- SNB is expected to ease for third time; might cut by 50bps

- RBA to hold rates but could turn less hawkish as CPI falls

- After inaugural Fed cut, attention turns to PCE inflation

- September flash PMIs to do the rounds; spotlight on euro area

SNB to keep trimming as strong franc bites

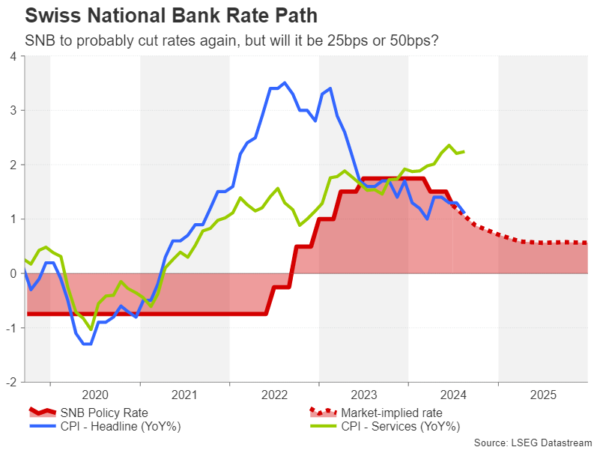

The Swiss National Bank (SNB) will be the final major central bank to announce its policy decision in September. Like the Fed, there is a substantial degree of uncertainty around the size of the cut.

Investors have priced in around a 60% probability of a 25-basis-point rate reduction, with the remaining odds being for a 50-bps move. Expectations for a larger cut have gained ground since the beginning of August when the Swiss franc spiked higher against the US dollar and euro.

SNB chief Thomas Jordan, who will chair his last meeting on Thursday before stepping down at the end of the month, has been quite vocal in expressing his displeasure at the franc’s strength amid calls by Swiss exporters for the central bank to do more to stem the currency’s appreciation.

The franc started the year on the backfoot after hitting nine-year highs versus the dollar and euro in December, but reverted to bullish mode in May, erasing its losses.

This has helped push inflation lower in Switzerland; headline CPI fell to 1.1% y/y in August. However, under the bonnet, the inflation picture isn’t quite so subdued as services CPI has been slowly edging higher this year. Moreover, the GDP data does not point to a particularly dire situation for manufacturers.

Thus, despite the grievances about a stronger franc, the case for a 50-bps cut isn’t very convincing. Besides, the SNB has already lowered borrowing costs twice this year by a total of 50 bps and opting for a double cut would deplete its arsenal as the policy rate currently stands at just 1.25%.

Nevertheless, a 50-bps reduction on Thursday would still send a clear signal to traders, potentially sparking a selloff in the franc and offering some respite to the export industry, at least in the short term.

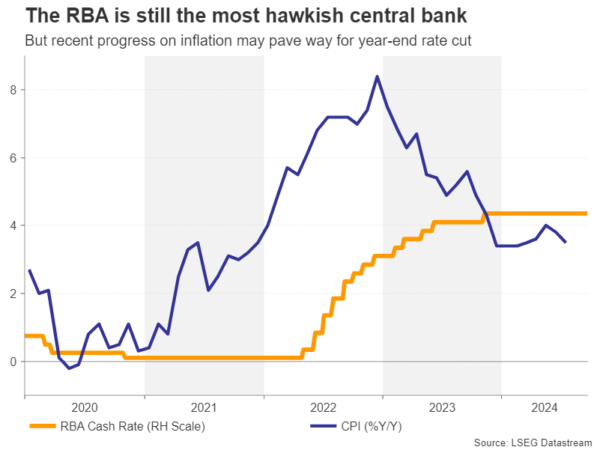

No rate cuts in Australia

Prior to the SNB meeting, it will be the turn of the Reserve Bank of Australia to announce its decision on Tuesday. Although inflation in Australia has started to come down again, taking the pressure off the RBA to hike interest rates further, a cut seems some way off.

The monthly CPI prints for August are due on Wednesday so policymakers may not necessarily have access to the latest data. But even if CPI were to fall further, having dropped to 3.5% y/y in July, the RBA is unlikely to want to discuss a rate cut just yet.

However, it’s possible that policymakers will sound less concerned about the upside risks to inflation and a change in tone could pressure the Australian dollar. Yet, a major policy pivot is not likely before the November meeting when economic projections will be updated. Even then, the markets are ahead of themselves and have already priced in about a 70% probability of a 25-bps rate cut by December, so further downside may be limited for the aussie.

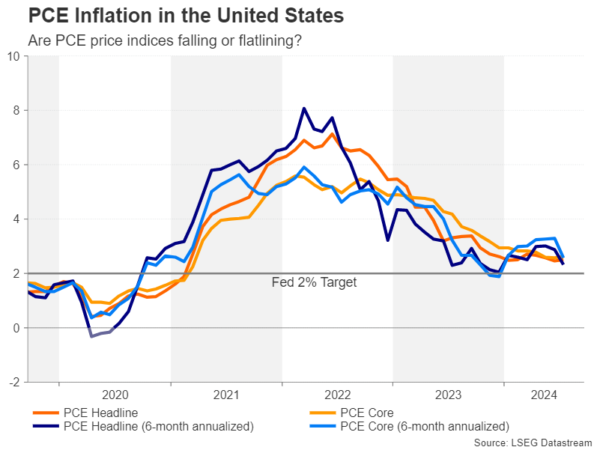

Dollar turns to core PCE for support

The Fed may have surprised markets when it slashed rates by a larger-than-expected 50 basis points at its September meeting, but it’s important to highlight that policymakers have not yet declared victory over inflation. And whilst the decision to kick off the easing cycle with a larger increment can be interpreted as a dovish move, Fed officials are not anticipating further big reductions, and 25-bps cuts are more probable if the latest dot plot is to be believed.

This seems to have put a temporary floor underneath the US dollar, as the sharp selloff over the summer that preceded the September decision may take a breather. Alternatively, investors will be looking for fresh clues on inflation that could potentially bolster dovish expectations.

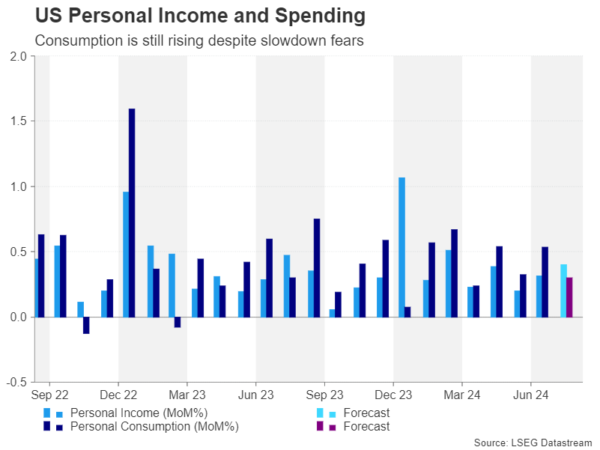

The PCE measures of inflation are due on Friday, along with the personal income and consumption numbers. In July, headline PCE was unchanged at 2.5% while core PCE held steady at 2.6%. Both appear to be flatlining above the Fed’s 2% goal. However, when looking at the 6-month annualized figures, there was a sharp drop in July, suggesting that the PCE gauges will resume their decline over the coming months. This may even have been a factor in the Fed’s decision to lower rates by 50 bps instead of 25 bps.

Further supporting the Fed’s actions is the moderation in consumer spending. Personal spending is expected to have risen by 0.3% m/m August after rising by 0.5% m/m in July. Personal income is forecast to have grown by 0.4% m/m.

Ahead of Friday’s data, the S&P Global flash PMIs for September will get the ball rolling on Monday. Although Chair Powell told reporters in his post-meeting press briefing that he doesn’t see any elevated risks of a downturn, any signs of a slowdown in the PMIs could be negative for the dollar.

On Tuesday, the consumer confidence index for September might attract some attention and investors will also be watching a batch of housing indicators that will include new home sales on Wednesday. Also important will be the latest durable goods orders and the final GDP estimate for Q2 on Thursday.

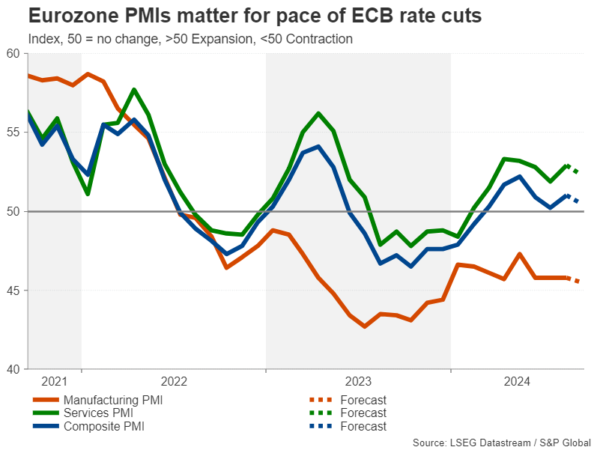

Eurozone PMIs eyed after ECB cut

The European Central Bank lowered interest rates for a second time in September but gave little away in terms of the pace of future easing. After a mini bounce back in the spring, the Eurozone economy appears to be losing steam again. The biggest source of weakness is coming from the bloc’s largest economy – Germany – but growth in the rest of the euro area isn’t quite as anaemic.

The good news is that inflation is almost under control and so the ECB is in a position to respond accordingly to a further deterioration in the growth outlook. In August, the composite PMI edged up, thanks mainly to a rebound in services, but the manufacturing PMI remained in contractionary territory.

As long as the services sector continues to prop up the broader economy, the ECB will likely maintain a cautious stance until it can be more confident that inflation has been fully tamed. Hence, the euro might not react much to Monday’s data unless there’s a big negative surprise.

More business surveys will follow on Tuesday in the form of Germany’s ifo business climate index.

Will UK PMIs continue to outperform?

The flash PMIs will also be the main highlight in the United Kingdom. The Bank of England has taken a leaf out of the ECB’s book in not pre-committing to a particular easing path, although a 25-bps cut in November is highly likely after policymakers stood pat in September.

All three of the UK’s PMI indices climbed for a second straight month in August, underscoring the brighter economic picture during 2024. A further improvement in September would likely lessen the urgency for the BoE to switch to a faster pace of rate cuts, boosting the pound.

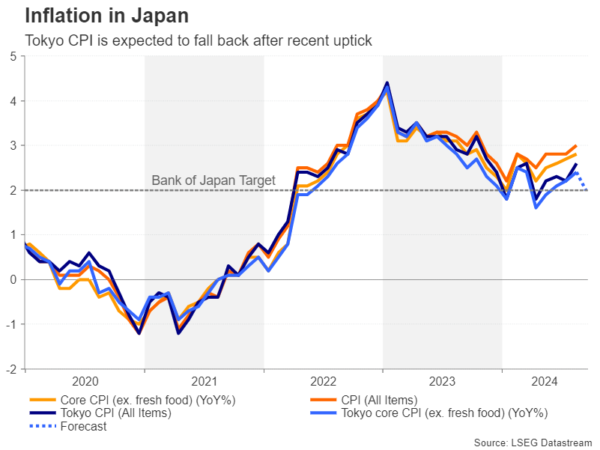

Japanese data could be vital for yen bulls

Finally in Japan, the flash PMIs are up first on the agenda on Tuesday before CPI figures for the Tokyo region come within investors’ radar on Friday.

Markets are undecided if the Bank of Japan will hike interest rates again this year, amid a patchy economic performance and signs that inflationary pressures are no longer so pronounced.

Still, if the PMIs show that the economy is maintaining the recovery that got underway in Q2 and there’s another uptick in the Tokyo CPIs, the yen might be able to resume its uptrend, which came to a halt after the dollar staged an unexpected rebound in the aftermath of the Fed meeting.