All eyes will be on U.S. jobs data on Friday for signs of weakness after the U.S. Federal Reserve kicked off its easing cycle with an outsized 50 basis point cut in September.

The Fed took pains to frame the cut (larger than earlier 25 basis point cuts from most other advanced economy central banks) as the beginning of a “recalibration” process rather than driven by urgent concerns about the economy. But, U.S. labour markets have shown signs of softening, even if at a very gradual pace, and Fed Chair Jerome Powell has reinforced that further weakening is a concern for the central bank.

The unemployment rate ticked down to 4.2% in August, but that only partially reversed an increase to 4.3% in July that triggered the so-called “Sahm Rule” recession indicator—when the three-month moving average of the unemployment rate rises by 0.5% or more relative to its low during the previous 12 months. In short, even the gradual increases in the U.S. unemployment rate to date have not happened historically outside of recessions. Job counts have continued to rise with much of the increase in unemployment coming from longer job searches for new entrants into the labour force, particularly younger workers, rather than layoffs, and initial jobless claims have remained low.

But the average 116,000 increase in payroll employment over the last three months was the softest since early 2021, and early estimates from the Bureau of Labor Statistics already have flagged that payroll employment earlier this year is overcounted by about 818,000 jobs. Hiring demand has continued to slow with job openings back down to pre-pandemic levels. Layoffs are still low, but they have been creeping gradually higher. Like the Sahm Rule for the unemployment rate, this is also unusual outside of recessions. Survey data suggests consumers are less confident in the job market than they were, and wage growth has been slowing.

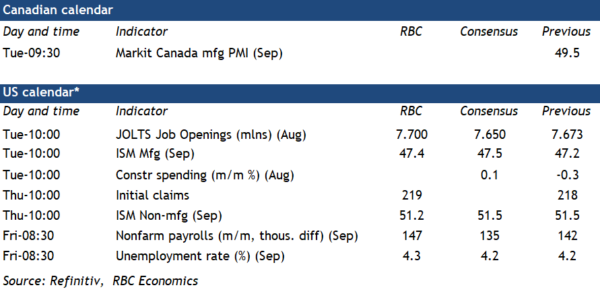

Our base case assumption remains that labour markets are normalizing rather than faltering. We look for payroll employment to rise 147k in September and for the unemployment rate to tick back up to 4.3%—still historically low but up 0.5 percentage points from a year ago. Interest rates impact the economy with significant lags, and the Fed’s start to interest rate cuts will help limit headwinds from monetary policy in the year ahead. An exceptionally large government budget deficit also helps demand in the U.S. economy. Still, labour markets will be analyzed for further red flags with risks tilted to the downside for it, and the Fed’s policy rates.

Week ahead data watch