- UK citizens head to the ballots on July 4

- Opinion polls point to a Labour Party victory

- Political stability could initially benefit the pound

- But BoE rate cut bets could prove negative in the longer run

How it works

On July 4, Britons will head to the ballots to vote in a general election, with opinion polls suggesting that they will end 14 years of Conservative rule.

The United Kingdom is divided into 650 constituencies. In each of them, voters choose a local candidate for a seat in Parliament, and typically those candidates represent a political party. There are two Houses in the UK Parliament: The House of Commons and the House of Lords. Voters are electing members of the House of Commons as members of the House of Lords are appointed by the government as life peers.

The party with the most seats wins the election but to run the government, they need 326 of the 650 seats or negotiate with other parties to build a coalition. They could still try and govern with a minority, but they could face huge obstacles in passing their agenda. The leader of the winning party becomes prime minister.

Who is leading?

Opinion polls have been consistently showing the Labour Party is leading the race, with Nigel Farage’s Reform UK overtaking Conservatives in some of the latest polls. It is also projected that the Labour party could win more than 400 seats in Parliament.

So, what does a Labour victory mean for the economy, the Bank of England, and consequently, the pound?

Labour victory, economy and BoE policy

Conservatives are focusing on tax cuts to reignite economic growth, while the Labour Party is portraying itself as the party of fiscal responsibility. Although the center-left party promised not to raise income tax, national insurance or corporation tax, they have not ruled out raising other taxes. What’s more, even though it is highly unlikely they would cut spending significantly, they said they cannot rely on using government funds to spur growth. They want to adopt a different strategy where finances are raised by companies.

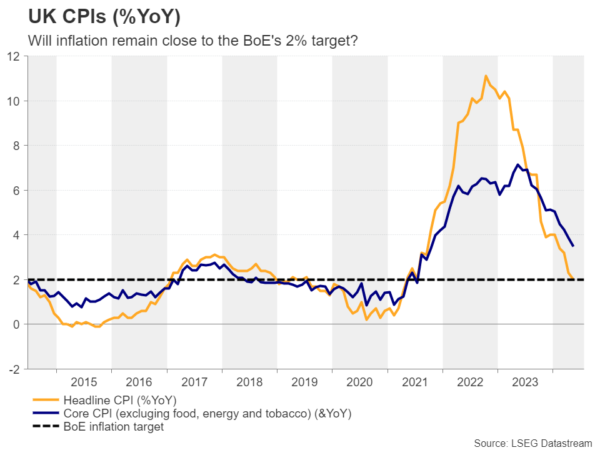

But managing to make the corporate mechanism to work could take time, which means that a potential economic boost will be delayed, thereby keeping inflation close to the BoE’s target of 2% and allowing policymakers to start cutting interest rates sooner and faster.

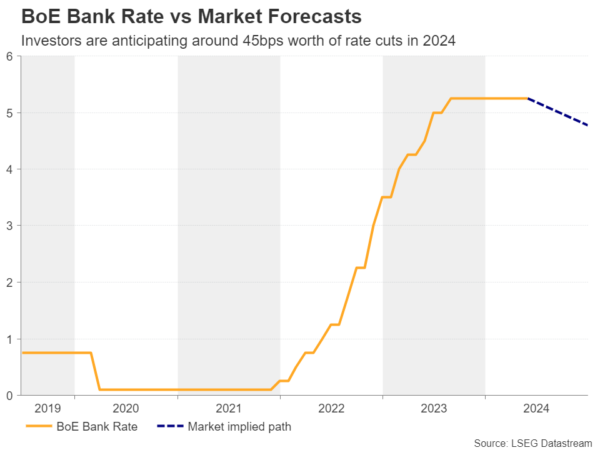

At last week’s gathering, the BoE kept interest rates unchanged, but the meeting minutes revealed that the decision was “finely balanced”, raising the probability for an August rate cut to around 50%. Taking that into account, a Labour victory on July 4 could increase that probability and perhaps encourage investors to add to the total number of basis points worth of reductions expected by the end of the year. Currently, there are nearly two quarter-point cuts penciled in for 2024.

Pound could benefit, but only temporarily

As for the pound, expectations of more rate cuts by the BoE could prove negative, but the initial reaction to a Labour victory may be positive as investors may view this as the beginning of a period of political stability amid a less divided party and amid Labour’s pledge to improve ties with the European union.

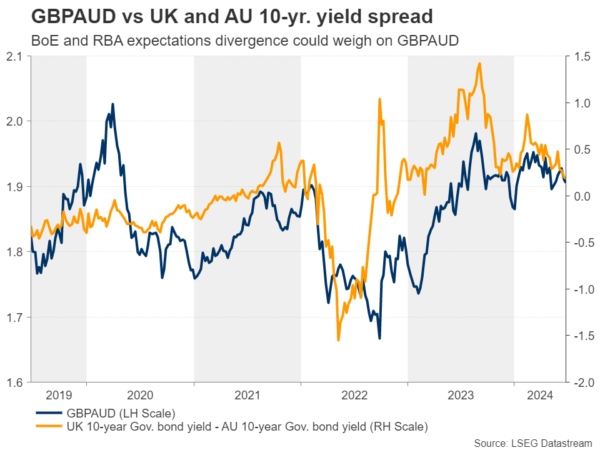

Having said that though, any reaction to a potential Labor victory may not have a huge market impact as this is the outcome already expected. If the pound is set to drift south in the post-election era due to increasing BoE rate cut bets, the currency against which it could lose the most ground may be the aussie. Remember that last week, the RBA maintained its neutral stance, while Governor Bullock revealed that they discussed the option of raising rates.

Pound/aussie remains in downtrend

From a technical standpoint, pound/aussie entered a recovery phase on June 21, but on June 26, it hit strong resistance at around 1.9110 and slid. In the bigger picture, the pair remains below a downward sloping trendline drawn from the high of March 3. Therefore, if the pair recovers again on the election outcome, the rebound may be considered a corrective phase within a larger downtrend.

The bears could take charge again at some point and the pair may slip towards the 1.8965 zone again or the 1.8900 barrier, which provided support between May 7 and 15. A break lower would confirm a lower low on the daily chart and perhaps pave the way towards the low of December 27, at around 1.8590. For the outlook to change to positive, the bulls may need to clearly overcome the 1.9350 territory.