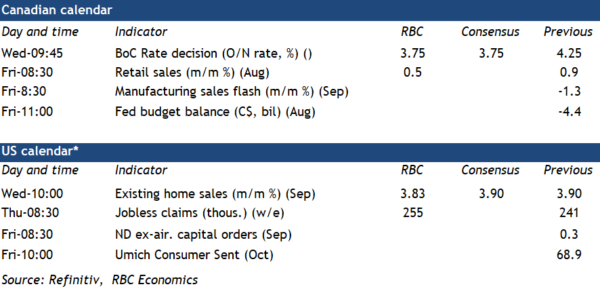

The Bank of Canada is expected to accelerate the pace of interest rate cuts with a 50-basis point reduction to the overnight rate to 3.75% from 4.25% on Wednesday.

An underperforming Canadian economy had already pushed the BoC to lower interest rates earlier than most advanced economy central banks. Three consecutive 25 bps cuts that began in June are already in the books. Yet, the economic backdrop has continued to soften, and risks to inflation look increasingly tilted to the downside of the BoC’s 2% target.

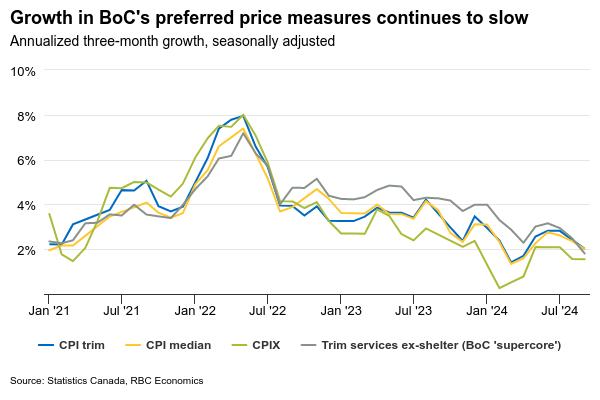

Headline consumer price index growth slowed to below 2% year-over-year for the first time since the pandemic in September, in part reflecting lower energy prices, but also a sign of further easing in broader inflation pressures. Downside inflation risks continue to build as the economy underperforms. Q3 gross domestic product growth is tracking well below the BoC’s 2.8% forecast from July, the unemployment rate is running a percentage point above year-ago levels and job openings are still falling rapidly into September.

Policymakers look increasingly worried that the current high level of interest rates is causing more economic pain (higher unemployment and lower per-capita GDP) than is necessary. Governor Tiff Macklem has explicitly said that economic growth needs to accelerate to avoid price growth slowing below the 2% target, and that they care as much about inflation below target as above. Interest rate changes impact the economy with a substantial lag, increasing the urgency to get rates back down to a more neutral policy quickly, which is somewhere in the 2.25% to 3.25% range, according to BoC’s estimates. We expect the BoC will ultimately need to go further than that to prevent the softening in the Canadian economy from stretching into the second half of 2025. Our base case assumes another 50 basis point cut in December and reductions down to 2% by mid next year.

Week ahead data watch

We look for Canadian August retail sales next Friday to show a 0.5% increase from July, in line with Statistics Canada’s advance estimate a month ago and consistent with industry reports that vehicle sales rose. But our own tracking of card transactions is pointing to a pullback in September.