- Last policy decisions of 2024 to shape market mood

- RBA, BoC, SNB and ECB are on the agenda

- US CPI report to be crucial too as Fed undecided

RBA to hold rates, but will it turn less hawkish?

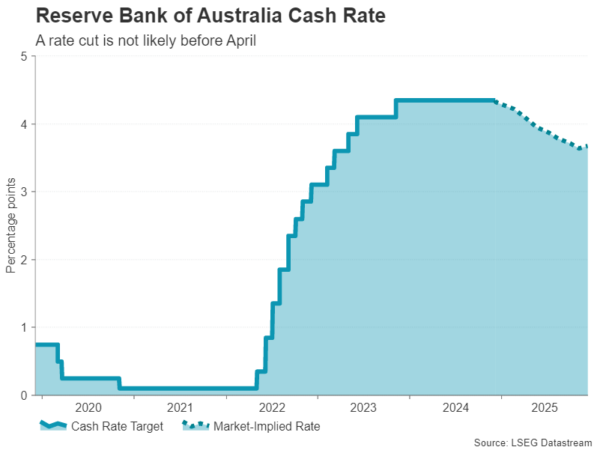

The Reserve Bank of Australia will kick off the central bank bonanza next week, announcing its decision on Tuesday. Unlike its major peers, the RBA has not yet embarked on a rate-cutting cycle as policymakers remain wary about inflation despite the recent decline.

Governor Michelle Bullock said underlying inflation is still “too high” in recent remarks and doesn’t expect for it to return to target sustainably until 2026. Unless that outlook changes, the RBA isn’t about to ditch its ‘higher for longer’ stance anytime soon, and investors don’t see a rate cut before April 2025.

Even April was considered a bit optimistic prior to the GDP data that showed Australia’s economy grew by slightly less than forecast in the third quarter. The soft reading undermines Bullock’s claim about the level of excess demand in the economy. Monthly CPI was also weaker than expected in October, and further downside surprises could see the timing of the first rate reduction being brought forward again.

This may prompt Bullock and other board members to sound a little more upbeat about inflation as they keep rates at 4.35%. A dovish lean could push the Australian dollar below the four-month lows brushed on the back of the GDP print.

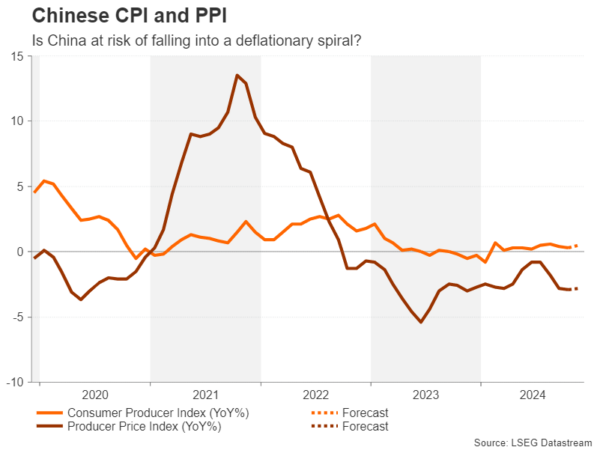

Aussie traders will also be keeping an eye on the November employment report due on Thursday, as well as CPI and PPI figures out of China on Monday, and November trade figures on Tuesday.

Whilst the Chinese data will be important in gauging the health of the world’s second largest economy, a bigger market mover might be any new announcement on stimulus, as political leaders meet next week to set out Beijing’s economic plan for 2025.

Will the BoC cut by 50 bps again?

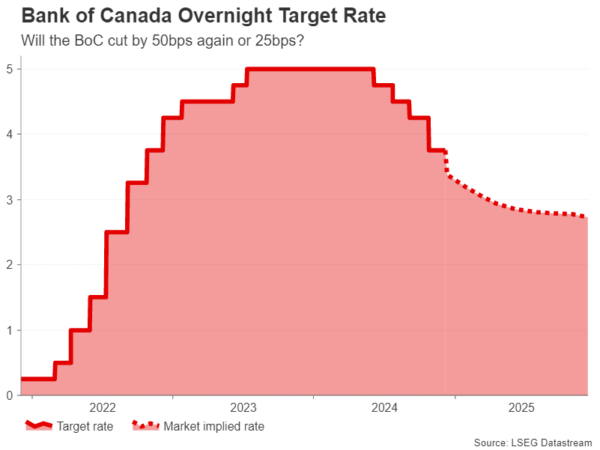

In sharp contrast to the RBA, the Bank of Canada has been taking the lead in the global race to cut rates. The BoC has slashed rates four times this year, the last being a hefty 50 basis points. But investors are split if another double cut is likely in December.

Both headline and underlying measures of inflation ticked up in October, and the jobs market is rebounding after a soft patch. On the other hand, growth remains subdued and businesses are downbeat about the outlook, especially now that US president-elect Donald Trump is threatening tariffs of 25% on all Canadian imports.

Another consideration for the BoC is the widening yield spread with the US, as the Fed has not been as aggressive and may even go on pause soon. With the Canadian dollar already down more than 6% this year, policymakers may not want to risk lowering rates significantly below US ones.

Hence, Wednesday’s decision of whether to cut by 25 bps or 50 bps will likely be a very close call, and the risks to the loonie are symmetrical.

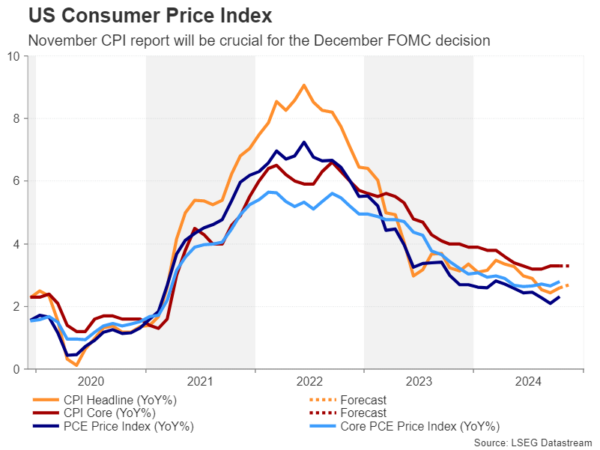

Dollar awaits CPI data as Fed meeting looms

The December policy decision is also proving to be a bit of a dilemma for the Federal Reserve. Judging by the latest rhetoric, most Fed officials appear to be in favour of a 25-bps reduction at the December 17-18 meeting but are not ready to commit just yet.

The CPI report for November out on Wednesday will be the last major piece of the jigsaw for policymakers ahead of the meeting, so a strong market reaction is almost guaranteed.

The headline rate of CPI is expected to edge up from 2.6% to 2.7% y/y, while core CPI is projected to stay unchanged at 3.3% y/y. Barring any upside surprises, the Fed will probably be inclined to lower rates and keep the January meeting as an option for pausing.

The producer price index will follow on Thursday.

The US dollar is consolidating after hitting two-year highs in November. Any unwelcome acceleration in the month-on-month rates could recharge the bulls to drive the dollar index to fresh highs.

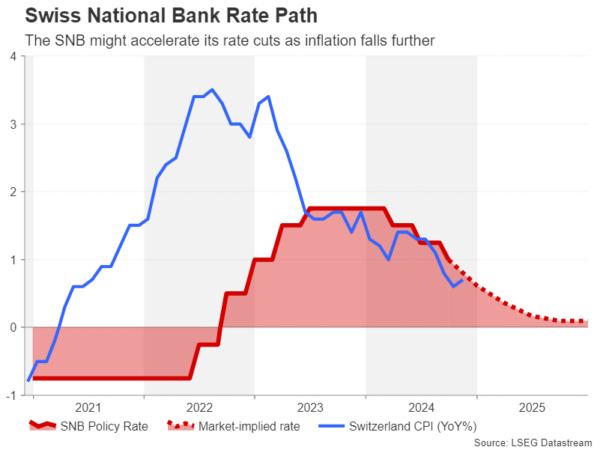

SNB set for first cut under dovish new Chairman

The Swiss National Bank has trimmed rates three times since March when it became the first of the major central banks to ease policy. It’s widely expected to cut again in December, which will be new Chairman Martin Schlegel’s first decision since taking over from Thomas Jordan in October.

However, the size of the cut is less certain, and the choice between 25 bps or 50 bps was looking like a coin toss until the October CPI data came along. Switzerland’s annual CPI rate increased by 0.7%, falling short of the 0.8% expected. The odds for a 50-bps cut subsequently rose to more than 60%.

Dovish remarks by Schlegel have further boosted the chances for a larger reduction, after he repeatedly floated the idea of reintroducing negative interest rates if necessary.

Should the SNB opt for a 50-bps cut on Thursday, the Swiss franc could resume its downfall against the US dollar. However, if policymakers stick with a 25-bps increment, the franc could extend its latest recovery.

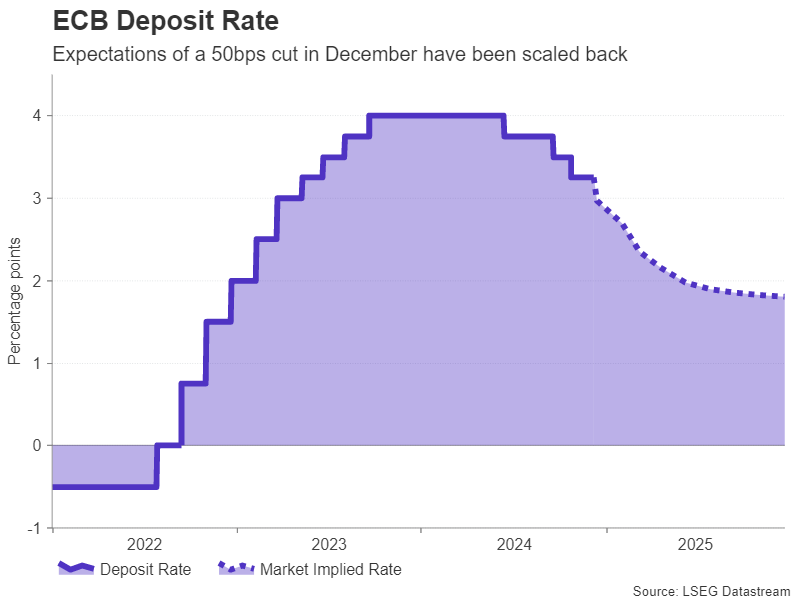

ECB unlikely to go big in December

Soon after the SNB announces its policy settings, the European Central Bank is expected to hit the headlines with its rate decision. A rate cut is almost certain, with economists predicting a 25-bps reduction. However, some investors think that a 50-bps cut is on the cards, although the odds have fallen in recent days to about 15%.

This has helped the euro to stabilize a little against the US dollar as ECB policymakers, including President Lagarde, have been careful not to pre-commit to a particular rate path amid a pickup in inflation in the euro area.

This has helped the euro to stabilize a little against the US dollar as ECB policymakers, including President Lagarde, have been careful not to pre-commit to a particular rate path amid a pickup in inflation in the euro area.

Nevertheless, a weak economy and renewed political uncertainty in both France and Germany have some traders betting that the ECB will have to be a lot more aggressive with its policy easing in the coming months.

However, it’s unlikely that the ECB will change its stance just yet and if it cuts rates by 25 bps as forecast on Thursday, the euro may not move much unless there is some unexpectedly dovish language by Lagarde in her post-meeting press briefing on Thursday that spurs a fresh selloff.

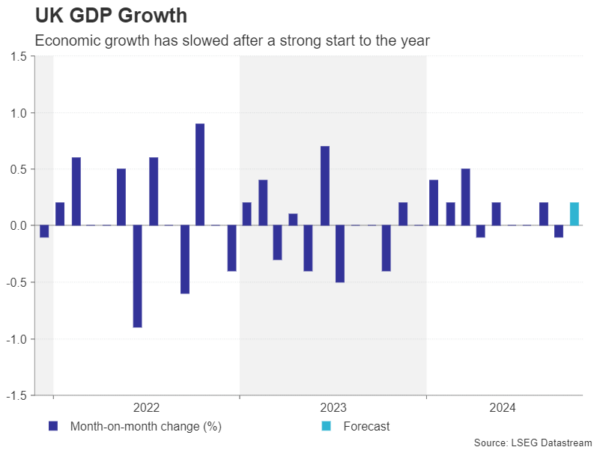

Pound rebounds ahead of UK data

Across the channel, the uncertainty over the UK economic outlook has also risen, mainly on the back of the Labour government’s budget. The tax and spend budget has been widely perceived as boosting inflation, limiting the scope for the Bank of England to cut interest rates. And whilst it does include measures that could lift growth, in the immediate term, the British economy appears to have stagnated.

GDP numbers for October will therefore be closely watched on Friday for signs that growth is coming out of the doldrums.

Although sterling has recouped a decent portion of its recent losses against the greenback, stronger-than-expected growth data could help it extend the gains.

Elsewhere, the yen might be sensitive to any revisions to Japan’s Q3 GDP print on Monday and any surprises in Friday’s quarterly Tankan business survey amid ongoing speculation about whether or not the Bank of Japan will hike rates at its December meeting.