- BoC could easily cut interest rates for the third time on Wednesday

- Macro data favors additional easing but will it be a continuous process?

- USDCAD needs a close above 1.3585 to gain fresh bullish momentum

The easing cycle has more room to go

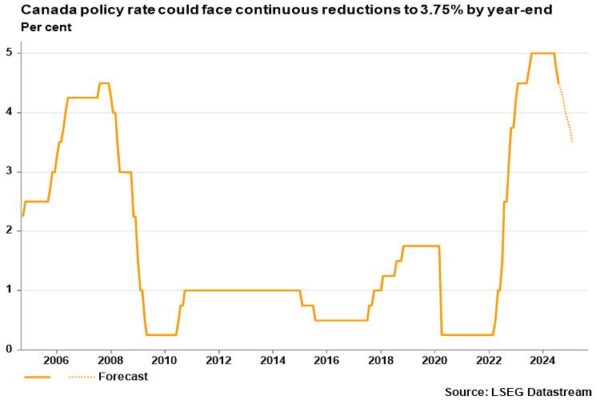

The Bank of Canada (BoC) is in the front of the global easing cycle. Having cut interest rates twice in a row, the central bank is widely expected to announce its third reduction on Wednesday at 13:45 GMT, but it won’t stop there. It is anticipated that interest rates will decline to 3.75% by the end of the year, based on the futures markets. The bank’s board is expected to approve two additional 25 bps cuts in October and December, and potentially more in early 2025.

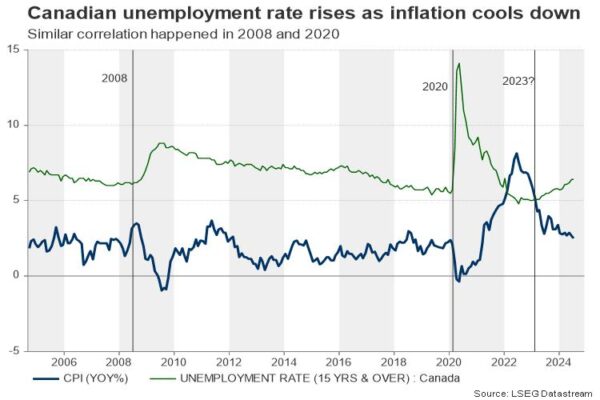

The question that comes instantly to mind is whether the current market pricing is realistic. Driven by base effects, inflation continued to trend down and towards the central bank’s 2.0% midpoint target, with headline CPI inflation falling to 2.5% y/y and the core measure easing to 2.6% in July. Of course, shelter costs remained elevated, but there was a slowdown from the previous month.

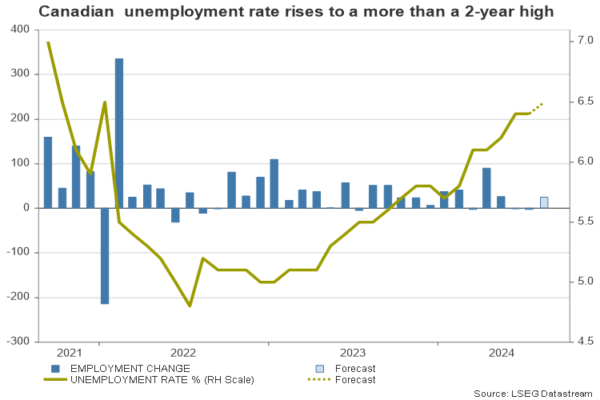

With the battle against inflation looking almost settled, the focus has started to shift to the labor market and to economic growth as interest rates are still hovering at multi-year highs despite easing lately. The unemployment rate has been steadily rising over the past year before stabilizing at a more-than-a-year high of 6.4% and is expected to tick up to 6.5% on Friday when the next employment report is published.

As regards economic growth, GDP rose at a faster-than-expected annualized rate of 2.1% in the second quarter. While the data was encouraging, the details showed that the expansion was driven by factors that could prove transient such as government spending and business investment on engineering structures in oil and gas facilities. Spending on services increased as well but the rise was trimmed by declines in goods consumption, net trade, and residential structure, while growing population squeezed per capita household expenditure to the negative region. Moreover, the monthly GDP readings for July displayed stagnation at the start of the third quarter.

Will the BoC send any strong signals?

Hence, the latest economic developments could justify further monetary easing as Canada is more sensitive to global trade and housing risks than the US. Still, whether there is a need for more aggressive rate cuts, or a continuous easing process remains to be seen. There will be no policy statement or updated economic projections following the rate decision, which reduces the odds for a serious shift in communication.

The certain thing is that messaging such an aggressive dovish strategy or delivering an unexpected 50bps rate cut could sow panic, signaling that things are going out of the central bank’s control. Note that futures markets are currently pricing a small probability of 23% for a double rate cut. Therefore, if that scenario unfolds, the loonie could drift significantly lower, lifting USDCAD above 1.3585 and beyond the 200-day simple moving average (SMA). The 1.3700 number could be the next target on the upside.

If the BoC slashes interest rates as expected but plays down the case of consecutive or double rate cuts, investors might take it as a hawkish signal, helping the loonie to resume its positive momentum. USDCAD might drift back towards the 1.3440 support zone in the aftermath of such a scenario. Failure to pivot there could bolster downside forces towards 1.3300-1.3350.

Perhaps volatility could stay relatively balanced if the policy meeting is uneventful and investors wait for fresh direction from Friday’s jobs report. A worse-than-expected employment report could keep the case of a double rate cut alive in the coming months, putting some pressure on the loonie. Strong numbers on the other hand could help the currency to strengthen. Analysts estimate a positive employment growth of 25.6k versus -2.8k in July and a slight pickup in the unemployment rate from 6.4% to 6.5%.