- Bitcoin find support following profit taking induced selloff.

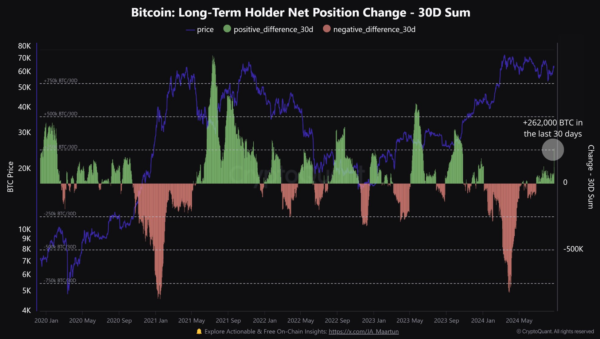

- ‘Hodlers’ continue to accumulate Bitcoin at pace, adding 262k Bitcoin over the last 30 days.

- Bitcoin’s current price stabilization above the critical 58,500 support level, a new leg to the upside?

Bitcoin prices have stabilized at a key area of support above the 58500 handle following a sharp selloff. Following a rally that took the world’s largest cryptocurrency to within a whisker of the 65000 psychological handle, the sharp selloff took many by surprise.

A massive transfer of around $1.88 billion worth of Bitcoin on Monday added further uncertainty as prices began to drop. A transfer of that size generally spooks markets as it is seen as a massive increase in supply which may be put up for sale and thus having a downward impact on Bitcoin prices.

Data from Arkham Intelligence provided some form of clarity. It shows that both the Bitcoin address that sent the initial amount and the one that received 30,000 BTC are owned by Binance. This suggests it was some form internal transfer and that should have eased the concerns of market participants.

Interesting data out from AMBCrypto of late suggests that many market participants have been cashing in on short-term Bitcoin rallies. This could explain the sharp selloffs Bitcoin has been experiencing when approaching key resistance levels.

The data used by AMBCrypto is the Bitcoin Futures Open Interest chart which showed that when price reached key resistance levels of late closed positions increased, signaling potential profit taking.

Source: Coinglass (click to enlarge)

AMBCrypto also noted that there seems to be an increase in USDT outflows from exchanges just after significant rallies in the price of Bitcoin. This would suggest that market participants may be cashing out their gains from shorter-term positions.

Despite this however, long-term Bitcoin holders have ramped up their accumulation of late which is a sign that many of them are taking advantage of the dips in price.

Long-Term ‘Hodlers’ Step Up Accumulation

Recent CryptoQuant data showed that long-term Bitcoin holders continue to snap up Bitcoin at an impressive rate. Over the last 30 days, long-term Bitcoin investors have added a massive 262,000 BTC to their stash.

This increase has pushed their total holdings to an impressive 14.82 million Bitcoin, which now makes up 75% of all Bitcoin available. This surge in accumulation highlights their confidence in the cryptocurrency’s future.

Source: CryptoQuant (click to enlarge)

Technical Analysis BTC/USD

Bitcoin is sitting at a crucial support level around 58,500, which it has touched before. Today’s closing price is important because it could signal a recovery with a strong upward pattern or a drop below this key level, potentially leading to more declines.

There’s a bearish sign where the 100-day moving average has crossed below the 200-day moving average, usually indicating downward momentum. However, since this indicator reacts to past data, it’s not always a reliable predictor.

The overall trend still looks positive, but if Bitcoin closes below 58,500, it might indicate a change. If prices go up, they could face challenges at the psychological 60,000 level and then around 61,750.

On the other hand, if Bitcoin breaks below 58,500, it might test lower levels like 56,561 and possibly 55,000.

Support

- 58500

- 56561

- 55000

Resistance

- 60000

- 61750

- 62917

Bitcoin (BTC/USD) Daily Chart, August 29, 2024

Source: TradingView.com (click to enlarge)