Data this morning shows that U.S consumers increased their spending only slightly in October, a sign that households spend moderated after a hurricane-related bump the previous month.

Sales at restaurants, retail stores and online-shopping platforms rose +0.2% m/m to a seasonally adjusted +$486.55B in October. Compared with a year earlier, sales increased +4.6%.

The market were expecting a +0.1% increase in October.

Digging deeper, sales at gas stations fell -1.2%, likely reflecting pullback from the spike in gas prices after the storms. Motor vehicles and parts dealers had a +0.7% sales increase, compared to a +4.6% increase in September.

Ex-motor vehicles, retail sales were up +0.1% in October, and ex-gas, sales were up +0.4%. Excluding both categories, sales were up +0.3% m/m.

Core U.S inflation finally picks up

The CPI index rose +0.1% in October, in line with markets expectations. The increase was driven largely by higher shelter costs, as food prices were unchanged and energy costs declined.

U.S consumer prices were up +2.0% on the year last month. Core prices were up +0.2% on the month and +1.8% on the year.

Note: That’s slightly higher compared to September’s reading, when core inflation was up +1.7% y/y – it’s the strongest in six months.

Empire manufacturing index disappoints

Other data shows that business activity continued to grow strongly in New York State.

The Empire manufacturing index headline general business conditions index fell -11 points from the multiyear high (30.2) it reached last month, it remained firmly in positive territory at 19.4.

The new orders index climbed to 20.7 and the shipments index came in at 18.4 – readings that pointed to ongoing solid gains in orders and shipments.

Market reaction

U.S Treasuries have held onto their overnight gains after consumer prices rose only slightly.

The yield on U.S 10-year note is trading at +2.331%. The market was looking for a stronger-than-expected inflation reading that would of solidified the Fed’s case to raise rates at next month’s meeting. This morning’s data has done little to suggest acceleration in inflation that might pose a threat to bond prices.

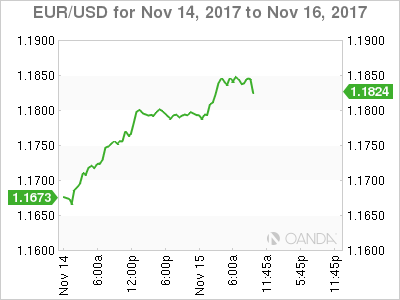

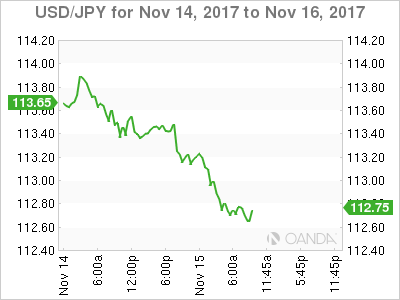

The USD remains on the back foot on investor concerns over the U.S tax reform proposal losing momentum.