Summary

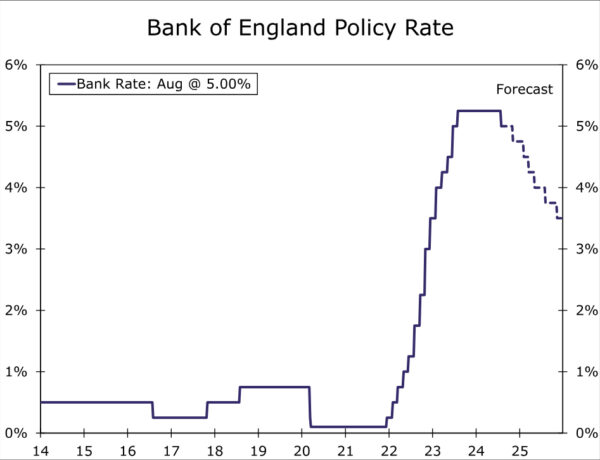

- The Bank of England (BoE) joined the growing group of G10 central banks that have eased monetary policy, by delivering an initial 25 bps policy rate cut to 5.00% at today’s monetary policy announcement. The guidance from the BoE’s announcement was also somewhat cautious, for now likely arguing against a steady series of rate cuts at each and every meeting.

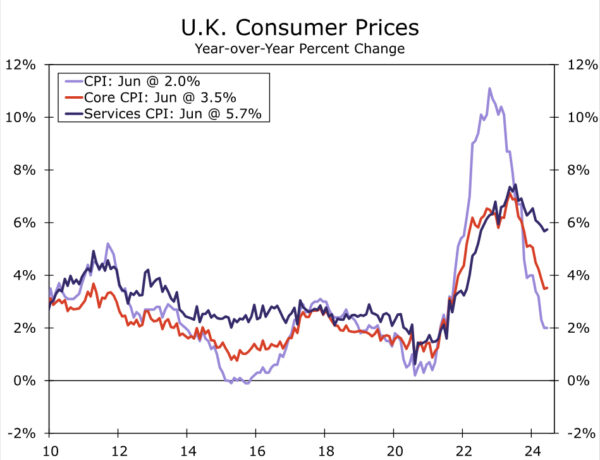

- That message was reinforced by the central bank’s updated economic projections, which envisage stronger GDP growth of 1.2% in 2024 and also see headline CPI inflation rebounding to 2.7% by the end of this year. Based on market-implied interest rates, however, inflation is expected to undershoot the 2% inflation target over the medium term.

- Overall, we view today’s announcement as consistent with our view the Bank of England will take an initially cautious approach to monetary easing. We forecast only one more policy rate cut this year, of 25 bps at the November monetary policy announcement. We expect somewhat faster easing in 2025, and forecast a cumulative 125 bps of rate cuts next year which would see the policy rate end 2025 at 3.50%.

Bank of England Delivers Rate Cut, Offers Careful Guidance

The Bank of England (BoE) joined the growing group of G10 central banks that have eased monetary policy, by delivering an initial 25 bps policy rate cut to 5.00% at today’s monetary policy announcement. To be sure, the decision was finely balanced, with a closely split 5-4 vote from policymakers to lower interest rates. The guidance from the BoE’s announcement was also somewhat cautious, for now likely arguing against a steady series of rate cuts at each and every meeting.

To be sure, there was some softening in the BoE’s assessment of the outlook for underlying inflation, comments that broadly justified the decision to lower interest rates. The central bank said it:

“expects the fall in headline inflation, and normalization in many indicators of inflation expectations, to continue to feed through to weaker pay and price-setting dynamics. A margin of slack should emerge in the economy as GDP falls below potential and the labor market eases further. Domestic inflationary persistence is expected to fade away over the next few years, owing to the restrictive stance of monetary policy.”

At the same time, the BoE acknowledged the risk that inflationary pressures from second-round effects could prove more enduring in the medium term. Balancing these factors, the BoE said it is now appropriate to reduce the degree of policy restrictiveness “slightly.” The central bank repeated, however, that “monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further.” And finally, the BoE said it will decide the appropriate degree of monetary policy restrictiveness at “each” meeting. Reinforcing that final point at a post meeting press conference, Governor Bailey said:

“I’m not giving you any view on the path of rates to come — I’m saying we will go from meeting to meeting, as we always do”

The Bank of England also published updated economic projections alongside today’s announcement. Those forecasts are based on market-implied interest rates, which envisage the policy rate falling to 4.1% in 2025 and 3.5% in three years’ time. The forecasts anticipate stronger economic growth than previously, with 2024 GDP growth seen at 1.25% compared to 0.5% previously, while GDP growth forecasts for 2025 and 2026 were left unchanged at 1% and 1.25% respectively. Meanwhile, headline CPI inflation is expected to rebound to 2.7% by the end of this year but, based on market assumptions, fall below the 2% inflation target over the medium-term. Headline inflation is seen at 1.7% after two years, and 1.5% after three years.

Overall, we view today’s announcement as consistent with our view the Bank of England will take an initially cautious approach to monetary easing. Stronger near-term economic growth, a likely rebound in near-term inflation and the possibility of upside surprises, and the BoE’s careful guidance all point to a gradual pace of rate cuts. We expect only one more policy rate cut this year, of 25 bps at the November monetary policy announcement. As inflation recedes next year and given the potential for a medium-term inflation undershoot, we do expect a faster pace of easing in 2025. We forecast a cumulative 125 bps of rate cuts next year which would see the policy rate end 2025 at 3.50% and, moreover, we believe the balance of risks is tilted toward faster rate cuts than slower rate cuts in 2025.