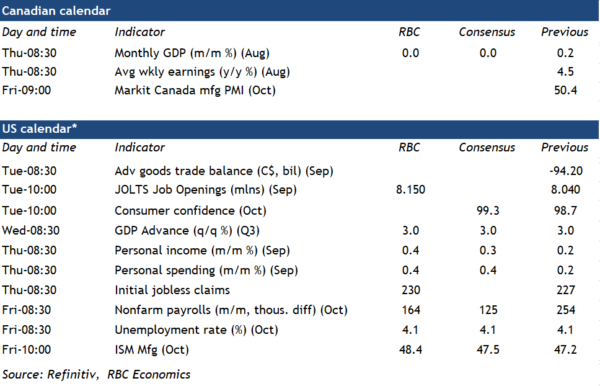

The Canadian gross domestic product report for August on Thursday will likely reveal more softness in the economy with no growth in line with Statistics Canada’s preliminary estimate a month ago and down from 0.2% growth in July.

A slowdown will be seen in both goods and services. The manufacturing sector likely saw a decline in output, given that sales and volumes were down in August. But, that decline was partially offset by higher output in mining, oil and gas. Wholesale sale volumes declined by 0.7% in August and our tracking of credit card transactions is pointing to a pullback in hospitality services, but retail sales and home resales increased.

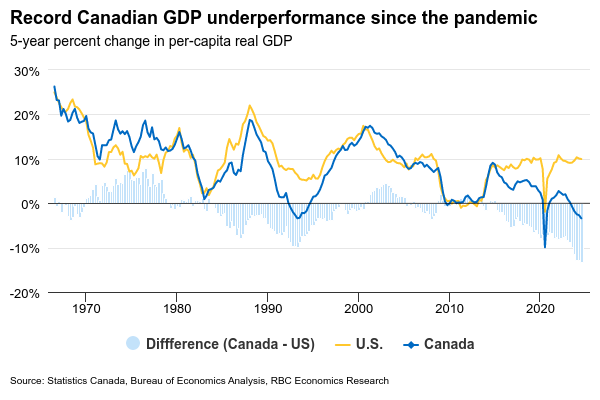

The early estimate for September GDP will also likely remain soft. Hours worked declined 0.4% in September—leaving GDP per capita tracking a sixth consecutive quarterly decline. That would extend a historically unprecedented underperformance on a per-capita basis versus the U.S. economy, where we expect Wednesday’s U.S. GDP for Q3 to show another solid 3% gain, faster than Q2. This is consistent with why we expect more interest rate cuts from the Bank of Canada than the U.S. Federal Reserve in the year ahead.

The Fed will be watching U.S. labour market data closely on Friday. U.S. unemployment has been inching higher, but the deterioration has been very gradual and more consistent with normalization in the job market from overheated conditions earlier in the recovery from the pandemic. Disruptions from strikes and hurricanes could significantly distort payroll employment estimates in October, but we look for the unemployment rate to hold at 4.1%. This should be a “cleaner” account of labour market conditions, because those temporarily off work due to bad weather will still be counted as employed for calculating the unemployment rate.

Week ahead data watch

We expect 164,000 jobs to be added to the U.S. labour market in October, slowing from 254,000 in September.

In U.S. Q3 GDP, residential investment is expected to show more weaknesses with housing starts and existing home sales both lower than in the previous quarter. For non-residential investment, equipment investment likely saw solid growth, mainly supported by the aircraft component. That will also offset the decline in structure investment. Lastly, exports likely expanded at a solid pace in Q3, outpacing import growth.

U.S. personal consumption likely grew by 0.4% given robust retail sales in September. We expect personal income to tick up 0.4% from 0.2% in July.

The August Survey of Employment, Payrolls and Hours on Thursday will be analyzed for further signs of easing in the Canadian labour market. Given slower hiring demand, we continue to look for lower job openings and slower wage growth moving forward.