- UK Inflation rises to a 6-month high of 2.3% in October, driven by services inflation.

- GBP/USD faces downside pressure but could rally if the daily candle closes above 1.2680.

- GBP/JPY shows mixed technical signals with a potential for upside in the short term.

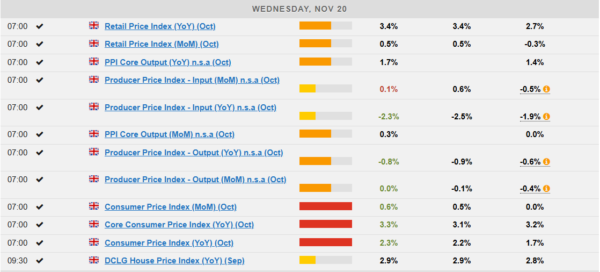

The GBP received a shot in the arm this morning owing to an uptick in UK inflation data. Market participants immediately repricing their rate cut expectations down to around 59 bps through December 2025, from a previous 65bps.

The impact on the GBP was immediate with a 40-odd pip rally for GBP/USD and around 80 pips for GBP/JPY.

UK Inflation Challenge

The UK continues its battle with inflation, and more importantly services inflation which ticked up slightly from September with a print of 5% vs the prior month’s 4.9%. The increase in headline inflation might also be a concern now as the annual inflation rate rose to 2.3% in October 2024, the highest in six months, compared to 1.7% in September.

Markets were expecting an uptick in headline inflation to around 2.2% while the MoM inflation number came in at 0.6% above the estimated 0.5% as well. The concern however remains with the service inflation number which is keeping headline inflation elevated.

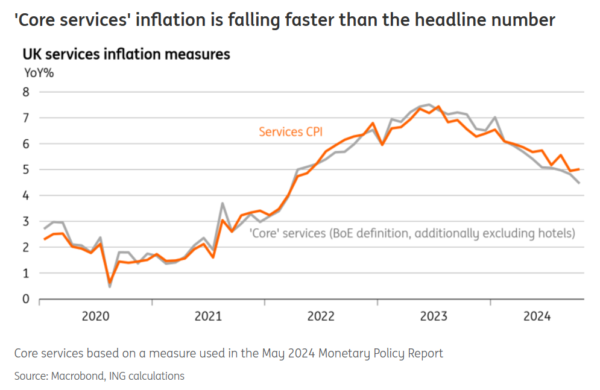

Looking more closely at the data and a lot of the stickiness in the October number comes from categories that the Bank considers less important or less likely to show lasting inflation. This would include things like rent, airfares and package holidays which could in part explain the uptick in services inflation.

A good example of this is when looking at the core services inflation which strips out the data of rent and airfare and we have an entirely different narrative. Given there is no single definition for this, however it has been aptly broken down by ING Think which showed the ‘core services number’ had actually dropped from 4.8% to 4.5% in October.

Source: ING Think

This does not change a thing for the BoE when it comes to the upcoming December policy meeting. I still expect a 25bs cut following the recently released GDP numbers from the UK. Growth is beginning to turn sour, much like the European Union. This is something the BoE would like to avoid and in my opinion may factor heavily at the December meeting.

Based on probabilities, market participants are now pricing in around an 85% chance of a hold at the December 19 meeting with a possible rate cut in February given a 50% chance. This should in theory lend some support to the GBP as the US is expected to cut in December and the Bank of Japan is likely to continue hiking rates in 2025. Will such a move and a GBP recovery come to fruition?

Technical Analysis

GBP/USD

From a technical standpoint, GBP/USD rose in the early part of the week but failed to hold onto any material gains. The weakness in the US Dollar Index did not yield any significant gains for the GBP and with the DXY looking at a recovery today, Cable may face further downside pressure.

At present the key level around the 1.2680 handle is proving a tough nut to crack with UK inflation data helping the GBP/USD to break above this level but failing to find acceptance. If a daily candle close above this handle occurs, bulls may be emboldened which could push cable higher.

A move above the 1.2680 handle may face resistance at 1.2750 and 1.28200 (which is where the 200-day MA rests). The next key hurdle for bulls will be the 1.3000 psychological level which may prove to be a hurdle too far.

Looking at the potential for a break to the downside and the most recent swing low at 1.2600 will be the first area of support before the 1.2500 and 1.2450 handles come into focus.

The driving force behind any move is likely to come from the US Dollar Index (DXY) and its performance in the coming days. Further US Dollar strength could facilitate a retest of the 1.2500 handle.

GBP/USD Daily Chart, November 20, 2024

Source: TradingView.com (click to enlarge)

Support

- 1.2600

- 1.2500

- 1.2450

Resistance

- 1.2680

- 1.2750

- 1.2820

GBP/JPY

GBP/JPY has been inching its way lower since topping out just shy of the psychological 200.00 handle. A pullback helped yesterday by renewed safe haven flow also helped GBP/JPY push further away from the 200.00 handle.

Looking at the technicals and we have some mixed signals. We have a death cross formation as the 100-day MA crossed below the 200-day MA hinting at downside momentum. The candlesticks on the other hand show a sharp rejection following the brief stint below the MAs yesterday with the daily candle finishing as a hammer candlestick hinting at further upside.

The mixed signals do not make it easier, however when combining this with the fundamentals, further upside seems more likely in the short-term. The question is will the 200.00 handle prove a step too far for bulls?

A move higher from current prices for GBP/JPY could face resistance at 198 and 199.30 respectively.

A move lower will first require a daily candlestick close below the two MAs resting around the 194.30-194.60 range. A break of this zone could push GBP/JPY toward the 192.50 and 190.00 handles respectively.

GBP/JPY Daily Chart, November 20, 2024

Source: TradingView.com (click to enlarge)

Support

- 194.30 (200-day MA)

- 192.50

- 190.00

Resistance

- 198.00

- 199.30

- 200.00