- Fed seen cutting in December, pausing in January

- BoJ leans towards keeping rates steady

- BoE seen ending 2025 on the sidelines as well

- Flash PMIs, UK and Canada CPIs, and core PCE also on tap

Fed seen taking the sidelines in January

Following the RBA, the BoC, the SNB and the ECB, the central bank bonanza continues next week, with the Fed on Wednesday, and the BoJ and the BoE on Thursday.

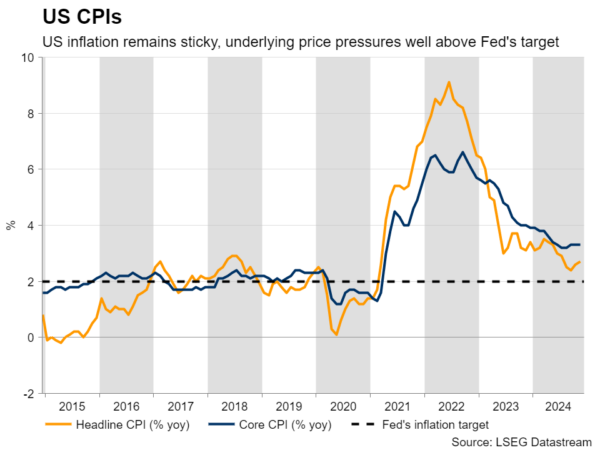

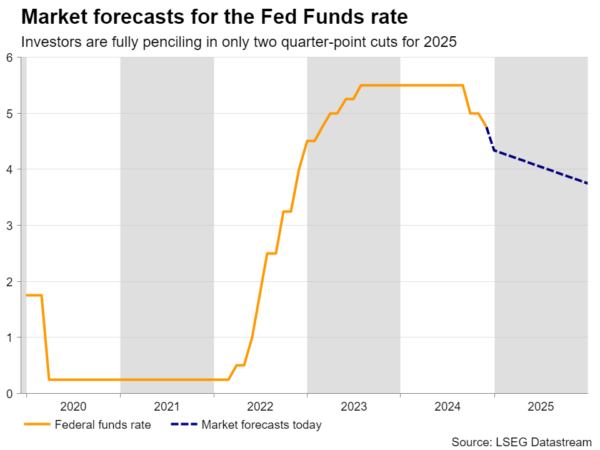

Although Wednesday’s data suggested that US inflation was a little bit hotter than in October, market participants became more convinced that the Fed will press the rate-cut button next week, almost fully penciling in a quarter-point reduction. Having said that though, the probability for policymakers taking the sidelines in January has soared to around 80%.

It seems that market participants took the words of several policymakers seriously, who appeared willing to vote in favor of a rate cut at the upcoming meeting, but they also stuck to their guns that a slower rate-reduction path moving forward is necessary.

That belief may be the result of president-elect Trump’s pledge to impose hefty tariffs on imports from around the globe, especially China, as well as his promise for massive corporate tax cuts. These policies are seen as fueling inflation, which has been proving sticky even before Trump’s plans are enacted.

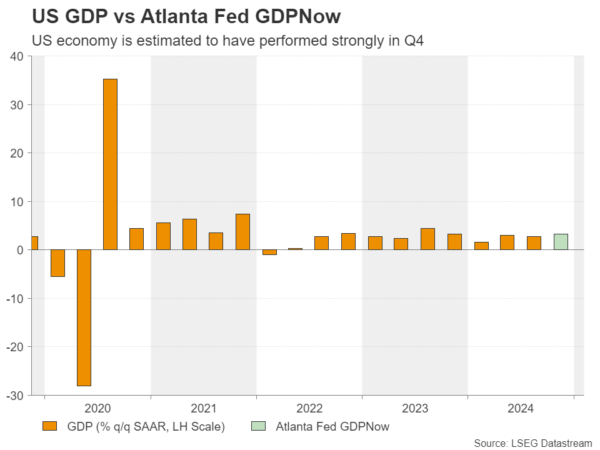

The stellar performance of the US economy corroborates the notion that Fed officials do not need to rush into lowering interest rates, something also noted by Fed Chair Powell himself. The Atlanta Fed GDP now model is pointing to a strong 3.3% QoQ SAAR growth in Q4, while the latest employment report confirmed that the labor market remains robust and that October’s dismal print was just an outlier, a one-off occasion due to strikes and adverse weather conditions.

Mind the dots

With all that in mind, a 25bps cut itself is unlikely to shake the markets much. Investors may focus more on hints and clues on how likely a January pause is, as well as on how many rate cuts policymakers are contemplating throughout 2025.

Taking next week’s reduction out of the equation, Fed fund futures are pointing to another 50bps worth of reductions by next December. Combined with an already strong chance for a pause at the first gathering of the year, this poses some downside risks for the US dollar.

Even if Fed Chair Powell corroborates the notion of a January pause, a median dot for 2025 pointing to more than 50bps worth of rate cuts could disappoint market expectations and thereby weigh on the greenback. At the same time, bets of lower-than-currently expected borrowing costs combined with Trump’s tax cuts, may be celebrated on Wall Street, with equity indices continuing to explore uncharted territories.

Bank of Japan – to hike or not to hike?

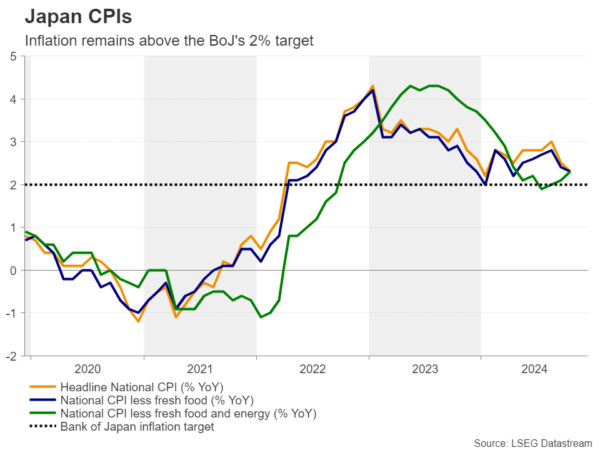

Passing the ball to the BoJ, up until very recently, investors were expecting 15bps worth of a rate increase at this gathering, or a 60% chance for a quarter-point hike. However, that probability dropped to around 25% after board member Nakamura said that, although he is not opposed to rate hikes, the decision should be data dependent.

His remarks disappointed those expecting the BoJ to finish the year with a hike, but yet, traders are nearly fully pricing in a quarter-point increase by March as Governor Ueda and his colleagues maintained their readiness to hike again due to an expanding economy, rising wages, and above-target inflation.

This means that there are upside risks for the yen. A rate hike by the BoJ next week could offer strong support, but even if officials decide to stand pat, strong hints that an increase at the turn of the year is warranted could still prove beneficial.

BoE appears in no rush to cut rates

A few hours later, the central bank torch will be passed to the BoE. Contrary to the Fed, investors are seeing only a 10% chance of a 25bps cut at this gathering. They are not even fully pricing in one before March.

Last month, policymakers lowered the Bank rate from 5.0% to 4.75% but raised their inflation forecasts as finance minister Reeves announced massive government spending in her first budget.

Combined with recent remarks from Governor Bailey that there is still “a distance to travel”, this prompted investors to anticipate no action before the turn of the year and around 75bps worth of reductions by the end of 2025.

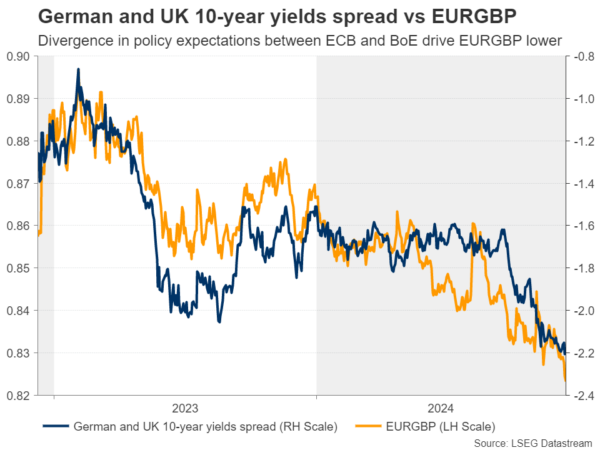

The relatively hawkish BoE bets helped the pound to be the only major currency that has not lost ground against the greenback in 2024, and to strongly outperform the neighboring euro as the ECB is expected to cut interest rates by another 115bps in 2025. Trump’s tariff threats pose another risk for the Eurozone and the common currency.

Ergo, should the BoE maintain a hawkish stance, the pound is likely to remain supported. It could even finish the year higher against the US dollar if the Fed disappoints current market expectations.

Flash PMIs, CPIs and more

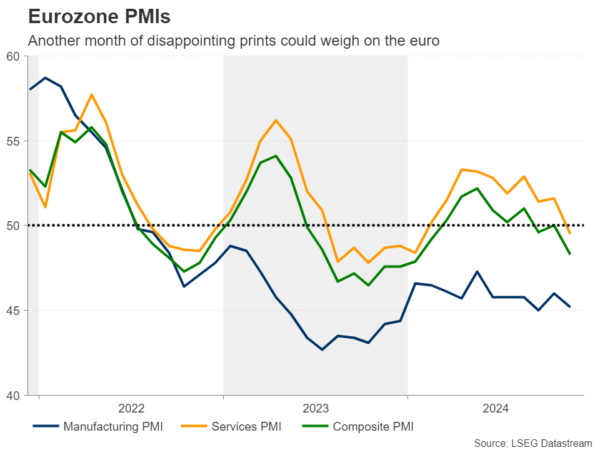

What could add extra pressure on the euro next week may be another round of disappointing PMIs on Monday. The preliminary numbers from France and Germany are coming out ahead of the Eurozone’s prints and signs of more economic struggles in these two nations, which are also face political uncertainty, could intensify headaches for euro traders.

The UK and US preliminary S&P Global PMIs are also out on the same day, but they may attract less attention than the Euro area prints as pound and dollar traders may have their attention fixed on the BoE and Fed central bank decisions.

That said, pound traders may be tempted to incorporate the UK jobs data for October and the UK CPI numbers for November, due out on Tuesday and Wednesday, into their expectations heading into Thursday’s decision. So, the pound could experience some early volatility before Bailey and co. announce their decision. The UK retail sales are due out on Friday.

On Friday, the agenda also includes the US core PCE index for October, which is the Fed’s preferred inflation gauge and is accompanied by the personal income and spending data for the same month.

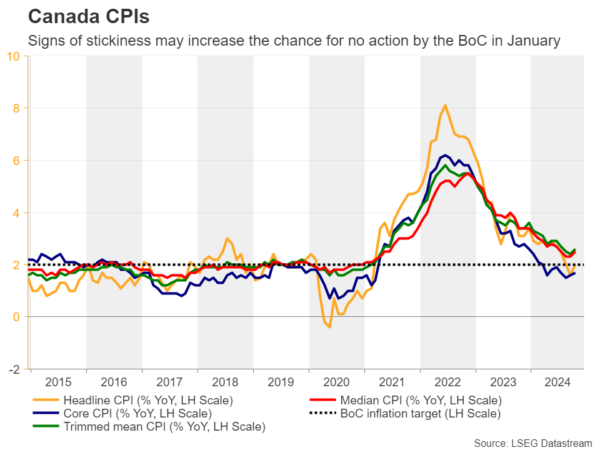

Speaking about inflation, following the BoC’s decision to cut interest rates by 50bps this week, loonie traders may turn their attention to Canada’s CPI data on Wednesday.

Although policymakers opted for the bigger move, Governor Macklem said that further reductions would be more gradual. Now, investors are seeing a 40% probability for the Bank to stand pat at the January meeting and signs of inflation stickiness may increase that chance, thereby adding some support to the Canadian dollar.