Headline U.S. inflation for August on Wednesday is expected to fall to 2.5% after dipping below 3% in July for the first time since 2021, setting up the U.S. Federal Reserve to cut interest rates for the first time since 2020.

Falling gasoline prices likely accounted for much of that slowing, but we also expect further signs of broader easing in price pressures. We look for core (excluding food & energy) inflation to slow to 3.1% from a year ago after a 3.2% reading in July on a modest 0.1% month-over-month increase. Rising rent prices still account for a disproportionate share of annual consumer price index growth—60% of core price growth over the last two months by our count. But, an earlier slowing in current market rent price growth has begun to filter more significantly into slower shelter CPI readings as leases are renewed. Rents are expected to post slower (though still positive) growth in August.

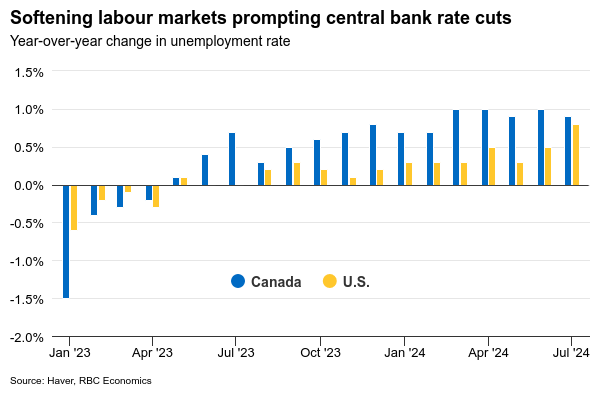

Excluding shelter, inflation has been hovering near the Fed’s target level through the summer. The share of CPI basket items reporting price growth above 3% has fallen below the pre-pandemic average, at just 25%. A gradual softening in the U.S. economic growth backdrop—with lower job openings flagging softening labour demand and the unemployment rate drifting gradually higher—has also increased confidence that broader inflation pressures will continue to slow. The economy hasn’t crumbled in a way that would push the Fed to panic, but it is increasingly clear that interest rates are higher than they need to be. We look for the Fed to kick off a rate-cutting cycle with a 25 basis point cut to the fed funds target range at the FOMC meeting this month.

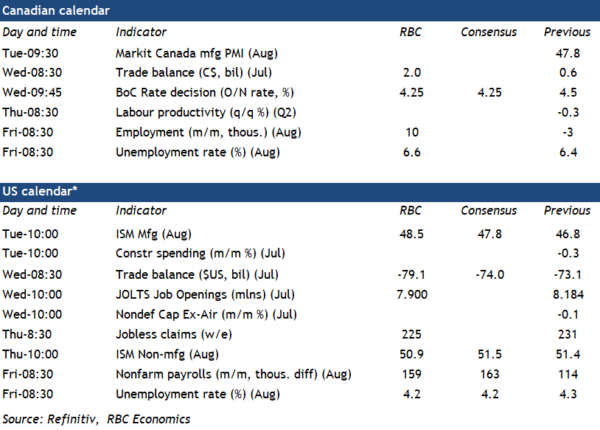

Week ahead data watch

In Canada, second quarter national balance sheet numbers should show the household net worth likely improved as loan growth remained slow, and strong equity markets boosting the value of financial asset holdings.

According to Statistics Canada’s early indicator, core wholesale sales likely fell by 1.1% in July, given lower sales were observed in the motor vehicle and motor vehicle parts and accessories subsector and in the personal and household goods subsector.