- ECB widely expected to deliver a second rate cut to 3.50%

- September’s data could be important for October’s meeting

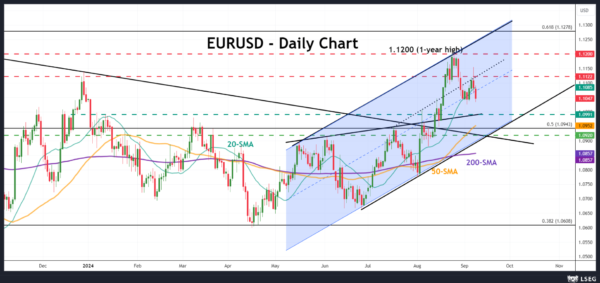

- EURUSD looks bearish; next support could develop near 1.0990

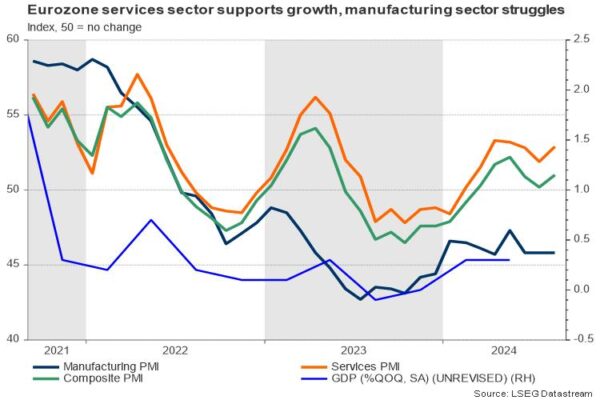

Spotlight turns to economic growth too

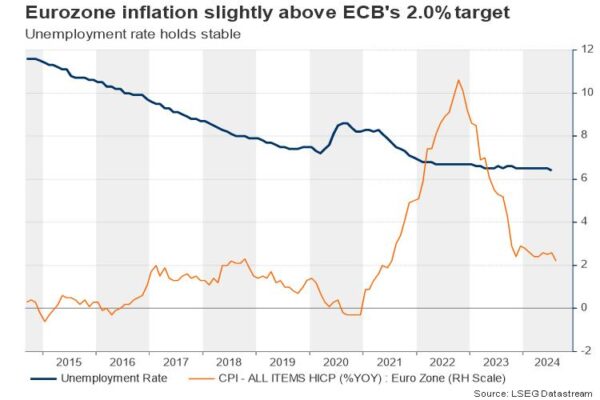

Inflation is no longer the sole focus, as economic growth has gained equal importance, although central banks still prioritize maintaining symmetrical price stability around 2.0%.

The story lately was that a couple of disappointing US business and employment data raised speculation that the world’s largest economy might be at the brink of a recession and could drag the rest of the world down with it as US interest rates remain unchanged at restrictive levels.

The Eurozone economy exceeded analysts’ expectations in Q2, showing ongoing growth since Q3 2023, but the pace remained modest at 0.3% q/q and 0.6% y/y, falling short of the ECB’s 2024 forecast of 0.8% y/y.

Of course, a glance at member states shows a widening gap, with tourism-led economies such as France and Italy displaying stronger GDP numbers than the struggling industrial-led Germany. The latest S&P Global business PMI report revealed that the Olympic games in France and the tourism boost in Spain and Italy could support Q3 GDP numbers. However, with Germany’s growth engines in artificial intelligence and other technological areas falling behind those of the US and China, and given the presence of geopolitical risks, it is questionable whether the bloc will attract noteworthy investment in the coming years.

Eurozone’s labor market is not a problem

As regards the labor market, the unemployment rate has been steady near a record low of 6.4%, but spending appetite was cautious as reflected by a near-zero growth in the household consumption and the falling savings ratio. Although the dynamics on the wage front are mixed across member states, with Germany demanding more increases, the latest round of negotiations within the bloc averaged at a lower level of 3.6% y/y in Q2 from 4.7% y/y in Q1, easing the risk of a wage-price spiral.

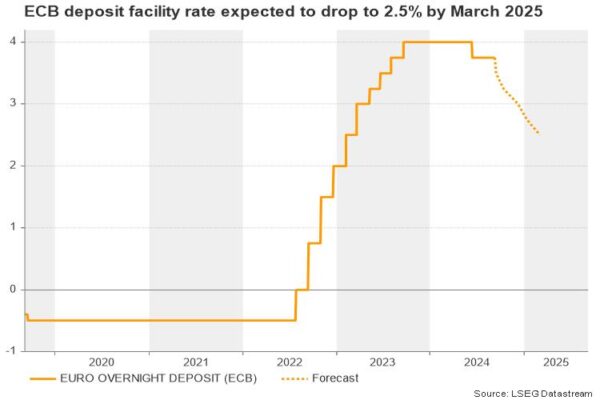

A second 25bps rate cut is a done deal. What’s next?

Hence, a second cut of 25bps in the deposit facility rate to 3.50% may not face strong opposition this week. Analysts believe this is a done deal, especially after ECB board member Kazaks admitted that the sideways move in inflation is consistent with further rate cuts. A few days later, headline CPI inflation broke its range to hit a three-year low of 2.2% y/y, standing marginally above the ECB’s target of 2.0%, while the core measure also eased notably to 2.8% y/y.

Similar to the Fed, we must ask if there is a chance for a significant 50bps rate reduction in the eurozone this year. The ECB is scheduled to update its inflation and GDP forecasts along with its rate decision and therefore it could give fresh hints about its next policy steps. However, October’s gathering could be considered a better timing for guiding investors when September’s economic figures are out.

In the meantime, futures markets are pricing in a third 25bps rate cut later his year, though they are uncertain about whether this will happen in October or December. There is also ambiguity about whether a potential reduction in December could be a double one if nothing happens in October. Overall, investors see interest rates at 2.5% by March, which suggests a back-to-back easing or a 50bps base rate cut with a break in the coming meetings.

Market reaction

For the time being, policymakers might avoid any strongly dovish language and could show preference for a step-by-step policy monitoring, given the elevated prices in the services sector. If that proves to be the case, investors might translate it as a hawkish signal, helping EURUSD climb back towards its 20-day simple moving average (SMA) at 1.1084 and then up to the 1.1100 tough resistance.

From a technical perspective, today’s drop below the 20-day simple moving average shifted the attention to the 1.0990 area, while lower, the 1.0915-1.0940 zone might pause steeper declines. Yet for the bears to reach the latter, the central bank must discuss the potential for a 50bps rate cut and/or even signal a continuous easing policy into 2025.