- Investors see decent chance for BoJ hike in July

- But struggling economy complicates the policy outlook

- Report on bond buying sets the hawkish bar even higher

- The Bank decides on Friday at 03:00 GMT

Obstacles in the road for the next BoJ hike

At its latest gathering on April 26, the Bank of Japan (BoJ) decided to keep the range for its benchmark rate unchanged between 0% and 0.1% as was widely expected. Policymakers upgraded their inflation projections, but they did not signal a reduction of their bond purchases, nor did they signal a strong intention to raise interest rates again soon. This resulted in a weakening yen and two intervention episodes by Japanese authorities in the following days.

Since then, data showed the world’s fourth largest economy contracted by more than expected in Q1, and inflation slowed in April, with the BoJ’s core CPI dropping below 2%. Although the Tokyo CPIs pointed to an acceleration on consumer prices in May, the struggling economy seems to be putting obstacles in the road for the next rate hike.

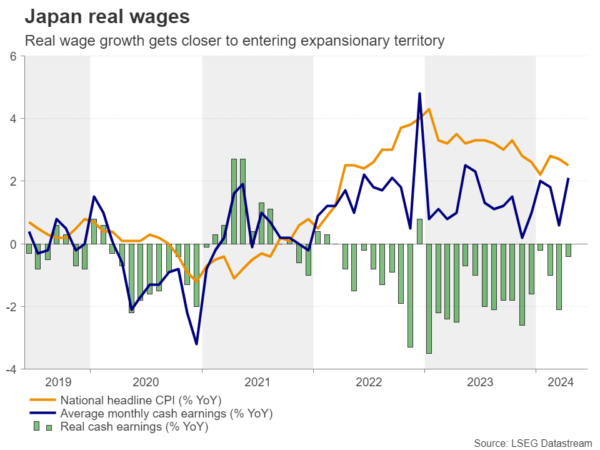

Yes, wage growth rebounded strongly in April, which brought real wages closer to entering expansionary territory, but this was largely expected after the strong pay hikes agreed during the spring wage negotiations.

Traders still assign decent chance for July hike

Investors are still assigning a decent 67% probability for another 10bps hike in July, which means that there is ample room for disappointment should the Bank appear less hawkish than expected when it meets on Friday.

On top of that, Nikkei cited unnamed sources saying that the Bank will consider whether to scale back its 6trn yen in monthly Japanese Government Bond (JGB) purchases. The key part here is “will consider whether”, which means that they could decide not to reduce their purchases, at least not at this gathering.

Will disappointment lead to another intervention?

This combined with absent signals about a hike next month could push the yen lower to test once again its recent lows against the US dollar, and perhaps trigger a new round of intervention.

For the yen to stage a meaningful recovery, the Bank of Japan needs, not only to announce a reduction in its monthly bond purchases, but also to provide strong signals that a rate hike is on the cards.

Dollar/yen remains in uptrend mode

From a technical standpoint, dollar/yen has been in a recovery mode since June 5, when it hit support at the crossroads of the 154.50 barrier and the 50-day exponential moving average (EMA).

In the bigger picture, the pair is still in an uptrend mode, which means that the bulls could add to their long positions without hesitation if the BoJ disappoints once again. A break above the high of May 29 at around 157.70 may allow advances towards the round figure of 160.00, near where Japanese authorities decided to intervene back on April 29.

For the outlook of dollar/yen to turn bearish, the price may need to drop below the key support territory of 151.85. That zone supported the pair on May 3, and offered strong resistance back in October 2023.