- Fed cuts by 50bps, sees another 50bps by December

- Investors turn more dovish, which implies upside risks

- Focus turns to PCE inflation due out on Friday at 12:30 GMT

Some investors expect a back-to-back 50bps cut

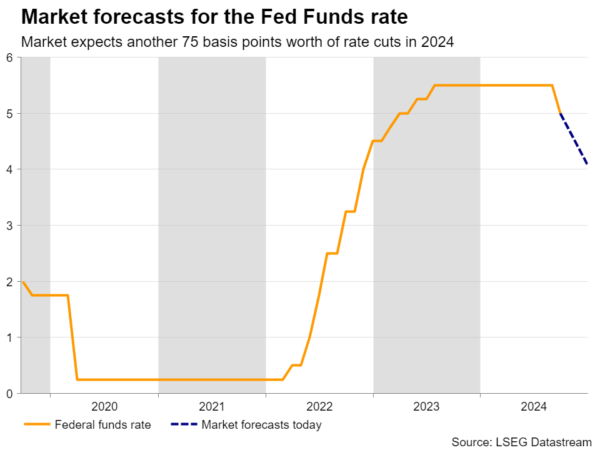

The Fed decided to begin this easing cycle with a double 50bps rate cut at last week’s decision, with the new dot plot pointing to another 50bps worth of reductions by the end of 2024. At the press conference following the decision, Fed Chair Powell noted that the economy is in good shape and that that the decision was designed to keep it there.

Combined with the Committee’s dovish take on interest rates, Powell’s view that there is no imminent risk of recession allowed investors to increase their exposure in stocks, while the dollar suffered some more losses.

Investors went as far as to pencil in another 75bps worth of reductions by December, despite the Fed’s dot plot pointing to 50, and despite a Reuters poll revealing that a strong majority of economists agree with the Fed. Economists believe that policymakers will cut interest rates by 25bps in both November and December, but according to the Fed funds futures, investors are assigning a strong 55% chance for a back-to-back double cut in November.

Dovish bets pose upside risks

This implies that there may be upside risks moving ahead should data heading into the November decision continue to suggest that the economy is faring well and/or that inflation is not slowing as fast as initially believed.

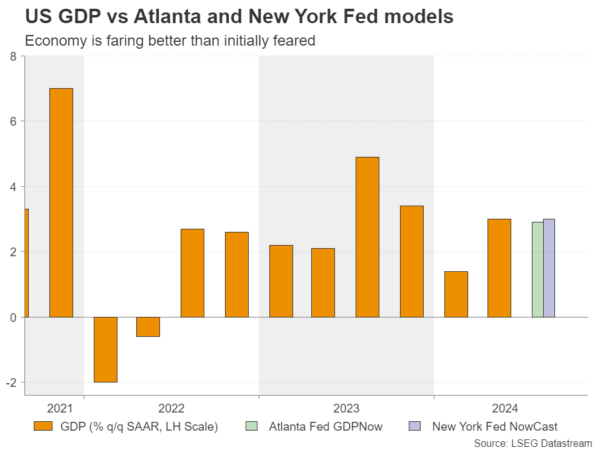

Indeed, both the Atlanda Fed GDPNow and the New York Fed Nowcast models are pointing to solid growth rates for Q3, while the composite S&P Global PMI for September came in slightly better than expected, holding well above 50, despite the further weakness in the manufacturing sector. This corroborates the notion that the world’s largest economy is doing well.

PCE inflation enters the limelight

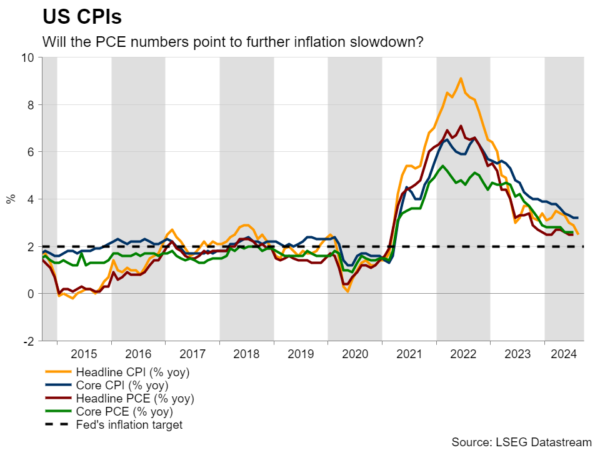

Now, investors are likely to turn their attention to Friday’s PCE inflation metrics for August, which are accompanied by the personal income and spending data. As is usually the case, the spotlight is likely to fall on the core PCE price index as it is the Fed’s favorite inflation gauge.

Considering that the core CPI for the month held steady at 3.2% y/y, there is the likelihood for the core PCE to have also held steady at 2.6% y/y. This view is corroborated by the Fed’s own projections, which suggest that inflation will end 2024 at 2.6%. Reuter’s poll is even pointing to an uptick to 2.7%.

Thus, should such an outcome be accompanied by strong income and spending numbers, investors will have fewer reasons to believe that a back-to-back double rate cut will be warranted, something that could help Treasury yields move higher and the US dollar to recover some ground.

Nevertheless, that doesn’t mean Wall Street will pull back. Even at a slower pace, interest rates are destined to continue decreasing. Thus, as long as data keep pointing to decent economic performance, equity traders may be willing to add to their risk exposure.

Euro/dollar may extend latest setback

Euro/dollar pulled back on Monday, after the Euro area PMI revealed that business activity fell into contraction in August, prompting traders to increase their bets about another 25bps cut at the October ECB decision.

The setback occurred after the pair hit resistance last week near the 1.1180 and should Friday’s US data prove supportive for the dollar, the pair may continue sliding, perhaps until it tests the 1.1025 zone, marked by the low of September 3, or the round figure of 1.1000, which stopped the price from moving lower on September 11.

Now, in case the data encourages investors to increase their Fed rate cut bets, euro/dollar may climb back to the 1.1180 zone, or the 1.1200 area, marked by the highs of August 23 and 26, the break of which could pave the way towards the high of July 18, 2023, at around 1.1275.