Key Highlights

- The British Pound is holding an important support area near 1.3040 against the US Dollar.

- There is a major bearish trend line with resistance at 1.3160 on the 4-hours chart of GBP/USD.

- The UK CPI in Oct 2017 increased 3%, less than the forecast of +3.1% (YoY).

- Today in the UK, the Claimant Count Change for Oct 2017 will be released which is forecasted to register a change of 2.3K.

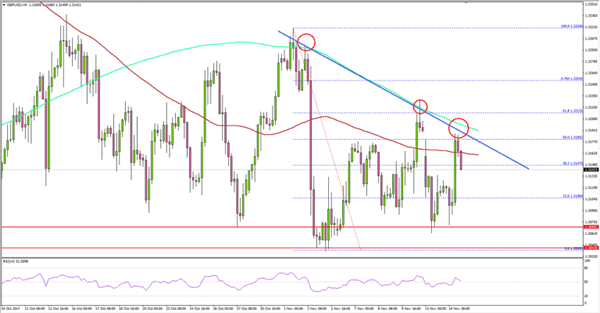

GBPUSD Technical Analysis

The British Pound seems to be struggling near 1.3160 against the US Dollar. The GBP/USD pair needs to stay above 1.3040 to avoid any further declines.

Recently, the pair corrected from the 1.3039 low and moved above the 50% Fib retracement level of the last decline from the 1.3320 high to 1.3039 low. However, the upside move was protected by 1.3200 and the 200 simple moving average (green, 4-hour).

There is also a major bearish trend line with resistance at 1.3160 on the 4-hours chart. Buyers need to push the pair above 1.3160 and 1.3200 to avoid a crucial downside break.

The important support is at 1.3040, which must hold. Otherwise, a break of 1.3040 would open the doors for a push below 1.3000.

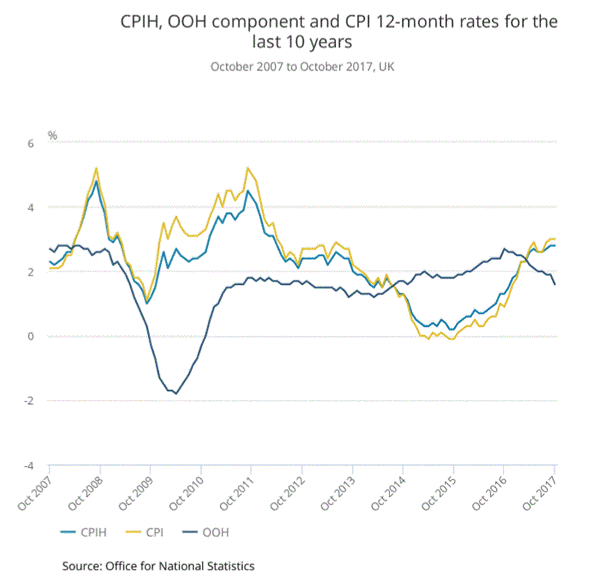

UK Consumer Price Index (CPI)

Recently in the UK, the Consumer Price Index report for Oct 2017 was released by the National Statistics. The forecast was aligned for an increase of 3.1% in the CPI compared with the same month a year ago.

However, the actual result was a bit on the lower side as the CPI increased 3%, unchanged from September 2017. In terms of the monthly change, there was an increase of 0.1%, less than the forecast of +0.3%. It was also less than the last increase of 0.3%.

The report added:

Rising prices for food and, to a lesser extent, recreational goods provided the largest upward contributions to change in the rate between September 2017 and October 2017.

Overall, the GBP/USD is under pressure and finding it hard to move above 1.3160-1.3200. Today’s employment figures might ignite the next move either above 1.3200 or below 1.3040.

Economic Releases to Watch Today

UK Claimant Count Change Oct 2017 – Forecast 2.3K, versus 1.7K previous.

UK ILO Unemployment Rate Sep 2017 (3M) – Forecast 4.3%, versus 4.3% previous.

UK Average Earnings Including Bonus Sep 2017 (3Mo/Year) – Forecast +2.1%, versus +2.2% previous.

UK Average Earnings Excluding Bonus Sep 2017 (3Mo/Year) – Forecast +2.2%, versus +2.1% previous.

US Consumer Price Index Oct 2017 (MoM) – Forecast +0.1%, versus +0.5% previous.

US Consumer Price Index Oct 2017 (YoY) – Forecast +2.0%, versus +2.2% previous.

US Consumer Price Index Ex Food & Energy Oct 2017 (YoY) – Forecast +1.7%, versus +1.7% previous.

US Retail Sales Oct 2017 (MoM) – Forecast +0.1%, versus +1.6% previous.