- Market is digesting last week’s US labour market data

- The August CPI report could fuel 50bps rate cut expectations

- Dollar weakness could continue if inflation surprises to the downside

- The US inflation report will be published at 12:30 GMT on Wednesday

Markets are preparing for the first Fed rate cut

At the recent Jackson Hole Symposium, Fed Chairman Powell indirectly pre-announced the September 18 rate cut and highlighted the importance of the labour market in the current decision process. As a result, last week’s mixed jobs market data sealed the rate cut. However, last Friday’s non-farm payrolls figure also increased the market’s concern about the magnitude of the expected economic slowdown, forcing a negative reaction in most stock indices.

Ahead of the usual blackout period, a number of Fed members were on the wires on Friday, essentially confirming the worst kept secret and offering their support for the first, and usually most difficult, decision in an interest rate cycle. But most refrained from openly stating their preference for a 50bps rate move.

Could inflation produce a surprise?

The focus this week turns to inflation as the August report will be released on Wednesday. Powell was quite direct at Jackson Hole about his inflation assessment. He mentioned that inflation is now much closer to the Fed’s objective and that “upside risks to inflation have diminished”. As such, the importance of the inflation prints has dropped a bit, but this release still holds significant market-moving ability.

Interestingly, the recent inflation-related information is mixed. Last week’s prices paid sub-components for both the services and manufacturing ISM surveys managed to produce upside surprises, thus revealing renewed strength in inflation. Similarly, the mid-August University of Michigan consumer sentiment survey had 1-year expected inflation at 2.9%.

Economists are forecasting a slowdown in the headline figure to 2.6% from 2.9% recorded in July, with the core indicator, which excludes food and energy prices, expected to ease to 3.2%. These forecasts match the Cleveland Fed Nowcast models estimates.

However, there is considerable risk for a downside shift in the headline CPI figure when examining the performance of oil in both August 2023 and last month. In 2023, oil prices increased by 2.3% on a monthly basis, but a sizeable 7% drop was recorded last month. In layman terms, inflation could fall more aggressively and thus add to the Fed doves’ arguments for a more aggressive monetary policy decision next week.

Could a 50bps rate cut become the central scenario?

The market is currently pricing in a 25% probability for a 50bps rate cut on September 18, and a downside inflation surprise would most likely prop-up these expectations. On the flip side, an unsurprising release, which confirms forecasts or even shows a small pick up in inflationary pressures, won’t impact the Fed rate move expectations but could, on the margin, curtail the dovish commentary accompanying the much-expected rate move.

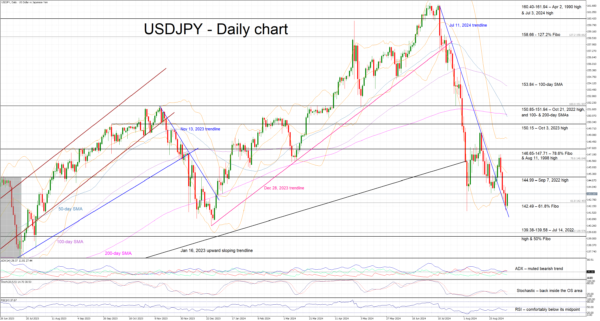

Yen’s outperformance might have legs

The yen has been consistently outperforming the dollar since July. After stalling in August, the move lower in dollar/yen appears to have started again as the Fed is preparing for its first rate cut. A downside surprise to Wednesday’s inflation report could further fuel the ongoing dollar weakness and could help the dollar/yen bears to finally overcome the 142.49 level.