not expect any controversial nominations as the Senate Banking Committee usually works by consensus (which is good for Fed’s independence). We may see a package of nominations including one Democrat-leaned person in order to get Democratic support for the nominations in the Senate.

It seems unlikely that John B. Taylor will become the Fed Vice Chair, as he may be too proud to accept something less than the Chair. The analysts we spoke with expect Yellen to step down as Fed Governor when her term as Chair expires although she could stay on the board as a regular Fed governor for a little while until some of the vacant seats are filled.

While a Powell-led Fed may be more hawkish on the margin (depending on future nominations), analysts do not expect the Fed to become more rule based. Also, any attempts to end/audit the Fed (or other controversial changes to the Fed) seem unlikely to pass Congress at this point.

Low probability of trade war with China

While President Trump has advocated for big shifts in US foreign and trade policy for a long time, he has tweeted more than he has actually acted. The foreign policy experts we talked with think the risk of a trade war with China is low, especially as China has made some concessions to the US on trade and is working with the US on North Korea. In general, analysts are more worried about NAFTA, as the negotiations are also spilling over to the Mexican election next year. A likely scenario, especially if Trump gets a victory on taxes, is that the US will get some concession on, for example, the rules of origin but will not pull out of the deal (all businesses are lobbying against this). If the US does pull out, it would be bad for companies, as many US companies have supply chains in Mexico. One risk factor is that if Trump were to become a ‘lame duck’ after the mid-term election (assuming the Democrats win either the House or the Senate), he may become more active on foreign and trade policy, where the President in general has more power to act alone