- Gold has added almost 30% during 2024

- Fed policy could continue to impact the precious metal in 2025

- Geopolitical tensions tend to drive the safe haven higher

- 2025 could be another bright year for gold

A spectacular year for the precious metal

It’s been a phenomenal year for gold, with prices rising by almost 30% and hitting numerous new all-time highs. Geopolitical uncertainties and the US presidential elections drove prices to a peak of $2,790 per ounce on October 30. On the other hand, gold prices experienced a dip when Donald Trump was re-elected, as uncertainty about a contested election decreased, and investors redirected their focus to the rising performance of the US dollar.

Impact of Trump’s re-election

Donald Trump’s re-election and the subsequent reduction in market uncertainty led to a retreat in gold prices as investors shifted toward the strengthening US dollar. The precious metal may face a significant negative movement between $2,200-$2,600 through the end of the first quarter of 2025. Following Trump’s recent victory, gold prices have seen a decline due to rising bond yields and a stronger US dollar, which make gold less appealing for investors. However, gold often serves as a safe-haven asset during times of uncertainty. If Trump’s policies lead to increased geopolitical risks or economic instability, demand for gold could rise again as investors seek to protect their wealth.

Gold prices pulled back by more than 3% in November, representing their most significant monthly decline since September 2023. Apprehension that elevated tariffs under a forthcoming Donald Trump administration may result in sustained higher interest rates is the market’s biggest fear.

Federal Reserve’s influence

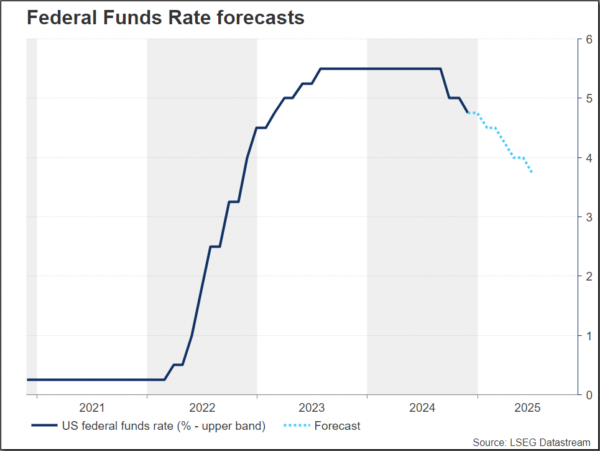

The Federal Reserve’s monetary policy will continue to have a significant impact on gold prices in 2025. If inflation in the US declines and the Fed cuts interest rates further as expected, this will reduce the opportunity cost of holding non-yielding assets, making them more attractive to investors. Additionally, lower interest rates can lead to a weaker US dollar, further boosting demand for gold as it becomes cheaper.

But persistent inflation and the Fed’s response to it can also drive gold prices higher. If the Fed’s policy stance is seen as insufficient to curb inflation, investors may turn to the precious metal as a hedge against rising prices.

Most economists are concerned that President-elect Trump’s proposed policies will lead to increased inflation, threatening to derail the Fed’s rate-cutting cycle.

Investors have already drastically scaled back their rate cut bets, slashing the odds in half, to about 75 basis points by the end of 2025, on the expectation of a spike in inflation from his proposed policies, which include increased tariffs and tax cuts.