Markets

The message from the July Fed meeting and even more from Chair Powell’s Jackson Hole address marked a U-turn in the Fed’s assessment. The focus shifted from taming inflation to preventing an unwarranted deterioration of the labour market. Markets are now in the process of finding out how fast the Fed will (have) to reduce policy restriction to allow the economy to keep creating enough jobs to avoid a further rise of the unemployment rate. Tomorrow’s payrolls are the key barometer. Data evidence earlier this week (manufacturing ISM, JOLTS) strengthened the case for the Fed to move fast and in bigger (50 bps) steps. The ADP private jobs report only added to the evidence of a labour market weakening. According to ADP, job creation in the US private sector in August was only 99K, the slowest pace since early 2021. The July figure was downwardly revised from 122K to 111K. On the other hand jobless claims declined slightly more than expected (initial claims 227k from 232k, continuing claims 1838k from 1860k). Still yields still drifted south with the US services ISM and tomorrow’s payrolls having the decisive voice in markets assessment. The US yield curve steepened slightly further ahead of the ISM (2-y -3.7 bps, 30-y -2 bps). German Bunds show a similar picture (2-y -3.5 bps , 30-y -2.0bps). Equities losses are far less sharp than was the case Tuesday. Still caution dominates. Investors pondering the impact of an economic slowdown prevents (US) equities indices to return near the peak levels that still were on the radar end last week. The Eurostoxx 50 is ceding 0.4%. US indices opened little changed, but especially the Nasdaq tries to reverse some of recent losses. Oil, a key pointer of market doubts on the global growth of late, stabilized near recent lows ($ 73.3 p/b). Headlines from people familiar with the internal debate within OPEC+ are flagging that the cartel is close to a delay in the scaling back of production caps. The rumours were confirmed in the meantime.

The Fed preparing a far more aggressive easing compared to most CB colleagues, is keeping the US dollar in the defensive, with especially the yen rivaling the greenback’s safe haven status. USD/JPY trades near 143.0 (from 143.74), closing in on the early August low. DXY struggles no to fall back below the 101 handle, with key support at 100.51. EUR/USD briefly jumped north of 1.11, but the single currency obvious also doesn’t play with strong cards. EUR/USD is returning intraday gains (1.109).

At the time of concluding this report, the US services ISM is reported little changed (51.5 from 51.4). Price paid rose slightly (57.3 from 57.0). Orders were OK (53.0), but labour momentum eased (50.2 from 51.1). It offers no reason for investors to change positions on the basis of this report going into tomorrow’s payrolls.

News & Views

Czech retail trade except of motor vehicles increased by 0.7% M/M and by 4.5% Y/Y (in real terms) in the month of July. Sales of food increased by 1.3% and for non-food goods by 0.4%, whereas sales of automotive fuel decreased by 0.1%. The Czech Statistical Office commented that the highest share in the year on year growth of sales in retail trade belonged to retail sale via mail order houses or via Internet and to retail sale in non-specialised stores with food, beverages or tobacco predominating. Sales for sale and repair of motor vehicles decreased by 0.8% M/M and by 2.1% Y/Y.

People close to Italian budget talks indicate that the Meloni government is aiming to reduce the nation’s budget deficit from around 4.5% of GDP this year to below the 3% deficit target by 2026 (2.9% of GDP). Finance Minister Giorgetti faces a September 20 deadline to come up with a budget plan. Other European countries face a similar deadline. The narrow deadline seemed difficult to make for France where a caretaker government is still in place since undecisive early July elections. Things might change rapidly though as president Macron today named EU brexit negotiator Michel Barnier as next premier. His first task is to form a cabinet to bridge views between the left, right and centrist blocs.

Graphs

USD/JPY: yen continues outperforming the dollar. Early August ‘stress-levels’ again within reach.

US 2-y yield extends decline below 3.85% support as 50 bps Fed cuts are becoming the more likely scenario.

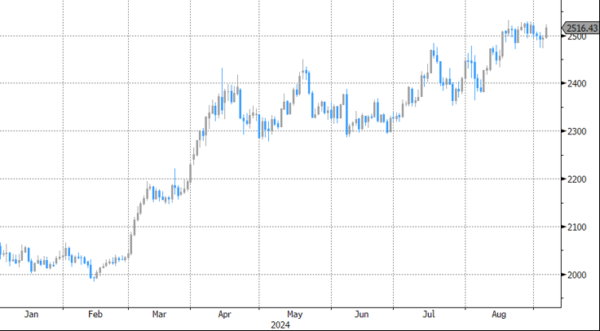

Gold ($/oz): declining yields and economic uncertainty propel gold back near all-time record.

Brent oil: delay in OPEC+ output hikes slows decline, but nothing more than that.