Markets

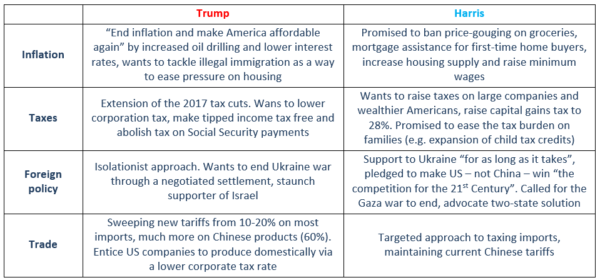

In the run-up to tonight’s US elections there’s little appetite for markets to make additional big directional moves. If anything, US Treasuries and the dollar underperform. Positioning over the recent month, the Trump-trade, unveils a final market skew towards a Republican victory despite basically every prediction model showing it’s an extremely close call. Below you’ll find a brief overview of some of the market-relevant themes (based on BBC analysis). The composition of Congress will heavily influence either president’s ability to push through their agenda. Harris has the odds against with a blue sweep less probable than a red one (due to the Senate).

News & Views

The Swedish services PMI jumped more than expected in October, from 48.9 to 52.9 (vs 50 consensus). It copied the manufacturing PMI’s last Friday (53.1 from 51.3 vs 51.6 expected), resulting a significant bounce of the composite gauge (53 from 49.7; matching best level since October 2022). Details showed business volumes spiking from 47.2 to 56.1 with accelerating new orders (56.4 from 50.2) boding well for the future and being somewhat at odds with layoffs suggested by the employment gauge (43.4 from 46). Especially as the order backlog increased (55.6 from 52.1) and with planned business volumes also rising (59.3 from 56.8). Strong PMI’s are at odds with the Swedish Riksbank’s normalization cycle which will see a step-up from 25 bps to 50 bps rate cuts at Thursday’s meeting. Sub-par inflation (core 1.1% Y/Y in September; 1.3% expected for October on Thursday as well) is the key concern. The Riksbank’s aggressive approach hurts the Swedish krona. EUR/SEK (11.66) is being lured by YTD tops around 11.75.

The ECB today published a system-wide analysis of commercial real estate exposures and risks as part of its macroprudential bulletin. The article is part of a broader study which started in the wake of some US financial institutions’ CRE-related failure in a rising interest rate environment. EMU banks have approximately €1.3tn in outstanding loans to CRE investors, making them a crucial source of financing for CRE markets. These bank loans, concentrated in a tail of smaller, specialized, banks are highly exposed to potential losses arising from the current market downturn. Credit quality is already visibly deteriorating, with the NPL ratio doubling since the start of the most recent monetary tightening cycle. However, this loan portfolio accounts for only 6% of total euro area bank assets and is unlikely to threaten the solvency of the banking system.