- BoC is expected to cut rates by 50 bps, the fourth one in a row

- Policymakers may give some hints about the December meeting

- Loonie looks strongly bearish

- Decision comes out on Wednesday at 13:45 GMT

Fall in inflation confirms the rate cut

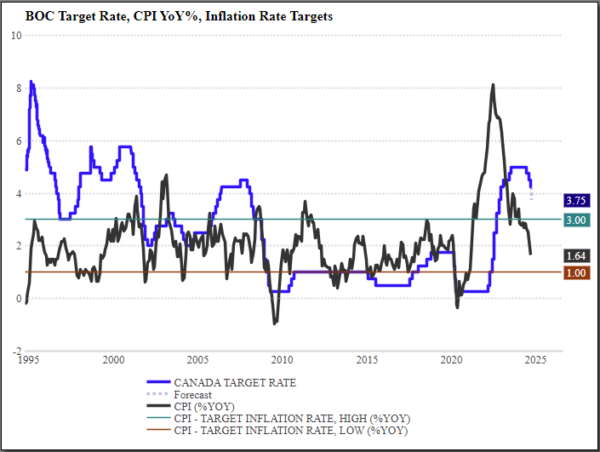

It is widely expected that the Bank of Canada (BoC) will announce a substantial interest rate cut on Wednesday, particularly in light of the inflation data that was released the previous week. The policy rate is expected to have a reduction of 50 basis points, resulting in a decrease to 3.75%. This would be the first substantial reduction in over 15 years and the fourth consecutive rate decline, excluding the pandemic era. The decision is motivated by the necessity to prevent inflation from falling too far below the target range and to stimulate economic development.

Numerous obstacles have confronted the Canadian economy. The jobless rate has risen from a post-pandemic low of 4.8% to approximately 6.5%, resulting in a sluggish growth rate since late 2022. In spite of these obstacles, there have been some encouraging developments. For example, the unemployment rate fell to 6.5% in September from the 34-month high of 6.6%.

Nevertheless, the economy’s overall performance has been subpar, as the real GDP has contracted on a per-capita basis for five consecutive quarters.

The inflation rate in Canada has decreased considerably in September, registering a low of 1.6% – the lowest level in three and a half years. The primary factors contributing to this decline were a significant decrease in gasoline prices and a general decrease in consumer demand as a result of high interest rates. The BoC’s preferred measures of core inflation, CPI median and CPI trim, remained relatively stable at 2.3% and 2.4%, respectively. The central bank’s target is to maintain inflation within the range of 1% to 3%. The most recent data indicates that inflation is currently within this range.

Monetary Policy Report follows BoC policy decision announcement

The BoC’s upcoming rate decision will coincide with the release of the quarterly Monetary Policy Report, expected to provide further insights into the central bank’s economic forecasts and policy outlook. Governor Tiff Macklem has stated that the central bank is prepared to reduce rates more aggressively if necessary in order to maintain inflation within the target range and support economic growth.

Experts anticipate additional rate reductions of up to 0.5% for the December meeting as the Bank seeks to bolster the economy in light of deteriorating conditions. This aligns with the bank’s previous dovish position and its emphasis on mitigating inflationary pressures.

Dollar/Loonie still flies near 2-month high

Any hawkish surprises could potentially provide support to the Canadian dollar. If the predictions come true, the loonie might encounter volatility.

However, investors will also be looking for any indications of potential future reductions. The loonie would be at risk of a more severe adverse trend if Macklem maintains the possibility of additional 50 bps reductions.

Dollar/Loonie is recouping the losses that were posted in the preceding week, after the spike to the two-month high of 1.3837. The rebound from the 1.3420 support level is still holding with the next target at 1.3890.