- US CPI data to guide Fed rate cut bets and the dollar

- RBNZ expected to cut interest rates by 50bps

- Wounded pound awaits monthly GDP numbers

- Canada jobs data and BoC business survey also on tab

Dollar rebounds on safe haven flows and upbeat data

The US dollar staged a meaningful recovery this week aided by Fed Chair Powell’s remarks that the US central bank would likely stick with quarter-point rate cuts, adding that they are not “in a hurry”, as new data have bolstered their confidence in the economy. The currency extended its gains not only because of upbeat data but also due to safe haven flows after Iran launched missile attacks on Israel in retaliation for Israel’s operations against Tehran’s Hezbollah allies in Lebanon.

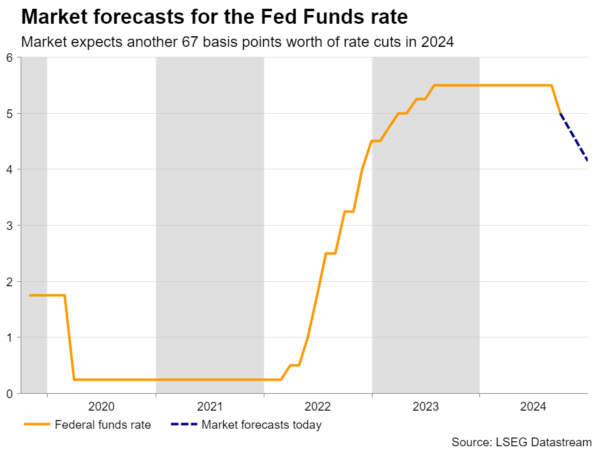

The better-than-expected ADP jobs report and ISM non-manufacturing PMI prompted market participants to scale back their rate cut bets, assigning only a 35% chance for a back-to-back 50bps reduction in November and around 67bps worth of reductions by the end of the year.

Fed minutes and US CPIs on next week’s agenda

Thus, barring any further escalation in the Middle East, dollar traders are likely to keep their gaze locked on the economic calendar. On Wednesday, the minutes of the latest FOMC decision are due to be released. Nonetheless, given that the dot plot pointed to 50bps worth of rate reductions by the end of the year and that most policymakers who spoke after the decision, including Chair Powell, favored quarter-point reductions from here onwards, the minutes are unlikely to shake the markets.

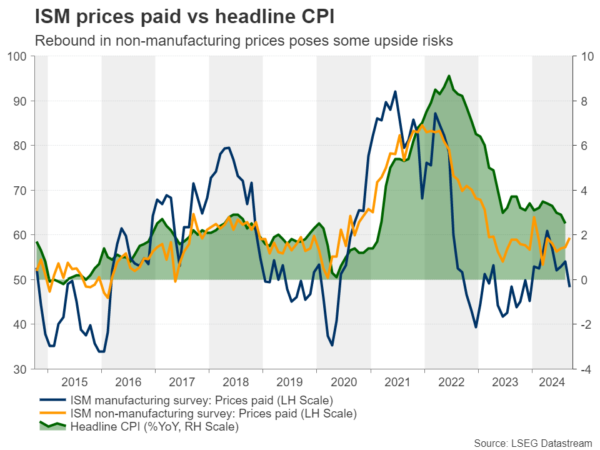

Therefore, the spotlight is likely to fall on the US CPIs for September due out on Thursday. According to the preliminary S&P Global PMIs, prices charged by businesses rose at the fastest rate in six months, and although the ISM manufacturing survey revealed a slide, the non-manufacturing report corroborated the notion of accelerating price pressures.

This implies some upside risks to Thursday’s data, especially to the core CPI rate. The headline rate could still ease somewhat as the year-on-year change in WTI crude oil slipped further into negative territory in September, despite the latest rebound in absolute prices.

Thus, should the data point to some stickiness in inflation, more investors may be convinced that the Fed will proceed as planned, cutting interest rates by 25bps at each of the November and December decisions. This could add more fuel to the dollar’s engines.

Will the RBNZ cut rates by 25 or 50 basis points?

Passing the ball to New Zealand, its own domestic dollar benefited last week from China’s decision to proceed with bold stimulus measures to revive economic activity. However, the latest wave of risk aversion and the recovery of the US dollar were reasons for a pullback.

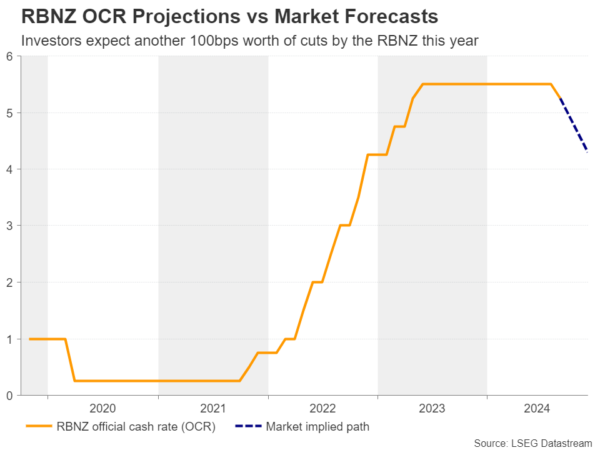

Next week, on Wednesday, it will be the RBNZ’s turn to drive the kiwi. The last time RBNZ policymakers gathered was back on August 14, when they cut interest rates by 25bps and signaled that more are coming as inflation is expected to remain near the mid-point of the Bank’s 1-3% target band.

The decision to cut rates came one year ahead of the Bank’s previous forecasts, with the new ones projecting the cash rate at 4.9% in the fourth quarter of 2024. However, investors took a more aggressive stance just after the decision, penciling in more than 30bps worth of cuts for the October decision.

Since then, data revealed that retail sales tumbled more than expected in Q2, and while the overall GDP rate was better than expected, it still revealed contraction. The Q1 print was revised down to indicate a modest 0.1% expansion, after the economy suffered a recession in the second half of 2023.

Now investors are convinced that the Bank will cut interest rates by 50bps next week, and by another 50 in November. This means that the risks for the kiwi may be tilted to the upside because if officials do proceed with a double cut and signal more aggressive easing, this will just confirm market expectations and thereby, the kiwi is unlikely to depreciate much.

On the other hand, if they cut by only 25bps just solely in order to wait for more data and/or because they will not have updated economic projections to work with at this meeting, the kiwi is likely to recharge and resume its prevailing uptrend.

Will the UK data provide a helping hand to the pound?

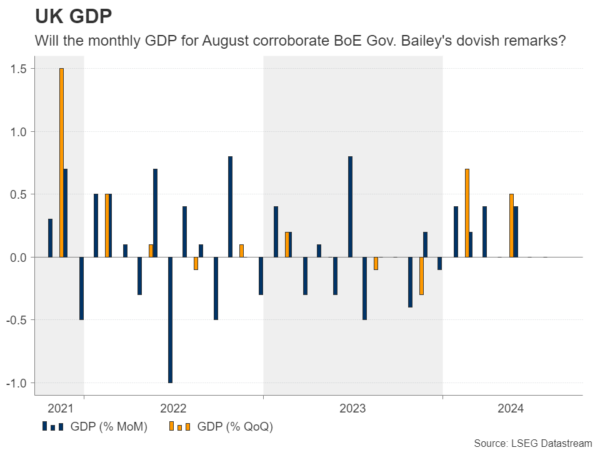

Among the major currencies, the pound has been the best performer year-to-date and by a large margin. However, it suffered a big blow this week after BoE Governor Andrew Bailey said in an interview with the Guardian that they could turn “a bit more activist” on interest rate cuts if data continues to suggest progress in inflation. The market is now nearly fully convinced that a quarter point cut will be delivered in November, assigning a 65% probability for another one in December.

The next test for the pound could come in the form of the monthly GDP data for August, due out on Friday, which will be accompanied by the industrial and manufacturing production rates, as well as the trade data for the month. A disappointing set of numbers could add credence to Bailey’s remarks and prompt traders to push sterling lower.

Elsewhere, the minutes from the latest RBA decision are scheduled to be released on Tuesday, while on Friday, with loonie traders assigning a 30% chance for a bigger 50bps cut by the BoC on October 23, the Canadian employment report for September and the BoC business outlook survey will attract special attention.