- Global markets are reacting to shifts in central bank policies, with the US dollar strengthening and rate cut expectations changing.

- The upcoming week will be busy with the IMF meeting, PMI data releases, central bank announcements, and US earnings reports.

- The US Dollar Index is in focus as technical factors may play a more significant role in its movement amidst a lighter data week.

Week in Review: US Earnings Surprise and Gold Hits Fresh Highs

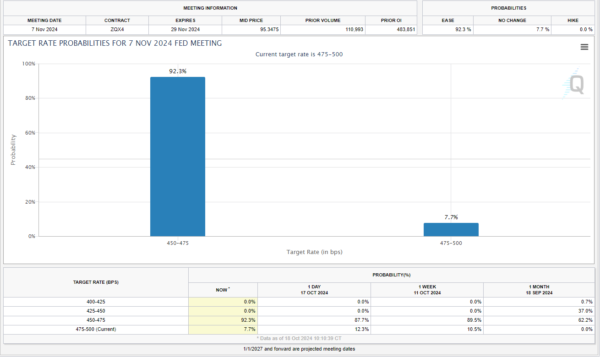

The week drew to a close with fresh highs for the S&P 500 and Gold while US earnings continued on its impressive path. As markets digest US earnings, rate cut bets in the US remain steady from a week ago. Markets are still pricing in around a 92.3% chance of a 25 bps cut from the Fed in November, up from 89.5% last week.

Source: SME FedWatch Tool

On the whole, the week itself was a bit of a hit and miss with quite a bit of choppy price action in the early part of the week. However, UK data and the ECB interest rate meeting have seen markets face up to the fact that the global rate environment is set for a correction. The Bank of England (BoE) which was expected to see its policy diverge from the Fed and ECB has found itself in the spotlight as softer inflation figures ramped up rate cut expectations.

The impact of this realization saw the UD Dollar emerge as the front-runner for the week once more. The greenback continued its impressive run of late as we approached the US elections in November.

Looking at fellow commodities and metals, Oil prices continued its slide this week. Softer data globally and renewed concerns around Chinese growth saw both OPEC + and the IEA downgrade their forecasts once more. Silver breached the 32.00 handle and similar to gold, analysts are predicting a further 12 months of bullish price action with a target price for silver set at $45/oz..

The FX front, as mentioned the US Dollar continued its rise this week. The Japanese Yen experienced whiplash price action as news filtered through of a possible rate hike which was immediately rebuked by the BoJ.

Bitcoin has enjoyed a renaissance this week with the world’s largest cryptocurrency having risen to trade at 68500 at the time of writing. This leaves the world’s largest cryptocurrency just 8% of its all-time highs.

The Week Ahead: US Earnings, IMF Meeting, Central Banks and PMI

The week ahead is a busy one underlined by the IMF meeting taking place in Washington next week. This is but one pillar of what is shaping up to be a busy week for markets across the globe.

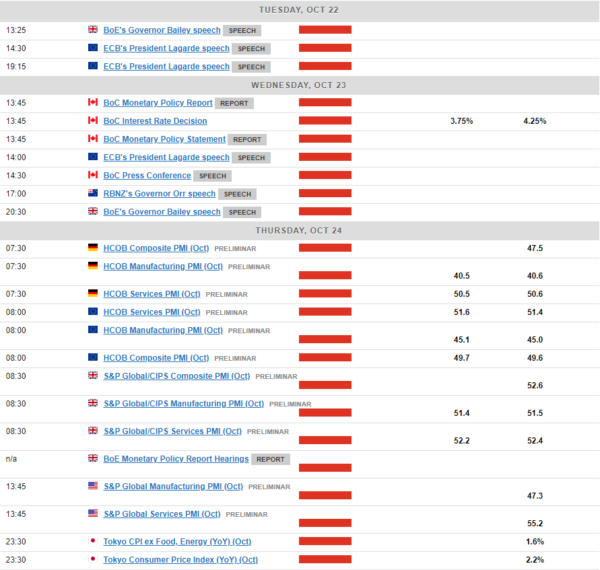

We have PMI data from a host of countries, a couple of Central Bank meetings, US earnings and geopolitical developments to consider. One has to wonder which event may deliver the greatest impact where markets are concerned and that is a tough question to answer.

Asia Pacific Markets

In Asia, the week is quiet following a busy period that culminated with a data dump from China this week. The biggest event in Asia will likely be Tokyo inflation data. Given the mixed rhetoric around rate hikes by the Bank of Japan (BoJ), the inflation data could meaningfully influence the timing of the Bank of Japan’s next move.

Australia and New Zealand will also be enjoying a quiet week with both countries likely to be affected by external factors in the week ahead. There is a speech by RBNZ Governor Adrian Orr which could affect the NZD.

Europe + UK + US

In developed markets, the European Central Bank has seen an increase in the probability of a 50 bps cut in December as much as they have tried to avoid it. Growth in the Euro Area has become a key area of focus and that makes next week a big one as PMIs will be crucial for the eurozone.

Since May, the composite PMI has generally been declining, except for a temporary boost in August due to the Olympics. September’s reading fell below 50, indicating contraction and heightening fears of a potential recession. While these fears might be exaggerated, an economic slowdown seems likely. The October figures will reveal if there’s any improvement; if not, concerns about a slowdown will intensify. Poor PMIs could send the Euro spiraling lower as market participants are likely to increase bets on a 50 bps rate cut.

The UK has just come off a week that has shifted the narrative for the Bank of England. A significant slowdown in inflation, more importantly services inflation and rate cuts are back on. Service PMIs have been gradually declining, aligning with slower growth rates in the year’s second half. If this trend persists, coupled with the recent slowdown in services inflation, the BoE might accelerate its rate cuts. Keep an eye out for any indications of this during Governor Bailey’s appearances in Washington next week.

The US data calendar is pretty bare next week with the Fed’s beige book being the biggest event. I expect we will hear more chatter from Federal Reserve Policymakers which could add volatility to markets. It will be interesting to gauge if the US Dollar can hold onto recent gains.

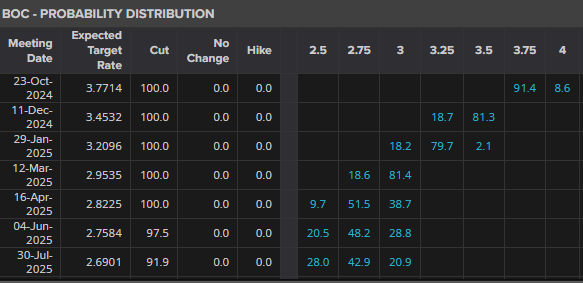

Canada will enjoy a bigger week with the Bank of Canada (BoC) rate decision expected on Wednesday. The market expects a big change due to low inflation and weaker activity, but I think the decision will be tight, with most officials cautious about moving too quickly. Markets are pricing in a 91.4% chance that the BoC will deliver a 50 bps cut.

Source: LSEG Refinitiv

Geopolitical developments and US earnings could have a major impact next week. I would also say that any comments from Central Bank Governors at the IMF may be worth paying attention to as policy rates remain a hot topic globally.

Chart of the Week

This week’s focus is back on the US Dollar Index (DXY) as we have a lack of data which could mean the technicals become more important.

Having enjoyed a stellar rally the DXY appears to have finally found resistance at the 200-day MA. There are signs that point to a retracement but given the overarching macro economic outlook the downside might be limited. The Fed are now expected to cut less than the BoE and the ECB which is contributing to the USD rise over the month of October. The RSI on the daily has now flashed a potential sell signal having broken back below the 70 level from overbought territory. This is usually a sign of shifting momentum and that a drop in price may continue.

The DXY is also caught between the 100 and 200-day MA with the 100-day MA likely to serve as a key support area around 103.180.A break below this support level could open up a retest of 102.65 and potentially 102.100.

Now a break above the 200-day MA remains possible and could open up a run toward the 104.oo and 104.50 handle.

US Dollar Index Daily Chart – October 18, 2024

Source:TradingView.Com (click to enlarge)

Key Levels to Consider:

Support:

- 103.18

- 102.65

- 102.00

Resistance:

- 104.00

- 104.50

- 105.00

- 105.63