The Canadian dollar appreciated on Thursday after a surprise gain by manufacturing sales. Oil prices continue to be under pressure after the large weekly buildup of US crude stocks reported on Wednesday. NAFTA talks are talking place in Mexico City where the Mexican Economy Minister said he did not agree with the US Commerce Secretary comments that if the US pulled out of the trade agreement it would be devastating for Mexico.

The NAFTA fifth round of talks have entered its second day and for this round the Trade Ministers from the three nations will not be present. They held talks at the APEC Meeting in Vietnam. This could free up the negotiators to move forward in the renegotiation of the Trade agreement with less political interference. Minister might not be present in the sixth round held in Washington.

Petroleum and coal products were behind the lift in Canadian manufacturing sales. The forecast form economists called for a 0.3 percent decline but instead showed a 0.5 gain. The energy industry was the big winner with a 10.3 percent increase in September.

The CAD was higher against the USD despite a report from private payroll processor ADP who published that the Canadian economy lost 5,700 jobs in October. The official figure from Statistics Canada was a gain of 35,300 jobs. While not in exact lockstep both reports share a long term direction and this type of divergence is unusual. The small sample size and other factors lend less credibility to the ADP numbers than the official data, but for now it would remain as something to look for in the next official release.

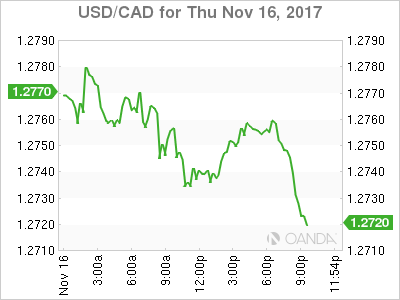

The USD/CAD lost 0.12 percent on Thursday. The currency pair is trading at 1.2749 despite oil losing momentum. The positive manufacturing sales indicator was enough to put the loonie over the US dollar in a day with little data releases on the agenda. Traders will be focused on tomorrow’s inflation numbers out of Ottawa. Canadian consumer price index (CPI) is expected to be almost flat at 0.1 percent. Yesterday Bank of Canada (BoC) Deputy Governor Carolyn Willing said that inflation pressures would be driven by economic growth than the short term swing of energy prices.

Canadian growth has cooled down after an impressive first half of 2017. The BoC hiked twice, once in July and then right way in September but has now turned dovish when talking about further hikes. Inflation is a huge reason why. Low inflation has started to be reported in the monthly indicators and now the central bank is not expected to move until the first quarter of 2018. NAFTA negotiations are a big unknown for Canada, with 75 percent of GDP going south. It would be hard for Canadian Trade Minister to claim that if the US leaves NAFTA it would not be devastated.

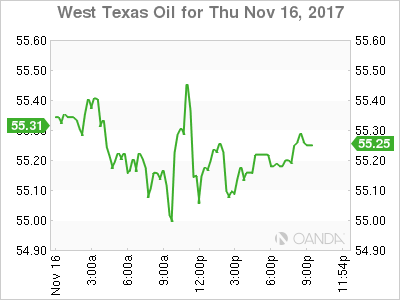

Oil continues its downward slide this week. The price of West Texas Intermediate is trading at $55.06 following strong US weekly crude buildups reported on Wednesday. The Energy Information Administration (EIA) published a rise of 1.9 million barrels. The market was expecting a miss on the forecast after the API reported an overnight rise of 6.5 million barrels. The International Energy Agency has already forecasted that the US energy industry will provide 80 percent of the growth in crude supply in the next 10 years.

The battle between the rise in production in the US and the cut agreement between OPEC and other major producers will continue. The Russian Energy Minister Alexander Novak spoke yesterday to reassure that Russian producers are committed to the agreement to cut output, but he did not mention if they will go ahead with an extension of said agreement. The OPEC and major producers will meet in Vienna on November 30.

Ecuador has stopped its plans to seek an exemption from the OPEC deal after prices have reacted to the group’s production agreement. The small oil producing nation had also floated the idea of leaving the cartel to be able to pump at levels that would make it easier to balance the country’s budget.

Iraqi and Turkish officials are close to reassuming crude exports form the Kurdish region of Kirkuk. The independence referendum was not recognized by Iraq and backed by Turkey it threatened military action. Oil production form the region has not been able to leave for export but those issues are now being worked out between Turkey and the Iraqi government.

Market events to watch this week:

Friday, November 17

8:30am CAD CPI m/m

8:30am USD Building Permits