Markets

Bank of France governor and ECB governing council member Villeroy leveraged low volume trading conditions (UK & US markets are closed) to get maximum market impact with some dovish comments. So far, ECB members generally didn’t pre-commit on the H2 2024 ECB policy rate path after the done deal 25 bps June rate cut. Markets interpreted this as ruling out back-to-back moves given the bumpy/sticky inflation path ahead, the Fed delay and the relatively small space from current restrictive levels (4% deposit rate) to more neutral ground. In an interview with German newspaper Boersen-Zeitung, Villeroy said that he sometimes reads the analysis to cut rates only once a quarter, together with the publication of new staff forecasts, and hence exclude July. He asked himself why, given the current meeting-by-meeting and data-driven mindset at the ECB. He doesn’t go as far as saying that the central bank should already commit on July, but wants to keep maximum optionality on the timing and pace. Villeroy labeled current market expectations for the ECB’s terminal rate, somewhere between 2.5% and 2.75% as “not unreasonable”. He doesn’t worry about the impact of a weaker euro stemming from divergence with the Fed as the pass-through to inflation would be rather small while tighter US financial conditions could be disinflationary to Europe. US fiscal policy is the elephant in the room and poses the biggest inflationary treat via structurally higher long-term interest rates and their inflationary impact. ECB Chief economist Lane added to earlier (weekend) comments. He cemented the June rate cut and expects the inflation to hit the 2% target next year. The constraining effects of past rate hikes are still unfolding with the transmission effect possibly only peaking at the turn of 2024. European bonds rallied after the ECB comments with the front end of the curve outperforming. German yields currently cede 2.5 bps (30-yr) to 5 bps (5-yr) after hitting fresh YtD highs at the end of last week for the shorter tenors. The single currency loses slightly ground at EUR/USD 1.0850. European stock markets only marginally profit from Wall Street’s solid performance on Friday, with main indices rising by up to 0.3%.

May German Ifo Business confidence data were on tap today. The headline figure stabilized at 89.3 instead of the hoped-for increase to 90.4. Details showed a deterioration of the current assessment while the forward-looking expectations component improved. US consumer confidence, ECB consumer inflation expectations (tomorrow), EMU May CPI and US PCE deflators (Friday) are highlights later this week.

News & Views

South African president Ramaphosa in a final campaign just before the general elections on Wednesday defended costly pledges made earlier. The leader of the ANC governing party in May signed into law a health insurance bill that aims to create a state fund to cover medical costs for all citizens. The ANC also promised to implement a “basic income grant” for the large cohort of the unemployed. But combined with the country suddenly no longer experiencing blackouts for almost two months (which critics say was done by massive spending on diesel to fuel the turbines), the election giveaways raise concern among voters. They fear that this unsustainable spending will either end shortly after the elections or boomerang back through higher taxes. The ANC according to the latest polls is on track to lose its parliamentary majority for the first time since the post-apartheid election in 1994. While it is still on track to become the largest party (43% vs 57.5% in the 2019 vote), it will probably have to partner up with some of the more radical parties including former-president Zuma’s MK (11% in the polls) or the Economic Freedom Fighters (<10%). South Africa’s main opposition party, Democratic Alliance, would secure about a quarter of the votes.

Belgian business confidence improved from -11.9 to -11 in May, erasing some of the April setback but doing less so than hoped for (-10.8). Business climate improved considerably in manufacturing, driven by a significantly better assessment of total order books and a much more favourable opinion on both demand and employment expectations. Sentiment in trade improved slightly with weaker demand expectations offsetting a positive evolution in employment and intentions of placing orders. Business-related services confidence fell for the third month in a row due to a sharp downward revision in both demand and activity expectations. A downturn in all components weighed on sentiment in the building industry. Demand expectations were the exception to the rule, as they have been improving steadily since this past February.

Graphs

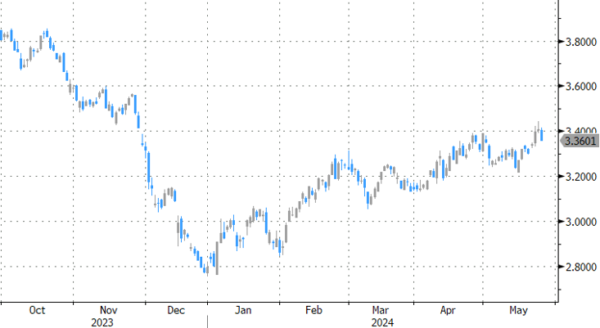

EMU 2-y swap eases off YTD top as ECB’s Villeroy doesn’t exclude back to back July rate cut.

USD/ZAR: Rand trades mildly constructive going into this week’s Parliamentary election.

EuroStoxx 50 holding within reach of cycle top.

EUR/GBP testing key 0.85 support area on potential ECB-BoE divergence.