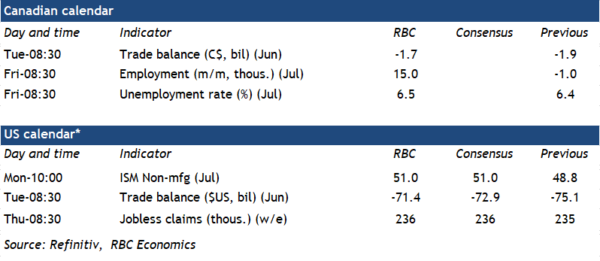

The Canadian jobs report for July next Friday is expected to show more softening in the labour market.

Employment gains have already slowed substantially into the summer, and we expect July will be no exception with 15,000 new jobs added. Against a still rapidly rising population, the unemployment rate will likely have ticked higher again to 6.5% in July, from 6.4% in June. In comparison, it was at 5.6% in early 2020 just before the pandemic, and dropped below 5% during the post-pandemic labour crunch in the summer of 2022.

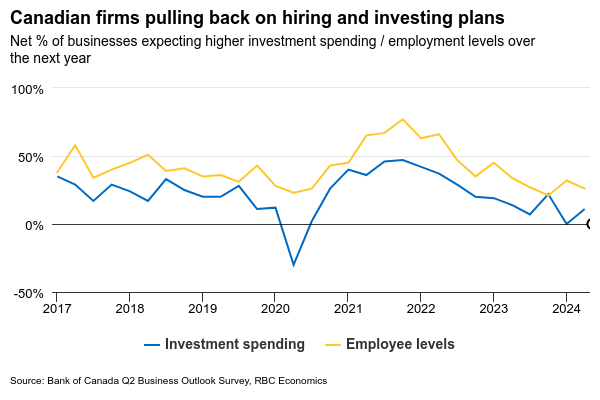

Overall, forward-looking indicators are showing little signs of recovery in hiring demand. Job openings in Canada have continued to decline in recent months, and businesses surveyed in the Q2 Bank of Canada outlook survey again reported lacklustre intentions to hire and invest over the next year.

Whereas employment growth has slowed, wage growth data from the labour force report has still been holding up at high levels. That contradicts data from elsewhere including the SEPH survey that has shown a more pronounced slowing in wage growth. In addition, business expectations on wage growth have also moderated substantially alongside the pull back in hiring demand, according to the Bank of Canada Business Outlook Survey. Overall, we expect wage growth to trend lower and don’t think it will fuel future inflation. That should quell the BoC’s concerns while it continues to cut interest rates.

Week ahead data watch

We expect Canadian goods exports dipped 0.4% in June, and imports dropped by a slightly bigger 0.6% to leave the trade deficit narrower at $1.7 billion. Details should show a decline in motor vehicle shipments. That coupled with a drop in oil prices are expected to have contributed to the slowdown in trade flows.

U.S. advance economic indicators showed the goods deficit narrowed by US$2.5 billion in June, as higher export growth (2.5%) outpaced growth in import (0.7%). The increase in exports was broad-based, led by food and beverages. Higher imports were supported by industrial supply, more than offsetting a decline in auto imports.