Overnight, European equities have shrugged off the broad-based declines in Asian stocks as better-than-expected German growth data this morning is boosting market confidence (preliminary Q3 GDP +0.8% vs. +0.6%).

In Fixed income, sovereign bond prices are under pressure as the world’s most powerful central bankers gather in Frankfurt.

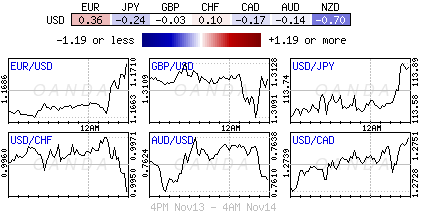

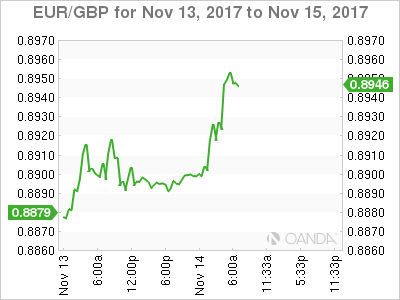

While in currencies, the EUR (€1.1717) remains better bid, while the pound (£1.3098) trades somewhat steady.

Currently, the markets focus of attention is on the European Central Banks (ECB) conference featuring appearances from ECB’s Draghi, the Fed’s Yellen, the BoE’s Carney and BoJ’s Kuroda.

Elsewhere, U.S inflation and retail sales numbers tomorrow are expected to influence the Fed’s interest-rate hike odds, while U.S tax overhaul discussions remain ongoing.

1. Global equities struggle

Asian regional equities completed a third consecutive day of declines after China’s industrial production (see below) came in lower than market expectations.

In Japan, the Nikkei share average ended little changed overnight in choppy trade, while the broader Topix slipped -0.25%.

Down-under, Australia’s S&P/ASX 200 index dropped -0.9% and the Kospi index in Seoul slid -0.2%.

In Hong Kong, shares finished down after data showed the mainland economy cooled further last month.

Note: China’s economy lost steam in October, with industrial output (+6.2% vs. +6.5%), fixed asset investment (+7.3% vs. +7.5%) and retail sales (+10% vs. +10.5%) missing expectations as the government extended a crackdown on debt risks and factory pollution.

The Hang Seng index fell -0.1%, while the China Enterprises Index lost -0.7%.

In China, the blue-chip index posted its worst day since mid-August on the weaker data. The CSI300 index was down -0.7%, while, the Shanghai index was down -0.52%.

In Europe, regional indices trade little changed in a relatively flat session, coming off the earlier highs as the Euro strengthens on better German GDP and ZEW (18.7 vs. 17.6) numbers.

In the U.S, stocks are set to open up in the red (-0.1%).

Indices: Stoxx600 -0.2% at 385.5, FTSE +0.1% at 7425, DAX +0.1% at 13085, CAC-40 +0.1% at 5347, IBEX-35 +0.2% at 10066, FTSE MIB +0.2% at 22487, SMI flat at 9158, S&P 500 Futures -0.1%.

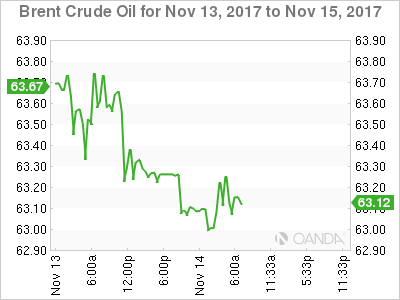

2. Oil is steady, tempered by caution over rising U.S output, gold lower

Oil prices are little changed as the prospect of further rises in U.S output is offsetting some of the optimism that OPEC led production cuts would tighten the balance between crude supply and demand.

Brent crude futures are at +$63.11 per barrel, down -5c, while U.S West Texas Intermediate (WTI) crude is down -13c at +$56.63.

Note: Both benchmarks managed to print two-year highs last week.

Recent EIA data continues to show the extent of rising U.S. oil output – it has grown by more than +14% since mid-2016 to a record +9.62m bpd. Yesterday, the U.S government said that U.S shale production in December would rise for a 12th consecutive month, increasing by +80k bpd.

Note: A cooling Chinese economy has also stoked some concerns about demand, although so far the country’s refiners are processing crude oil near record levels of +11.89m bpd.

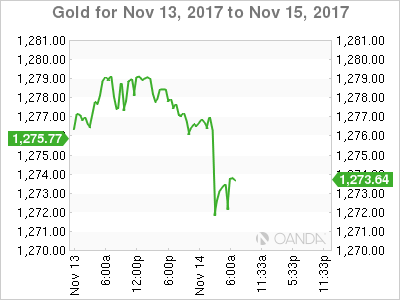

Ahead of the U.S open, gold prices have inched down, hurt by higher U.S Treasury yields amid uncertainty over the outlook for tax reforms stateside. Spot gold is down -0.1% at +$1,276.26 per ounce.

3. German yields rally on data

Eurozone bond yields have rallied across the board as strong growth in Germany has pushed the ‘single’ unit higher and increased the case for tighter monetary policy.

The yield on Germany’s 10-year government bond has backed up to +0.43% on this morning’s German GDP print.

Note: The target for central banks is ‘inflation’ – GDP growth is important, but central bank’s mandate is inflation.

Elsewhere, the yield on 10-year U.S Treasuries have gained less than +1 bps to +2.41%, hitting the highest in almost three weeks with its fifth straight advance. In the U.K, the 10-year Gilt yield has climbed +1 bps to +1.339%.

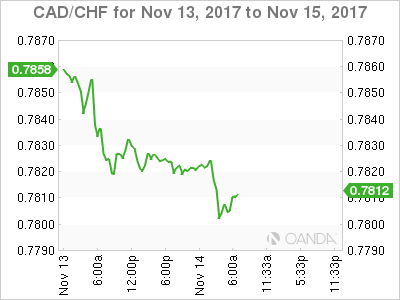

4. Dollar not weak, EUR is strong

Strong German economic growth data this morning has pushed the EUR (€1.1720) to a three-week high – the economy is growing at annualized rate of more than +3%. Coupled with higher Euro bond yields would suggest the market is pricing in an end to ECB stimulus.

Elsewhere, the pound (£1.3090) remains under pressure after slightly softer than forecast inflation (see below). The currency is also pressured on concerns that PM Theresa May might be losing her grip on power.

Note: May’s blueprint for the U.K’s departure from the E.U faces a test starting today, when lawmakers try to win concessions on legislation to sever ties.

The dollar is up +0.2% at ¥113.88 after bouncing from ¥113.25 support levels overnight.

5. U.K inflation flat in October

Data this morning showed that annual inflation in the U.K. held steady at +3% in October, suggesting a surge in prices fueled by a steep fall in the pound (£1.3088) after last year’s referendum on E.U membership may be coming to an end.

Market consensus had been expecting a pickup, to +3.1%. Data from the Office for National Statistics also show that wholesale prices grew at the slowest rate for a year.

Bank of England (BoE) had said they expected consumer price-growth to peak in October as the effect of the devaluation fades.

Nevertheless, data continues to show that U.K prices are still rising faster than wages, suggesting consumer spending will remain subdued unless wage growth picks up.

Note: Earlier this month, BoE policymakers increased borrowing costs for the first time in a decade, reversing the emergency -25 bps cut enacted shortly after Brexit.