Wednesday will mark a much anticipated first interest rate cut from the U.S. Federal Reserve. Gradual but persistent labour market softening and slowing inflation make it clear that current high interest rates are no longer needed.

Indeed, the U.S. unemployment rate ticked lower in August but that was after having trended persistently higher over the last year, driven by a combination of slower hiring demand (as employment growth decelerates) and rising labour supply (as immigration boosts the size of the labour force). This makes it less likely that growth in consumer prices, which are more pronounced among service components, will pick up even with domestic consumer spending broadly holding up.

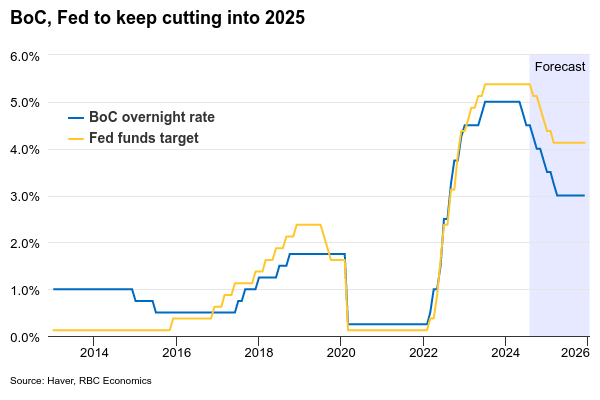

Expectations that inflation will remain lower should keep the Fed on a steady easing path. We expect the Fed’s Summary of Economic Projections will show a median of 75 basis points worth of cuts this year, up from the 25 bps that was expected in July and in line with our forecast. Outside of that, we think Governor Powell’s comments will likely stay on the cautious side—hinting at future rate cuts without committing to a pre-determined path to allow for more flexibility in future decisions.

In Canada, inflation trends have also been slowing. Tuesday’s consumer price index report for August is expected to continue that trend. We expect headline price growth will tick down to 2.1% year-over-year from 2.5% in July, and just a hair over the BoC’s 2% inflation target. Most of that August slowing is expected from a pullback in gasoline prices, but the BoC’s preferred core CPI measures are also expected to trend lower, with the closely-watched three-month annualized growth rate easing from an average of 2.6% in July.

Moving forward and as highlighted in our monthly update , growth in the U.S. is not expected to slow but not falter given unusually large amounts of fiscal spending that is expected to extend into the years ahead, while underperformance in the Canadian economy is expected to persist. We expect a 25 bps cut at every meeting for both the BoC and the Fed, but the BoC will reach a relatively lower terminal of 3% compared to a 4 to 4.25% range for the fed funds rate by Q2 next year. Risks are for a more aggressive easing path – something that central bankers have been clear that they are willing to conduct should the economic growth backdrop deteriorate more quickly than is currently expected.

Week ahead data watch

We expect manufacturing sales increased by 1.1% in July, consistent with StatCan’s flash estimate. Much of that was led by higher sales in petroleum and coal, as well as chemical subsectors.

Statistics Canada’s advance estimate of Canadian retail sales was up 0.6% in July after two consecutive declines. Auto sales dipped 0.2% in Augus, by our count, and a drop in gasoline prices likely lowered sales at gas station.

The Canadian Real Estate Association (CREA) will publish the August resale housing statistics on next Monday. Early reports from regional housing boards have not flagged a sharp resurgence in home resales in the wake of initial Bank of Canada interest rate cuts. More interest rate cuts are likely to stimulate homebuyer demand across the country. but we expect this will be gradual.

U.S. retail sales likely edged lower by 0.6% in August, given both gas prices and auto sales were down during that month. Industrial production likely edged up 0.1%, following the 0.6% reduction in the prior month, the growth was mainly led by higher output in mining and utility sectors.